Manual AR wastes time and money

So do most AR workflow "tools" that promise automation but can't actually DO the work for you.

Stuut has pioneered an AI-powered revenue collection solution. It doesn’t just assist, its AI agents learn each customer and work across disconnected systems to automate outreach, payment matching, dispute resolution, and portal management.

By the time you log in, the cash is already in your account.

The Mailbag lives and dies by your questions. Send me your trickiest CFO dilemmas (anonymously if you wish), and I’ll answer them here.

👉 Send me your questions by filling out this form.

Now, on to today’s Mailbag.

We’ve got some great topics. Here’s what’s on tap:

Culture change in a family business

The pathway to IPO-CFO

Acquiring top talent

Now, let’s get into it.

Matt from Phoenix, AZ, USA asked:

What is the first step toward bringing expense management discipline into a third-generation, family-owned-and-managed business that has never even created a budget, let alone stuck to one?

Background: The good times started about 15 years ago. Most employees have known nothing else. Family doesn't care about expenses as long as dividends get paid. I'm CFO and a family member, so I'm one of the few who know what we are giving up and share in that opportunity cost (so I'm motivated). We don't want to nickel-and-dime or micromanage.

Matt, this is a great question because the answer is different in a family business.

Expense discipline only matters if the shareholders want it to matter. And for the last 15 years, it sounds like the family has been perfectly happy as long as dividends get paid. That’s their prerogative. But you’re in a rare position: you’re the CFO and family. You both understand the opportunity cost and have a mandate that a non-family CFO would never have.

This is about shifting culture. In family businesses, culture change sticks best if it comes from the family itself. Your CFO title carries some weight, but your last name carries far more.

So the first step is more political than operational. You need alignment from the family board to make sure you don’t have other people with the same last name undermining you in the business. And the way you get that is not by pushing false urgency or lecturing about discipline.

Avoid the “dividends could be 5 percent higher” pitch. It sounds like that won’t move anyone. Instead, show opportunities to use the savings in an unexpected way:

a strategic investment the family has always wanted to make

a modernization project that the company has put off

a small employee profit-share or perk that enhances loyalty

a rainy-day reserve that protects the dividend long-term

You are trying to paint a picture of “what could be” if you build even light expense discipline. If you can create excitement around a shared prize, you’ll avoid the typical resistance of “CFO wants to nickel-and-dime us.”

Once you have the family aligned, start small and extremely simple:

basic spend limits

purchase/expense cards with built-in controls

light approval workflows

simple communication around “why”

And don’t send all the savings straight to EBITDA on day one. Let the organization feel some of the benefit - even symbolically. When people see a tangible win, culture starts to shift. You can tighten the system over time.

Your job is to get the snowball rolling in a way the family supports, the business can absorb, and employees don’t resent. Not to create a finance-led revolution.

It will compound.

TLDR: Get family buy-in first by framing the upside in terms they care about. Start with tiny, simple controls, let the organization share in some of the savings, and build discipline slowly. In a family business, culture change happens fastest when it comes from the family itself.

And here is a cool remix of Family Affair by Sly and Family Stone for no reason at all. (My editor allows me one music clip in the mailbag per month)

N from the US asked:

I’m in a small startup. I joined at a junior position, and now I’m the head of finance. My goal is to be the CFO even at IPO. How do I keep leading the finances of the business as it grows more complex when I don’t have exposure to larger organizations at this level?

Thanks for the question, N.

It is the right ambition. Get to the number one finance role in a rocketship and ride it all the way to IPO.

At a headline level, the answer is simple: help the business grow at warp speed, and make sure you grow at least as fast as the business.

But you are looking too far ahead at the moment. You have the job right now, so focus on not losing it…

If you are, say, at $5m ARR and the goal is to get to $10m by the end of 2026 at an LTV:CAC of >4, then focus on that. When you get to $10m, figure out the next step.

How you evolve into a public company CFO is a luxury problem for later. Right now, you are new at this level and need to prove yourself. So focus on:

Delivering the numbers

Making sure finance does not get in the way of gorwth

Managing your board and investors well

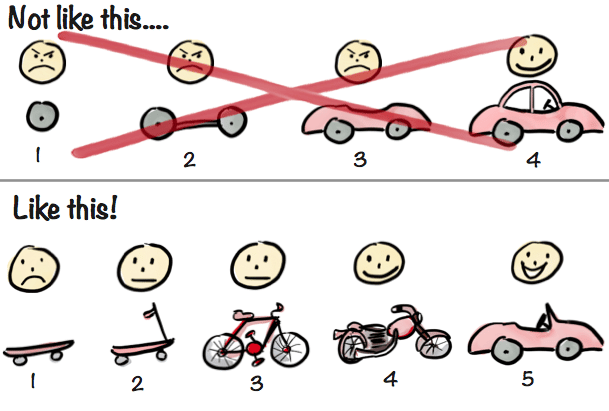

If you think too far ahead too early, you risk making the mistake in this image:

Not just with the business, but also with the finance function and your own career.

That said, there are a couple of practical things you can do now.

Get a critical friend. Find a mentor who is doing what you want to do, but is three to five years ahead of you. Join CFO or startup finance networks. Talk to people who have lived the next phase you are heading into. It will help you stay sane and avoid obvious traps.

And try to sort the title. Titles “should not” matter, but they do. In a successful startup, at some point, there will be a CFO above a Head of Finance. Your job is to make sure that when the time comes, they are just changing your title rather than hiring over you.

The way you do that is to think and behave like the CFO now. Own value creation, push for speed, and maintain control. Be the adult in the room without slowing the room down.

If you do that, the board will start to see you as the natural CFO already. Then, when the conversation about “needing a proper CFO for the IPO” comes up, you are the obvious answer.

TLDR: Aim for IPO-CFO, but do not obsess over it now. Focus on proving yourself as the number one in the business, then it’s yours to lose…

Rosey from Northeast, USA asked:

Hi Secret CFO,

I am a business-level finance lead for a publicly traded manufacturing company. Our business has seen above-average growth since the pandemic.

However, over the last two years, we have been struggling with talent acquisition and retention from the manager level down. This year was our worst year in a decade for on-time delivery, which is our most important metric. We have promoted key individual contributors to managers, and the talent has not been filled in behind them. Closing actions that I used to take for granted often require management intervention.

The talent acquisition strategy/tactics are not differentiated in any way. We target 5% below market TCC for the individual contributor level. The bonus pool is top-heavy relative to peers.

The business-level leadership acknowledges the problem, but the solutions leave me wanting. More pizza parties and increasing the frequency of the internal comms will make a difference at the margin, but it's not enough. I have plenty of favors saved up. How would you target going cashing them in on a big ask?

Rosey, thanks for the question.

Let me start with this:

Targeting comp 5 percent below market for junior roles is insane to me. Especially if you are growing quickly. Ending up there accidentally happens. Intentionally aiming for it? That is your company’s actual definition of success?

That’s institutional arrogance.

And it comes with consequences. You are living some of them: chronic turnover, under-filled roles, accidental managers, declining function performance, and process fragility. None of this is surprising.

Now… some companies can get away with below-market pay:

world-class brands

genuinely elite training/career development

culture so good people are beating down the door

outstanding leadership bench

But if you do not offer those things, and your strategy is still “5 percent below market + pizza,” then you are insulting the intelligence of the very talent you claim you are trying to attract.

Young, ambitious operators today want three things: impact, development, friends at work, and fair pay. It is not an unreasonable ask, and it’s not complicated.

And the part that really matters: the AI revolution will be powered bottom-up, by bright young doers experimenting in the weeds. Not by leaders sat in boardrooms. If you underpay and understaff that layer, you will be left behind.

So what do you do?

Propose a “fewer, better people” model.

This is how you get approval.

If your cost envelope cannot increase, then present a plan that changes the mix instead of the total:

automate low-value tasks

eliminate zombie processes

collapse layers that add no leverage

upgrade key operators and pay them properly

Same total cost. Far higher capability. Lower turnover. Better delivery. Stronger leadership pipeline.

This is the only argument that works in old-school environments. “Let me keep total cost flat, but let me spend it more intelligently.” It makes it easier for lazy leadership teams to agree.

Once you’ve built the plan… don’t “ask,” tell. In fact don’t even tell, just get on with it.

Every CFO and operator learns this at some point. Sometimes it is better to beg for forgiveness than ask for permission, especially when you are acting in the long-term interests of the business.

If it’s your function, your budget, and you can make the numbers work, then act like an owner, and do the right thing.

If someone wants to die on the hill of being 5 percent cheap, make them explain why.

TLDR: Your company’s comp philosophy is the problem, not the symptoms. You won’t fix this with pizzas and posters. Build the business case in dollars, redesign the team into “fewer, better people,” keep total cost flat, and then execute. Don’t wait for permission.

A few of the biggest stories that every CFO is paying close attention to. This is the section you might not want to see your name in.

Here we go… OpenAI is taking an equity stake in Thrive Holdings (think: Josh Kushner’s PE shop). As part of the deal, OpenAI will help push automated accounting adoption at Thrive’s portfolio companies via engineers, researchers, and product teams.

I’ll just leave this month’s Playbook right here for you, Jay Malave…

Hmmm… seems pretty defensive to me.

Oh, and at the same conference, Nvidia’s CFO admitted their $100B investment in OpenAI still wasn’t finalized. Big day on the IR desk for Colette Kress.

ICYMI, here are some of my favorite finance/business social media posts from this week. In the words of Kendall Roy, “all bangers, all the time.”:

Can someone make me this same chart, but make it specific to finance teams?

If you’re looking to sponsor CFO Secrets Newsletter, fill out this form, and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

If you enjoyed today’s content, don’t forget to subscribe.

You can help make sure this newsletter always stays free simply by spreading the word. And when you share CFO Secrets with your finance friends, you’ll earn rewards, including a 50-page PDF guide on what it takes to be a great CFO. Start sharing your unique referral code today: {{rp_refer_url}}

Let me know what you thought of today’s Mailbag. Just hit reply… I read every message.

There’s been a ton of noise around stablecoins recently. But are CFO’s ready to put crypto in the treasury stack? In the most recent edition of The Boardroom Brief, we dug in. Check it out now.

And on Saturday, we launched a brand new Playbook series on finance transformation (and what CFOs who undertake them get wrong). Check out the newsletter here.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.