This is CFO Secrets. The weekly newsletter that is “super pumped” for Q1 reporting season.

5 Minute Read Time

In Today’s Email:

🤗 Bringing a great finance opportunity to your inbox

🔄 Beginning a new series on FP&A

🥚 Cousin Greg reads the Economist

THE DEEP DIVE

When FP&A goes wrong at a $100bn business, and what you can learn

“Sorry. Did you say $20m?”

I couldn’t believe my ears.

I was in my first week of a new finance manager role. Only 3 years out of college, but excited to have joined this global mega corp. One with a reputation for only hiring the very best finance talent.

It made what I had heard even more surprising.

I was coming in to run reporting and FP&A for a part of the Income Statement for the business. It was only a sub-category of opex, but this business was so large that was still near $1bn of spend.

And the margins were narrow. The pennies mattered.

The guy who was handing over to me explained that there was a $20m black hole in the current year finances. Let’s call him “Matt” (because his name was actually Matt.)

I wasn’t clear what Matt meant so I asked him to explain.

He told me that it started at the strategic planning process. They had a corporate stretch target forced down on them. It had $20m of cost reduction stretch in year 1.

That year 1 became the budget expectation. And when he’d done the bottom up budget, he hadn’t been able to solve for the corporate task. So he started the year with a $20m difference between the corporate target and the bottom up.

Ouch.

But it got worse.

Matt had been posting a credit to the Income Statement to offset the budget task each month. He said “they would fix it later in the year."

We were in the fifth period of the year.

“Hang on… if you have already reported four periods like that, we are a third of the way through the year. One third of that $20m must have crystallized already? You must already have $7m of sh*t on your balance sheet?”

“That’s right, you’ve got it.”

Casual…

Matt had checked the box on his handover sheet. Dufus.

“That’s a big f*cking problem Matt. You are sat here with a corporate team who thinks your area is spending $20m (per year) less that you are. Meanwhile your locations are working to an aggregate number $20m higher, without a care in the world. And all the sh*t is stacking up on your balance sheet, at a rate of $2m a month? Good job you are f*cking leaving.”

“Oh … I hadn’t thought of it like that.”

The incompetence flabbergasted me.

But for me, it had shortcut my learning process.

I was fresh out of audit in the Big 4. Not used to FP&A / budgeting dynamics.

It was new.

Matt had managed to f*ck it up so badly, I was about to get a baptism of fire. Thanks Matt.

I now had court side seats to an education in alignment through a budget process. The VP of Finance for my area was now leading the charge.

I’d see first hand how to resolve tension between top down corporate expectations and the bottom up budget.

And the principles I would learn in the next few weeks would serve my approach to FP&A for the rest of my career.

Above all else; Good FP&A drives positive changes in business behavior

The next series of newsletters will dive deep into how this works.

We will walk through how to run a robust FP&A cycle. Process by process.

And how to get the alignment and transparency to drive performance.

We start this week setting the scene, and with an overview of the cycle as a whole. Then dive down into each component process in future editions.

Let’s start with the basics…

What is an FP&A cycle?

The set of processes that work together to improve future business financial performance.

Features of a typical FP&A cycle:

Almost always annual.

Each annual cycle takes approximate 18-20 months (meaning that cycles overlap one another)

The precise processes vary business by business, but typically include:

Long Term Plan

Budget

Management Accounts

Reforecasts

Monthly Performance Reviews

The below table summarizes each of the component processes and how they work:

Summary of key FP&A processes

The processes at the top of the table are more strategic, and get more operational towards the bottom.

But it’s how they work together that is most important.

They come together to form the annual cycle. The cycle tends to start 4-6 months before the start of a new year and finishes 2 months after the year end.

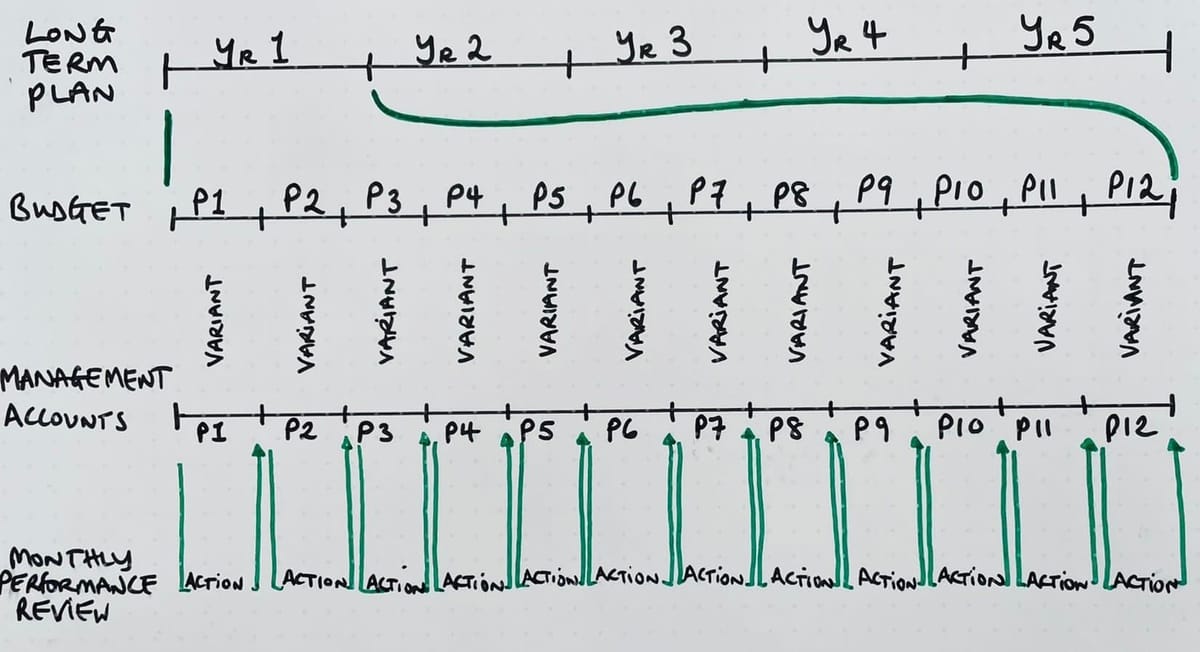

A typical example could look like this:

A typical annual FP&A cycle

I drew that myself with my kids pens … I hope you like it.

But it is the hand off points from one processes to another that makes it complex.

This is where Matt f*cked up. At each critical handoff point, he made a fatal error:

Long Term Plan - failed to resolve the expectation gap with corporate.

Budget - repeated the mistake from the LTP process

Monthly Accounts - parked the budget gap on the balance sheet

Monthly Performance Review - nobody discussed or resolved the variance. They didn’t know there was one!

Each of these processes also interfaces with the business in a different way. Great FP&A cycles should mean no-one ever gets surprised.

The below shows how a well controlled FP&A cycle should expose issues in the right place as early as possible.

How the FP&A cycle exposes issues and drives action

We will break down each of the key component down over the next six weeks, and dive deep into each:

Planning (Setting the targets)

Long Term Planning (Week 1)

Annual Budget (Week 2)

Re-forecasting (Week 3)

Reporting (Reporting Actuals vs Target)

Management Accounts (We’ve already covered this)

Monthly Performance Reviews (Week 4)

Engaging the business beyond finance

KPIs (Week 5)

Incentive Structures (Week 6)

Over the next 6 weeks, you will build up your financial planning playbook.

Remember …

A failure to align the business around targets, is a failure of the CFO.

And we will help you actually deliver that alignment. From the top of the business in the board room, all the way down to the shop floor.

I haven’t ever read any material that explains how this is done, only that it is important. Hopefully we’ll break new ground.

Spoiler: It’s 80% people and 20% numbers.

And for those wondering what happened to poor old Matt.

I don’t know… but I hope he has found a very rewarding career somewhere outside of finance. Or better … outside of business altogether.

BOOK CLUB

No book this week, something a bit different. Something … better.

Check out OnlyCFO. A finance newsletter, a bit like this one, but with better hair and more saas-sy.

OnlyCFO writes brilliant long form posts breaking down Saas business model and metrics. Software isn’t my sector, so I’ve learned a bunch from his blog, and you can too. Subscribe below

FEEDBACK CORNER

What did you think of this week’s edition?

A review from last time:

POACHED GREG

Greg trying to look smart in front of a centibillionaire.

Anyway …

That’s all for this week. As always you can find here on CFO Secrets, Twitter, & LinkedIn.

Look forward to getting suck into FP&A next week. Until then…

Stay Crispy,

The Secret CFO

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director or friend. Well, maybe I’m your friend. But I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need to make the right decisions.