Churn is a silent killer

It’s draining your bottom line, negatively impacting forecasting, and growth.

The Stripe guide to churn helps finance leaders fight churn, helping them protect profits and business valuation. Learn proven strategies to recover lost revenue.

David Timson from London asked:

We operate gyms nationwide, and each location has a local ops team making sure the place doesn’t fall apart — cleaning, maintenance, general firefighting. Our COO is pushing hard for these teams to fully own their contribution margin. But the contribution margin includes a mix of centrally managed and locally influenced costs. In many cases, local teams don’t actually control the numbers they’re being held accountable for.

Example - some repairs & maintenance are arranged centrally (i.e., AC repair contracts). This hits the contribution margin for each gym. Have I designed the P&L wrong, or is there a way I can save this?

I feel like I’m stuck between two extremes:

Do I embrace the “local ownership” model, even if it means assigning budget responsibility for costs outside their actual control?

Or do I centralise budget ownership, protect the P&L’s structural logic, and risk disengaging the people closest to the action?

Looking forward to your wisdom.

David - this is a tough question. The sort of thing that keeps CFOs up at night. How do I orient the internal presentation of my P&L to put accountability in the right place?

I have had so many conversations on topics like this across my career, I can’t begin to tell you. In any business with a mix of a central and local structure, you will always find a point in the chart of accounts when the accountability lines are blurred. It can be a tremendous source of internal politics, so making it clear is important, and having a COO who is keen to drive a local accountability approach is a blessing!

The short answer is that there is no perfect answer.

On one hand, you want the operation to see the full cost of their business as much as possible (and keep your COO happy).

On the other hand, you don’t want your operators using ‘someone in head office’ as an excuse for missing their profit targets. Even worse, you don’t want to disengage them from the numbers.

And while I’m sure this is not small change, it’s also not the business end of your P&L which will be membership income, and staff costs. So the key here is to keep it simple for the operating units.

But I don’t think you need to see this as two extremes. You control that definition of contribution margin, so could change it, if you thought that was the right thing to do. Let me give you a couple of ideas that will help you find a compromise between the two:

1) Separate the locally managed indirect costs from the centrally managed ones in the local P&L. Each has a separate budget and separate GL level reporting detail. You can then, at least, easily see P&L performance with and without these centrally managed costs. You could report gym-level profitability before and after the central costs and see which one sticks as a KPI.

2) Equalize the budget and the actual for the centrally managed costs for each gym. The easiest way to do this is to use a recharge. Manage those ‘central’ costs using a centrally held GL and cost center managed by your central maintenance team. At the start of the year, agree on a fixed recharge for each site using those central services. Then set that fixed recharge as both the budget and actual cost.

Another variant on the above would be to give each local site a ‘menu’ style price list for each service the ‘center’ provides. And make them accountable for which services they use, while keeping your central team accountable for pricing and delivery. But in a way that most closely mimics who owns what.

Some of this does bring extra layers of work for finance, but it sounds like you’ve reached a point where it’s important.

Good luck with it, David.

Jeff from Miami asked:

We're a $100M services business (no inventory) with a sh*tty procure-to-pay process with too many steps (PO requisition approval > PO issuance > Invoice > Shipping Receipt > Payment). About 80% of requisitions already come with an invoice anyway. Too crazy to just pay invoices, after a field manager confirms the goods/services were provided?

Hi Jeff,

Too many steps for whom? The flow you describe is not unusual. Just paying invoices when they land on the instruction of a field manager doesn’t work for me. It circumvents any pre-commitment approval and undermines segregation of duty controls. It makes the monthly accounts very hard to get right, and cash flow visibility very difficult too. If 80% of requisitions “come with an invoice,” that is a sure-fire sign the process is broken - the requisitions are being raised too late.

Designing a good procure-to-pay process is hard. The objective is to make it as easy as possible to process legitimate spend that has been through the right channels, and hard as hell for anything that hasn’t.

The good news is that there is an answer. Many of the modern P-card/integrated AP solutions make this process so much easier. Brex and Ramp are two examples. By setting preprogrammed workflows and limits by spend type, they do a good job of reducing friction on proper spend and increasing it on improper spend, or spend that needs more examination.

Thanks for the question, Jeff.

Jorge from Los Angeles asked:

How do you handle ethical gray zones in controls? For example, when questionable expenses are submitted for reimbursement, or a company owner applies for PPP loan forgiveness when the company didn't need the loan in the first place, or the owner is pushing for excessive employee retention credits (ERC)?

Thanks for the question, Jorge.

It’s a good question and an important one. Let too much slide, and you can put the company (and yourself) at serious risk. But if you cry wolf on every gray zone, you’ll quickly become ineffective, isolated, and probably out of a job. This is one of the trickiest balancing acts in finance leadership.

Experience really matters here. I’ve seen inexperienced CFOs let things slide that absolutely shouldn’t have. Things that exposed the business to legal, financial, or reputation damage. I’ve also seen the reverse: CFOs taking such a hard ethical line on gray areas that they alienated their executive teams and lost the trust needed to be effective.

The key is knowing where your lines are. And I say “lines” plural, because there are usually three.

First, there’s the law. This is the clearest line. Jorge, I don’t break the law, and neither should you. Whether it’s tax declarations, PPP loan eligibility, or insurance certifications, this is a hard red line. If someone asks you to cross it, the answer is simple: no. And if that puts you in a corner, you leave. Period.

Second, there’s your professional code. As finance professionals - CFO, CPA, whatever - we have standards that define what’s professionally acceptable. Think of it like the range of reasonable assumptions in a forecast or the appropriate interpretation of tax guidance. You might not go to jail for crossing this line, but you could lose your reputation, license, or career trajectory. If you’re being pushed into something that violates your professional standards and you can’t course-correct, it may be time to go.

Third, and most personal, is your own ethical code. This is about your values, how you feel about aggressive tax planning, government handouts, or treatment of gray-zone expenses. These lines are less rigid, and they’ll vary person to person. What matters is that you work somewhere that overlaps enough with your personal beliefs that you’re not holding your nose every day. But you also need to be realistic. Your job is to operate within the organization's values, not to impose your own. If the mismatch is too great, that’s your cue to move on.

So the first thing to do is figure out what kind of discomfort you’re facing. If it’s legal, get out. If it’s professional, find a way to stay within your code, or leave if you can’t. If it’s personal, only you can decide whether that compromise is tolerable. But don’t ignore it. These things have a way of compounding.

A few of the biggest stories that every CFO is paying close attention to. This is the section you probably don’t want to see your name in.

Welcome to “Who’s Accounting Trick is it Anyways?” where everything's made up and the numbers are always goof. NRG is trading at 23X earnings, but it elected to freeze its balance-sheet values on its large derivative-trading operation instead of including fluctuations in its quarterly earnings…

AI isn’t taking all the jobs, it appears. PwC is hiring and expanding from 4 to 8 divisions in its advisory services. This is after a recent cull of their audit and tax teams.

Some stories you just can’t make up. Former IRS Commish Danny Werfel joins Alliant Group after raiding it in 2022.

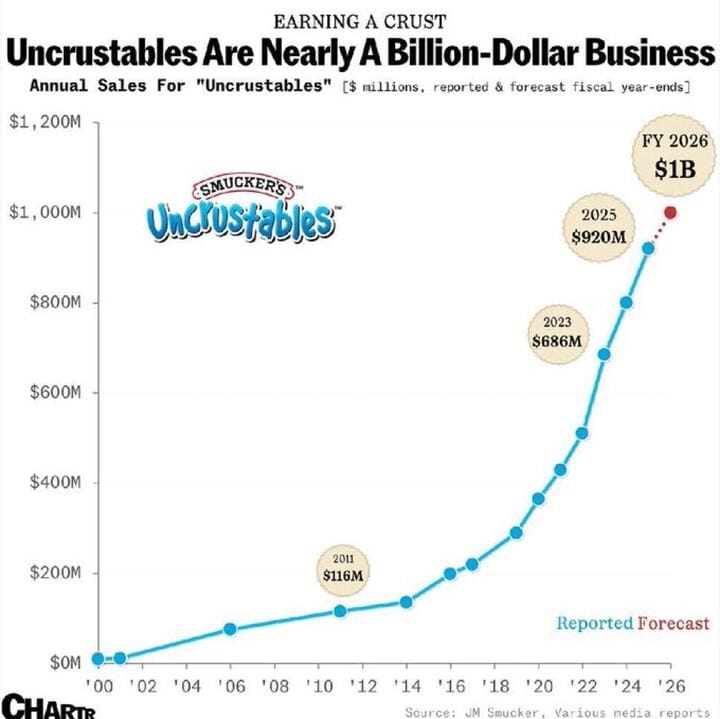

This is actually pretty sweet - beats team pizza.

ICYMI, here are some of my favorite finance/business social media posts from this week. In the words of Kendall Roy, “all bangers, all the time.”:

Happy intern season to all who celebrate…

If you’re looking to sponsor CFO Secrets Newsletter, fill out this form, and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

If you enjoyed today’s content, don’t forget to subscribe.

Let me know what you thought of today’s Mailbag. Just hit reply… I read every message.

In Saturday’s newsletter, we got nerdy with variance bridges. A lot of people have written to say how much they enjoyed it. Check it out here.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.