Legacy ERPs come with baggage…

Steep learning curves, manual accounting workflows, and subpar native reporting. Plus, a huge price tag.

That’s why Campfire built the AI-native ERP for modern finance & accounting teams. Automate revenue, streamline your close, and centralize accounting—all on one unified platform.

Read about Campfire’s recent $35M Series A, led by Accel, to power the next generation of mid-market and enterprise finance.

The Knives Are Out

I'd never been through anything like this before. Three independent directors had just walked off the board in 48 hours.

We'd expected each of them to leave at some point, but not together and so quickly. Something had detonated.

I'd had my own run-in with one of those directors the month before. Let's call him Alan. Alan thought my demeanor was "too laid back" for a turnaround situation. I'd told him I'd accomplished more in six months than the previous two CFOs had managed in five years. Staying calm under pressure was my superpower. The fuel that made sh*t happen. So maybe he should focus on the real problems.

Except I wasn’t that polite…

Late that evening, sitting at my desk staring at my laptop, I realized I'd dodged a bullet I never saw coming. Alan had been taken out by the Chair. But I didn't know why. And if that hadn't happened, it might’ve been me. Alan had serious influence with most of the board. He probably would've convinced them I was the wrong guy for the job.

The scary part was, I'd kinda been blind to the threat.

It reminded me of something an executive coach had told me years earlier: "You think the org chart shows you how decisions get made? That's cute." He'd introduced me to the concept of the invisible organization chart. The middle manager who went through the same MBA program as the CEO 25 years ago and still texts him on weekends. The CEO's spouse, who's sick of late-night crisis calls interrupting family dinners. The board member's golf buddy, who is also an investor, and whispers his concerns over the 19th hole.

Power doesn't always flow where you think it does.

I decided to confront the Chair directly. What really happened?

Turns out Alan and the other two had cornered the CEO after our last board meeting. They'd given him the same "too laid back" feedback about me, but extended it to him, too. They wanted us both out. The CEO had looked them in the eye and said, "I'm here to fix the mess you created through poor board governance and by hiring an exec team who couldn't find their ass with both hands. If you don't like how we work, go."

They took it.

Here's what hit me: I'd been fighting a war I didn't even know was happening. While I had my head deep in the hand-to-hand combat of a serious turnaround, Alan was building a coalition to remove me. And I would've been next if the CEO hadn't nuked the whole thing first.

That's when I learned one of the most important lessons of my career: politics don’t stop when you hit the boardroom. They only just started…

Before we dive in…

You’ll spot a few changes to Playbooks starting today. Nothing dramatic - just a tightening of screws based on your survey feedback.

From now on, the big story - the long, cinematic “Working Capital” anecdote - will only appear in the first issue of each series. Instead, we’ll weave shorter anecdotes into the pieces, alongside more worked examples and case studies - especially in the more technical or numerical stuff.

You’ll also notice clearer visuals and sharper formatting. Making each issue easier to read and faster to act on. We’ve also got an awesome run of content lined up for the second half of 2025. Keep an eye out for some new formats, too 😯.

All of this is in service of the same thing: building the best damn learning product on the internet for real CFOs.

The Subtle Art of Giving A F*ck (About Politics)

This month, we head back into the viper’s nest: corporate politics.

The CFO seat is lonely at the best of times. And when the pressure’s on, you’ll feel the invisible hands steering the CEO, whispering to the board, testing your footing. Even at the top, it’s hard to tell who’s really pulling the strings.

We’ll cover the sharpest edges of organizational power: turf wars over budget, execs playing both sides, whisper campaigns, boardroom landmines.

This series is about how to survive it… and maybe even win.

In my early days, I proudly told my boss that I didn’t do politics.’ I thought that made me sound smart and mature. She gave it exactly the treatment it deserved. She told me it was the ‘dumbest sh*t she’d ever heard.’ And that ‘everything is politics.’

She helped me see that my framing of ‘politics’ was wrong. The real job was influencing. And politics was just a label we put on influence we didn’t like doing…

So, you don’t get to ‘not do’ politics. Even if you opt out of politics, that is, in itself, a political act. And sets fire to your own seat at the table. Not a good idea.

When politics is dangerous (or useful)

Politics are dangerous when they are hidden, self-serving, and unconscious. But can be powerful when transparent, anchored in the business, and thoughtfully played.

Ultimately, this comes down to the cultural model in your business. The best leaders I’ve seen give and demand radically direct feedback, even if it's painful. This is great because people know what they need to do. But there is a much bigger benefit. When feedback is clear, direct, timely, and open, you don’t have an organization wondering what leadership thinks.

I remember spending face to face time with my internal audit team for the first time in a while, after COVID. The atmosphere was weird. I surfaced the elephant in the room. What are you guys not saying? Why are you so quiet?

“Are you here to fire us?”

“What?! No…?”

“We heard that you didn’t value internal audit and were going to wipe out half the team.”

It was a complete fabrication. Totally unfounded. But through my own failure to provide clear and frequent enough feedback, I’d left enough space for the team to speculate. And then it turned out, one of the BU controllers, who’d been unhappy with their audit, had twisted the knife.

The feedback vacuum had been filled with fear, bullsh*t, and conjecture. Politics at play.

The Intent Hierarchy

With leadership comes responsibility. The responsibility to put the business interest before your own.

Critical to understanding politics at play is to know the people you are dealing with, and who they are there to serve in the business:

Self. These people make decisions and take actions that affect the whole business in service of their own interests. To protect their position, make their bonus, and get ahead personally.

Individuals. These people prioritize the interests of specific individuals, often preferred members of their team or friends within the business.

The Team. Highly protective of their domain and the people within it. Even if it's to the detriment of the business as a whole.

The Business. These people make decisions that are right for the business. Even if that means sacrificing themselves, their allies, and their team.

If you want to understand the people around you and how to influence them at work, understanding their intent and who they are serving is the most important skill.

And this isn’t easy to spot. What I think is right for the business might be different from you. And even if we agree on what is right, we might disagree on how we do it.

Which is why the question here is about intent. If our shared intent is that we truly both want what is best for the business, we should be able to find the way to a solution without toxic politics.

One of the reasons the PE model is so powerful is that it uses equity incentives to force an alignment of intent to the best interests of the business.

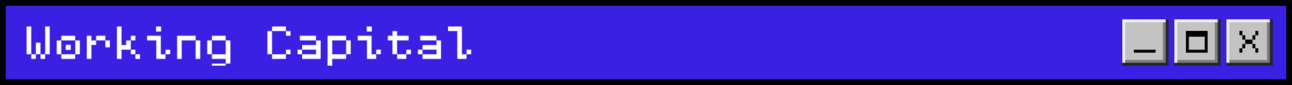

The 8 Political Faces

As I mentioned earlier, opting out isn’t really opting out. It’s just a kind of passive brand of politics. That can be equally as powerful.

But combining the active and passive posture with the 4 layers of the intent hierarchy, we get to 8 different ways people engage in corporate politics:

Working from the top down:

The Grown Up: Active engagement and puts the business first

Understands that the best way to dissolve politics is to engage them head-on. Providing direct feedback, making tough decisions, and prioritizing what is right for the whole business over what is easy.

Some people were born for roles like this, some of them end up here reluctantly. But the greatest leaders all end up here eventually.

To put this in Game of Thrones terms, this kind of leader would be Jon Snow:

The De-Escalator: Passive engagement and puts the business first

Calm, principled, and avoids drama and conflict. Has faith that facts and logic will always win. But isn’t always right. Can be seen/used as a neutral resource to resolve disputes.

Tends to influence quietly on a one-to-one basis, but always for the good of the whole.

This is a common archetype for well-principled, yet introverted, CFOs. It works, but can lack range when something more forceful is needed.

Samwell Tarly woud be a de-escalator.

The Figurehead: Active engagement and puts the team first

These people can often look like the ‘grown up’ but they are not serving the best interests of the business as a whole. Their loyalty is to their kingdom: their team.

They will typically use their political influence to secure power and resources (budget) for their team.

Tywin Lannister is the perfect example of a Figurehead. Managing his own PR to appear as if his interest is for the good of the realm. When in fact the only thing that matters is his family’s legacy (his team):

The Shield: Passive engagement and puts the team first

Fiercely loyal to their team, but lack the context of the bigger ‘why’. They will quietly absorb pressure to protect their function.

They don’t actively engage to further the ambitions of their team unnecessarily, but they will defend their team’s interests fiercely even if it's the wrong answer for the whole.

Brienne of Tarth is the example here. Not politically active, but once she’s pledged to someone, she is 100% loyal.

The Dealer: Active engagement, putting individuals first

Cuts backroom deals to help their friends and allies. Clever, charming, and good in one-on-one situations. But will occasionally find themselves compromised.

Whether they are a force for good or not depends on who they have allied themselves with.

Tyrion Lannister would be a dealer, trading his way to outcomes for his chosen ones.

The Pleaser: Passive engagement, putting individuals first

Quietly devoted to individuals. Tend to avoid conflict, but lack the bigger picture of the consequences of their loyalty. This leads to misplaced trust.

Davos Seaworth or Jorah Mormaunt would be the examples here. Moving around quietly, helping the people they have chosen to serve. Without it ever being clear why they are so loyal.

The Sh*tbag: Acitvely self-interested

Openly manipulates and deceives to further their own interests. Their motivation is more for themselves, regardless of the consequences.

Dangerous, but easy to spot. Just like Cersei Lannister.

The Sniveller: Passively self-interested

These are often the most dangerous of the 8 archetypes, because they are hard to spot and good at wearing masks.

Strategically absent. Hoards and weaponizes information. Master at avoiding risk while angling for an advantage.

Classic Littlefinger… chaos is a ladder

The CFO Archetype

You've probably been each of these archetypes at some point. Maybe without realizing it. I certainly have.

But where's your default setting? And more importantly, where do you want to be?

My appeal to you, CFO: be the grown-up whenever possible. Actively put the interests of the business first (not least its your fiduciary duty.) It'll make you a better leader, your business more effective, and your workplace less toxic.

If you're an introvert (like many finance pros), start as the de-escalator. Put business first, but influence quietly. Then, as your voice grows stronger, evolve into the grown-up.

The business needs someone willing to make the hard calls. Doing that consistently, fairly, and transparently is the best antidote to a toxic environment that there is.

Common Political Traps

So what prevents CFOs from putting the business first? We’ll get into that across this series, but here are five common political traps I see in CFOs:

1) Avoidance. Pretending politics doesn’t exist. This means they merely give up influence to those who know it does.

2) Control through ‘no’. CFOs have ‘veto power’ over many decisions in the business. Either directly or indirectly (through the budget process). But some choose to wield that ‘no’ selectively. Like a weapon. This is bullsh*t. And masks bias as objectivity. I see this in finance leaders A LOT.

3) Rules for me, not for thee. One of finance’s dirty secrets is often how poor they are at following their own rules. Particularly when it comes to disciplines around spend approval processes. If you have the keys to the override switch, it’s hard not to use it.

4) Overusing the Higher Authority. A classic ploy of a ‘passive’ political CFO is an over-reliance on the ‘higher authority’ to make difficult points:

“That won’t work for our investors.”

“The Board won’t like that.”

It’s a powerful tool, and is something the CFO should have in their arsenal. But use it too often and you’ll look like a patsy and encourage people to go round you.

5) Back channel addiction. Well-placed back-channel discussions are crucial for building influence towards the right outcome. But if it’s your only way of communicating, you’ll soon be seen as a figure who works in the shadows and can’t be trusted. It’s common for introverts to make this mistake, with their shyness being misinterpreted as untrustworthiness as a result.

The above are all common distortions away from the north star (being active and open in putting the business first… even when it's hard).

Through this series, we will get into some specific examples where politics cause problems for the CFO and how to respond.

Spotting the Faces in Others

But the real art of politics is being able to spot in others which of the 8 faces you are dealing with.

If you are trying to get the best outcome for the business, a sniveller needs different tactics from a dealer. A sniveller most likely needs their games to be exposed, or called out, to make their tactics impotent.

Whereas with a dealer, it might actually work best to play their games and trade with them as long as it results in the best outcome for the business. We are going to get more into how you adapt your own style to deal with these faces throughout the series.

Series Plan

Here is the running order for this month's series on corporate politics and the invisible org chart:

Week 1: Series Intro - the CFOs role in corporate politics

When politics help and when they hurt

How to read intent inside the org

The 8 faces of corporate politics

The traps CFOs fall into without realising

Week 2: The Hidden Hands of Power

Who really holds power (and who pulls their strings)

The influence matrix behind the CEO and board moves

How to read silent shifts in power

What to do when you sense it turning against you

Week 3: How to survive a change in CEO

Why you’re being re-audited even if you keep your title

The real disruption no one names

How your scope shifts without warning

What great CFOs do (and when to quietly plan your exit)

Week 4: How to use data to dissolve politics

How data became the new political weapon

Why nobody agrees on “truth” anymore

What AI will amplify and expose

A practical model to reclaim discipline and trust

Net Net

Unhelpful corporate politics are like mold. They grow in dark, damp corners. The best antidote is radical transparency that starves toxic behavior and the conditions it needs to thrive.

Next week, we're diving into the invisible org chart, and the hidden hands of power. Watch your back!

If you’re looking to sponsor CFO Secrets Newsletter fill out this form and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

:::::::::::::::::::::::::::::::::::::::::::::::::::

:: Thank you to our sponsor ::

:: CAMPFIRE ::

:::::::::::::::::::::::::::::::::::::::::::::::::::

What did you think of this week’s edition?

If you enjoyed today’s content, don’t forget to subscribe.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.