Forward-looking CFOs recognize the potential of billing systems to open new revenue streams and accelerate global expansion.

Discover how finance leaders can use billing to propel strategic growth.

Johnny Cash from Scotland asked:

Our Whisky Distillery is still in the start-up phase, after a few false starts. We have recently restructured the workforce and are ready to move on to the next stage of our development and growth.

One of the systems the new management and board brought in at great expense was SAP Business One. They had obviously not been reading your newsletters on ERP implementations, and it was a disaster.

Part of my job was to come in and sort out how the company was using it. We are now using the system and it is working fine.

But it's too big a system for our company. It is a significant cost to maintain, and anytime we want to add some bespoke functionality or integrate with another system, it costs a fortune.

I have identified a combination of cloud-based systems that would be better tailored to our needs at far less cost and would allow us to be more agile. Ultimately, I think this will save us time and money whilst getting better results.

Is there ever a case for an ERP DE-implementation? How do I discuss this with the board, which does not see the day-to-day workings of the system?

Johnny. You hurt yourself today.

It’s not easy having to walk the line in a company like this. Only to find it’s a ring of fire.

OK, OK … I’ll stop.

I cannot tell you how many times I have heard this record.

“Hey, we will need a bells and whistles ERP eventually. May as well do it now so we are fit for the future.”

That is not how you build a finance function in a scaling business. This is how:

I invested in a small manufacturing business a few years ago. They had a great product and a lot of demand. They had a full ERP implementation. One fit for a business 20x their size. And they were proud of it.

It set alarm bells off for me, but it was a small check, and I was excited about the product, so I wrote it anyway. The company turned out to be a disaster. It couldn’t execute. They had turned into an IT company that was making a few things on the side.

I managed to get my money out, but only just. And I definitely spent more calories on it than I wanted. Mostly, I was p*ssed off with myself for not trusting my instinct.

It was the mother of all red flags.

Not just because the heavy-handed system got in the way. But also because it was symptomatic of a management team that had no idea how to execute. As I write this, I’m still cross with myself for not seeing that the unnecessary ERP was a symptom of a bigger problem.

Overburdening an infant business with overly complex systems is unforgivable.

It’s not the fault of the system (although I would lay some blame at the feet of the people who sold it to you), it’s the implementation. But some businesses are just not ready to implement this kind of solution.

So yes, there absolutely are moments when its right to ‘de-implement’ an ERP. If it’s that bad, just turn the f*cking thing off at the wall and start again with something simpler.

The question you have to ask is this will it be faster and cheaper to mature your business into the ERP you have, or to rip it out and put something fit for purpose in its place. Most of the time, the answer is the former, but not always.

So, forget the sunk time and cost. It’s gone. Ask yourself what problem you are trying to solve today with your ERP. And the best way to solve it. I’m assuming MRP (material requirements planning) is a big part of the motivation for using an ERP at an early stage. And good materials planning is important in a complex manufacturing operation, even if its small.

If the answer is pressing on and completing your SAP B1 implementation… then hold your nose, hold your nerve, and keep going.

But the bar is probably lower than you think for cutting your losses and trying something else. If you do decide to do the latter, focus on the best tool for your MRP requirements then bolt the bookkeeping around, rather than the other way round.

Best of luck, I don’t envy you.

Josh from NYC asked:

How do you deal with a supervisor who is being a 🤬

On the one hand... you want to have some dignity. On the other hand, you want to grow in the company.

Josh. Life is too short for working for an a**hole.

So if you are having to work every day with someone unpleasant, it had better be worth it. You better be getting exceptional growth, opportunity or paid a sh*t ton of cash.

If not, you shouldn’t tolerate it for long.

But before that, why are they being unreasonable? Is this a new thing? Are they under pressure? Going through something personal? Is it something you have done? Or is it just who they are? Are there small wins you can focus on that will make life easier for your boss and maybe change the relationship?

Context is important. Because the context will dictate if this can change and how quickly.

You should ask your boss if you can have an hour of coffee with them, or buy them a drink one night, because you ‘want their advice’ (play to their ego.)

Share some of your personal vulnerabilities with them about your career and choices, and you will hopefully get some reciprocity from them. The more you can understand what is driving them, the more you can understand why they are behaving the way they are.

And if you can understand why, then you can start to unpack if you can change the relationship, and how long it might take to do so.

It’s worth having some patience (changing companies/roles has a cost to it), but don’t be too patient. As I said, life is too short to be miserable at work.

Thanks for the question, Josh. And best of luck.

Michael from Portugal asked:

I work in corporate finance consulting (never worked in finance in a corporate setting) and enjoyed reading through your FP&A series.

However, I could not help but think that the whole process (the LRP and top-down targets, the many individual detailed budgets, the negotiation, the review and re-forecasting...) seems quite complex and cumbersome. In consulting, I have also witnessed several times that companies get so overwhelmed by the process itself that they forget what it is actually meant for, i.e., driving, tracking, and reviewing results. It also tends to be a process that is very finance-focused, and therefore ends up ignoring non-finance KPIs and variables.

Therefore, I was wondering whether you had some guidelines for simplifying the FP&A process, particularly for organizations that need more agility and/or have fewer resources, while at the same time making it more holistic by covering non-finance KPIs. For instance, I quite enjoyed your post on KPI and KPI dashboards. Could a Balanced Scorecard of sorts and the monthly tracking of a given set of KPIs replace a complex and excessively finance/budget-focused traditional FP&A process?

Thank you very much for all the high-quality content you share.

Thanks for the question, Michael.

You are right, the FP&A playbook I have set out is most directly applicable in a corporate setting. But the principles are identical for small businesses, it’s just the details of the precise steps that change. More specifically, some steps are simpler or can be left out.

The big differences to note between an SMB FP&A cycle and that in a corporate environment ultimately come down to one thing… the number of people that need to be involved in the process: The stakeholders are less complex in an SMB setting (often one or a few well-aligned owners/founders + 1 bank).

The top floor and shop floor are closer together, meaning the steps to align, cascade, and communicate assumptions and targets are more natural.

Many of the iterative loops you see in the Playbooks I have set out, especially in the long-range plan and budget processes, are there to align people. They bring a necessary formality to avoid chaos and confusion among a disparate group of complex stakeholders.

So you can certainly lose a lot of the process formality I set out in a simpler business.

But should an SMB have a high level multi-year financial plan, annual budget, monthly management reports showing financial and KPI performance against that budget, and a performance review cycle?

I believe most should, yes.

The SMBs I own all have these things. I have one for this newsletter, even if it’s just a few numbers in a spreadsheet that took me 30 minutes.

At a minimum, you should have some kind of rolling forecast/model and a monthly reporting regimen, if only to understand how your business makes money and ensure you aren’t going to run out of cash.

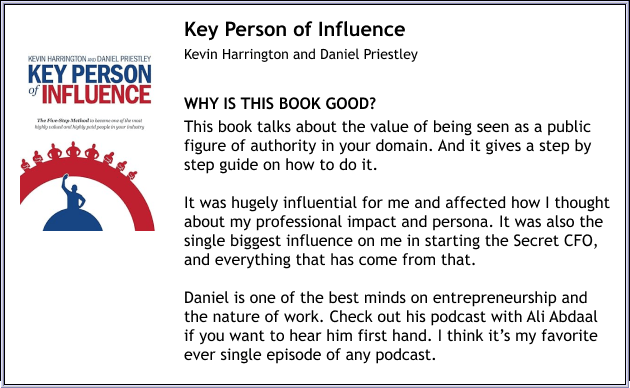

Every week, I’ll share a book I loved or found useful.

A few of the biggest stories that every CFO is paying close attention to. This is the section you probably don’t want to see your name in.

Ten years ago this guy was a senior manager in PwC’s audit practice. He’s had quite the run. Good to see he’s negotiated himself serious hurt money for being Elon’s CFO.

MN lawmakers just signed off on two new paths to earning a CPA. In addition to the 150-hour rule (i.e., an extra year of college), Minnesota residents can achieve licensure via:

1) Bachelor’s degree + two years of experience + CPA exam

2) Master’s degree + one year of experience + CPA exam

It comes at an interesting time though with most large accounting firms downsizing their audit practices.

ICYMI, here are some of my favorite finance/business social media posts from this week. In the words of Kendall Roy, “all bangers, all the time.”:

🚨CFO Secrets 2025 Reader Survey 🚨

Last call for the CFO Secrets 2025 reader survey. If you enjoy this content, please take 5 minutes today to complete the survey, before we close off the results tonight.

If you’re looking to sponsor CFO Secrets Newsletter, fill out this form, and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

If you enjoyed today’s content, don’t forget to subscribe.

Let me know what you thought of today’s Mailbag. Just hit reply… I read every message.

ICYMI, in Saturday’s newsletter, we got into big, beautiful management accounts. You can check it out here.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.