AI buzzwords don't drive change...

Candid conversations with leading CFOs do.

Campfire, the AI-native ERP built for modern finance & accounting teams, is hosting a first-of-its-kind finance and account AI Summit in San Francisco.

The sharpest minds in finance and operations are coming together to get tactical about AI in finance. Learn how forward-thinking CFOs are closing their books, managing data, and driving strategic insights with artificial intelligence.

Wake-up call

This was the final part of my plan. Or so I thought.

I’d risen to CFO of a $1bn+ revenue complex division of a corporate. I’d led a big M&A deal as CFO and was now running the integration. And I was still only 31.

But all of that? Just the warm-up act. What I really wanted was a shot at being a PE CFO.

I’d had a small taste earlier in my career, working on the sellside transaction team helping out on the DD of a corporate carve-out for a sale to PE. Just a taste. But it seemed cool. And I wanted in.

This was my first real shot. A specialist recruiter had set me up to meet a senior MD who ran the special sits book at a mega fund. A South African guy named Barry.

Barry had climbed the corporate ladder, then nailed multiple big-cap PE exits, shifted fund side as an operating partner, and now ran a part of the fund. Barry was a serious guy.

Up to that point, I’d aced every interview I’d ever done. I was used to being treated like the ‘young prodigy.’ I pretended to hate it. Secretly, I liked it.

So I naively assumed this would be no different. I’d meet Barry. He’d be impressed. He’d like me, because that’s what always happened.

But I walked into their plush PE office and instantly felt out of my depth. I hadn’t spent much time with bankers or on the investor side, so the environment felt unfamiliar. I was used to an earthier home. That, in hindsight, was the first giveaway.

My meeting with Barry was short.

He told me I had some “nice experience” (🤮), but I didn’t “understand how PE worked properly.”

Turns out he had initially agreed to the meeting as a favor to the recruiter. But I later found out he did have a live CFO role, a $50m revenue business that he’d have considered me for.

But he clearly didn’t believe I was ready for a serious PE CFO seat. Even one in a much smaller business than I had cut my teeth at.

With hindsight, I know where I went wrong. I hadn’t shown him that I understood PE economics, and execution of a value creation plan, well enough. So in the absence of any direct experience, why should he take a risk on me?

It was a humbling experience. And while I was sure he was wrong, I’d done a bad job in showing him that. And for the first time, I’d fallen flat.

He told me he was sure I’d learn on the job fast. But also that he had ten CFOs in his phone who wouldn’t have to. He’d seen them do it before. He had no incentive to speculate on potential.

Then he landed the killer blow:

“Come back when you’re ready.”

It brought me back to earth. I wasn’t one rung down from the top of the ladder. Nowhere near it.

I was standing at the bottom of a new one.

PE CFOs are built different

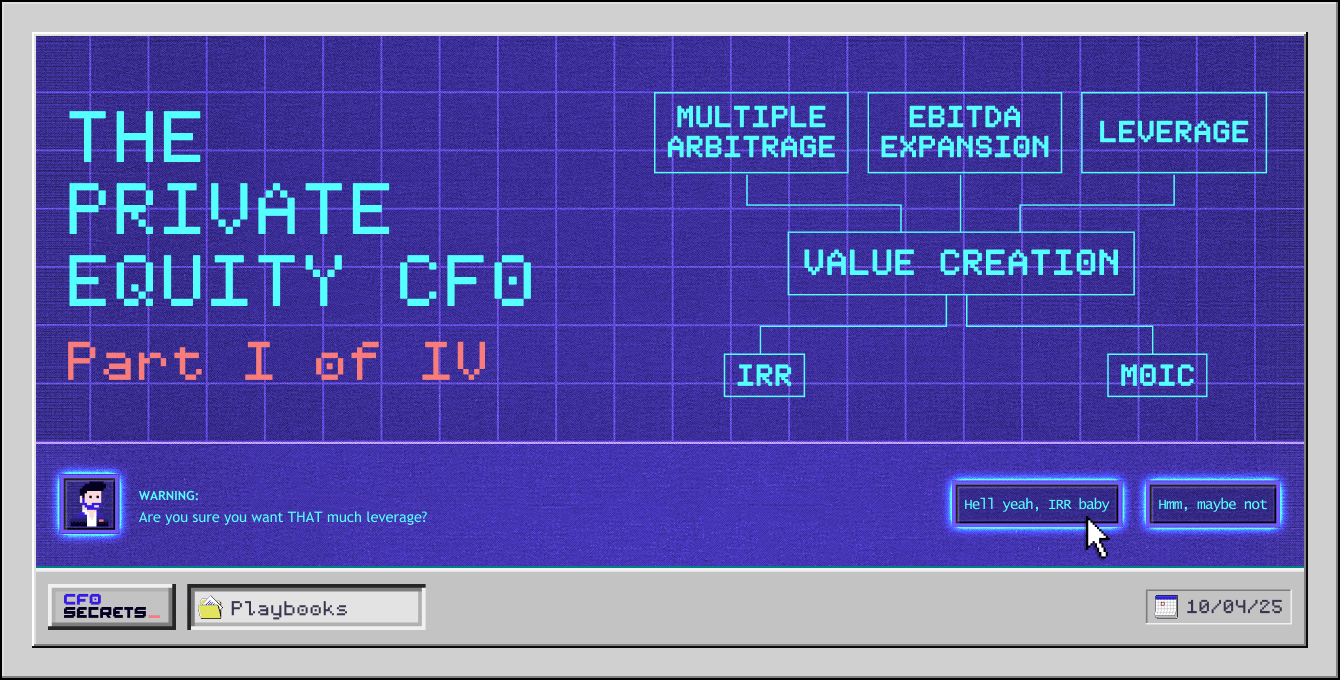

Welcome to a new series for October: The Private Equity CFO.

One of the most common questions I get from established CFOs is: “How do I break into Private Equity?”

The tone is interesting, because the suggestion is that it is seen as the apex of the CFO game. Whether it is, or not, depends on your perspective.

But you don’t have to look hard to see the appeal. Value creation isn’t theoretical, it’s tangible and time-bound. PE CFOs are probably the purest example of operating in the no man’s land between the numbers and the business.

You’re not getting paid to provide ‘strategic insight’ from the spectator seats (although they certainly can do that to). You’re actually in the business dragging every decision through a filter of what it will do to the exit value of the business, and the time to reach that exit value.

But first, let’s define Private Equity

Private Equity (PE) is the business of buying businesses. In this game, the business is the product. PE firms raise capital from institutional backers (think pension funds, endowments, sovereign wealth funds), then use that capital, plus a healthy dollop of debt, to buy companies.

The playbook is simple: buy, transform, exit. In theory… but the execution is anything but.

Everything in PE is about value creation, but more precisely, it’s about the trade-off between value and time. Grow EBITDA. Squeeze cashflow. Stay inside bank covenants. Professionalize operations. And ultimately, position the business for a lucrative exit in 3–7 years.

PE often gets slammed for gutting businesses. And yes, there are plenty of horror stories. A few bad actors, too. But done right, PE is about unlocking trapped value. It’s taking a good-but-underperforming business and making it perform like a great one. Almost makes it seem like a noble profession.

Are they building companies to last 50 years? Not directly. But durable, resilient businesses command higher multiples. So while PE isn’t playing the infinite game, durability does sell.

Let’s see an example:

Case Study: Dr. Martens – A Win For Private Equity

Dr. Martens is an iconic British boot maker beloved by punks, fashionistas, and workers alike.

But, this isn’t CMO Secrets… we’re not here for the brand story. We’re talking numbers.

In 2013, the 60-year-old family business was acquired by Permira for around £300 million.

Fast-forward to January 2021 and Dr. Martens IPO’d at a £3.7 billion valuation. That’s a 12x leap in value.

So how did they pull it off?

Private equity value creation isn’t magic – it’s math. Math backed by operators good enough to bend reality until the numbers obey.

In Dr. Martens’ case, three big drivers powered the jump from millions to billions.

1) They grew sales by more than 3x

They leveraged the cult brand and unlocked its sales potential.

Annual sales more than tripled from about £209 million in 2014 to £672 million by 2020. They expanded globally, opened stores, and (crucially) embraced e-commerce. Online sales went from 7% of total revenue at entry to ~20% by 2020.

The brand’s 60+ years of counter-culture heritage gave them a built-in growth engine: a fiercely loyal global fanbase. Permira knew they had a one-of-a-kind, iconic brand. They figured out how to unlock the sales potential of that fandom.

2) The big fat margins got even fatter

They shifted Dr. Martens from a manufacturing-led wholesaler to a consumer-first, digital-led retailer. They offshored manufacturing, built their own stores and scaled e-commerce.

Before the buyout, operating margins were ~14% (e.g. £22.9m profit on £160m sales in 2012). Under Permira, EBITDA margins nearly doubled to ~29% by FY2021. In cash terms, EBITDA went from roughly £30–40 million at entry to £224 million by 2021.

Higher sales and higher margins. This is the sort of stuff CFOs dream about..

3) Captured multiple expansion through a smart exit

Once the earnings engine was humming, the market rewarded it. Permira bought in at a single-digit to low-teens EBITDA multiple (~£300m on ~£30–40m EBITDA). By IPO, the business was valued at a high-teens earnings multiple.

Why? It was bigger, de-risked, and had a proven growth and margin story. Public market liquidity premium.

Not only did EBITDA grow ~7x, but every £1 of EBITDA was valued more richly in 2021 than in 2013.

And, of course, Permira timed the IPO perfectly into a hot market. But that’s not luck. That’s the job.

Permira turned a £300 million entry into a multi-billion exit by growing the top line, expanding the margins, and selling into a hungry market. A masterclass in picking a business with good fundamentals, a smart plan, strong execution, and perfect timing.

And that doesn’t happen without outstanding, hands-on, finance holding it all together. In a deal like this, the CFOs fingerprints are everywhere:

Structuring the financing

Managing leverage without choking growth

Building reporting muscle to track margin expansion

Driving the hell out of working capital to fund store rollouts

Preparing the business for IPO scrutiny

Since the IPO, the share price has fallen sharply (~70%). Some say the margin expansion came at a cost with long-time fans claiming the product quality isn’t what it used to be. So, how well this deal has aged is debatable (with public investors now wearing the blisters.) But as a demonstration of the private equity value-creation playbook - growth, margin, and multiple - it still stands as a masterclass.

Skin in the Game: Why the Right CFOs Chase the PE Seat

For the right CFO, private equity can be life-changing. Unlike traditional corporate roles, PE offer the chance of meaningful ownership, typically 1–3% of the business. On a successful transaction, that’s real money. If you’re holding 2% of sweet equity in a company with $1.5 billion of value to share (after pref stack dilutions), that’s a $30 million outcome. (More on how this works next week.)

Now this is a top-end outcome, of course. A median outcome of $1m-$5m is much more common. But it shows what’s possible, and what attracts CFOs to this world.

Of course, these outsized rewards come with plenty of risk…

With the level of debt these deals carry, it doesn’t take much for the equity to fall underwater. And once it is, it’s hard to pull out without a reset of incentives, or a full recapitalization.

And the equity is vital … base salaries are often modest compared to big corporate gigs and bonus schemes are rare.

PE works because it aligns incentives, capital and talent pulling in the same direction. But that also means the bar is brutally high.

To earn the seat, and keep it, you need far more than financial fluency or vague promises of “strategic partnership.” You must manage the board like an operator, not an advisor. Track value like a hawk. Know the covenants cold. Handle the CEO, the investors, and the lenders, simultaneously. And above all, ensure incentive alignment and measurement connect from the top floor to the shop floor.

Why a PE CFO mindset is helpful

Over this series, we’ll break down the PE model. What makes it work? What PE funds measure (and why)? What does that mean for investment strategy, portfolio companies, and their CFOs? And how you can become a top PE CFO if that’s what you want.

Whether you're on the CFO path, looking to break into PE, or already living it, I hope there's something here for you.

PE CFO roles are full-spectrum finance, not just P&L management or cashflow driving.

It’s three-statement management. PE CFOs live and breathe the income statement, balance sheet, and cashflow, as a system.

You can’t drive EBITDA without managing working capital. Revenue growth won’t bail you out if margins are poor. Your debt covenants are tight as hell, and if you breach them… well, you are in for a world of pain.

A great PE CFO is obsessive about managing their capital structure. That means eating, sleeping, and breathing leverage covenants, cash sweep mechanics and amortization triggers, working capital variability and liquidity risk, etc.

In PE, the capital structure means the CFO can’t hide in one or two financial statements. Everything connects. Everything matters.

Which is exactly why every CFO can benefit from being a bit ‘more PE’:

A PE mindset = value discipline. You learn to treat capital like it’s not yours, because it isn’t. Every dollar has a cost and a clock.

Knowing cash is survival. PE CFOs have to embrace cashflow discipline at another level. World-class cash discipline isn’t a nice-to-have, it’s life or death.

Understanding outcome > process. Everything starts with the exit. The entire operating model is reverse engineered from it. There’s no room for ‘process for process’s sake.’

Recognizing value realization is universal. PE is just the most distilled version. But every CFO benefits from viewing the business through a value creation lens.

Knowing you’re the bridge. A PE CFO isn’t just a number-cruncher, they’re the connective tissue between management and the fund. That means juggling board management, investor reporting, and capital strategy.

While you’ll see shades of this in any CFO role, in PE-backed companies it’s all dialed up to 11. The pace is faster, the scrutiny sharper, and the stakes (for the CFO) are higher.

Put another way, PE CFOs are just a different kind of animal.

Series Preview

Here is what we have in store for this series:

Part 1 (Today): Why PE CFOs are built different

Part 2: How the PE Machine works

How PE creates value (a deal example)

The Fund model (fund lifecycle, hold period economics, capital stack)

LP/GP dynamics

Operating partners

Debt, leverage, and recaps

Part 3: Value Creation Playbook

Buy and build strategies

Operational turnarounds

Tech enablement

Exit planning (From Day One)

Part 4: How to get hired (or fired) as a PE CFO

Sponsor credibility

Value tracking frameworks

Managing the board/operating partner

Getting in the door

Net-net

You don’t become a PE CFO by luck. It’s a different game. Faster, sharper, and with higher stakes.

This series will break down what makes the model tick. But first, you need to understand the model. How PE firms actually work, what they’re solving for, and how that drives everything the CFO does.

And that’s where we’ll head next week.

If you’re looking to sponsor CFO Secrets Newsletter fill out this form and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

:::::::::::::::::::::::::::::::::::::::::::::::::::

:: Thank you to our sponsor ::

:: Campfire ::

:::::::::::::::::::::::::::::::::::::::::::::::::::

What did you think of this week’s edition?

If you enjoyed today’s content, don’t forget to subscribe.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.