Churn is a silent killer

It’s draining your bottom line, negatively impacting forecasting, and growth.

The Stripe guide to churn helps finance leaders fight churn, helping them protect profits and business valuation. Learn proven strategies to recover lost revenue.

We’ve got some great topics today. Here’s what’s on tap:

A complete framework for ‘MBR-Lite’ - monthly business reviews for start ups

My philosophy on handling the pressure (lighten up)

Building a an SMB management buyout

Now, let’s get into it.

Abe Froman from Chicago asked:

Any advice on how to institute a Monthly Business Review (MBR) process in a fast-moving, pre-revenue startup? Is there a “lite” MBR version we can start and ramp up as the company matures to avoid consuming valuable time for monthly meeting prep workstreams? We don’t have a deep finance team or dedicated business partners to support the MBR prep. I’m trying to strike a balance between:

1) Giving executives and business unit leaders the management accounts they need to assess financial health for the company and their units, and

2) Not bogging down the teams in rear-view financial analysis as we get off the ground.

Our CEO doesn’t want to spend too much time on the past beyond simple explanations for actuals vs. plan (we diverge there) or create a bunch of new workstreams to pull vital time from the teams (we agree here).

I don’t want to create finance work for the sake of creating work, but I also understand that the importance of the process isn’t only the actual monthly report, but the meeting and transparency. I’m curious how you’ve navigated or observed a similar situation.

Abe, your instinct is spot on. A full MBR (as I’ve described them in the past) is not right in this environment at all.

Your company doesn’t really have any ‘financial health’ if it’s pre-revenue. The only thing that matters (from a financial perspective) on a monthly basis is your burn rate and how much runway that gives you.

So the first question is whether a monthly rhythm is right for your business? I like EOS (The Entrepreneurs Operating System) by Gino Wickman in small businesses and start ups. Which tends to work more with a quarterly-weekly cadence.

But there is merit to a monthly cycle too. And by training it into the execs now, it gives you a framework you can grow with.

So how would I build an an MBR-lite deck for a start up?

It might look like this:

MBR Lite Framework — Monthly Ops Review for Pre-Rev Startups

1. Finance Overview (one to two pages)

Burn vs. Plan: Actual cash burn vs. forecast

Runway: Updated months remaining at current burn

Variance Drivers: One-liners for material shifts (e.g., hiring slippage, unexpected vendor cost)

Cash Bridge (if burn volatility is high)

Keep it simple. No overproduction.

2. Functional Update Pack (two pages per function)

Organize this per team: Product, Engineering, GTM, Ops, etc.

Page 1: Commitments & Outcomes

What We Said We’d Do | What We Did | Status | Notes / Impact |

Launch MVP v2 | Launched on time | ✅ | N/A |

Hire 2 backend engineers | Hired 1 | ⚠️ | 1 declined offer |

Draft pricing model | Not started | ❌ | Deferred to Q3 |

Use emojis or RAG for fast signal scanning.

Page 2: Reflection + Forward Look

What Went Well: 2-3 bullets

What Went Badly: 2-3 bullets

What’s Next: Clear upcoming priorities

What Needs Help: Any roadblocks that need discussing or support from the CEO/Exec

3. Launch Timeline

Latest Gantt-style roadmap to launch

Highlight slippage risk areas in yellow/red

Keep it updated only monthly to avoid process creep

But crucially, you shouldn’t be waiting a month to uncover problems. This meeting should be confirmatory, not diagnostic. Its real value is building a monthly rhythm and enforcing functional accountability. Each exec should be able to prep their update in 15 minutes and talk it through in the same time. The whole meeting shouldn’t take more than 90 minutes. Big issues should be surfaced and solved in real time, not saved for the MBR.

You can evolve the format as there is more to measure and formalize, and by embedding the discipline now, you won’t be starting from zero.

Andrea from Milan asked:

In The Subtle Art of Giving a F*ck (About Politics), you wrote, “Staying calm under pressure was my superpower.” My long-term goal is to become a CFO, but I worry that I may struggle under intense pressure. What advice can you share on improving my ability to manage stress? Is staying calm something we’re born with, or is it a skill I can develop?

Andrea - brilliant question.

I do think some people are naturally wired to handle pressure better than others. But experience is the secret weapon here. It helps you separate real pressure from the imaginary kind. The manufactured stress we wrap ourselves in because of politics, perfectionism, or impostor syndrome.

I could give you a list of “stress hacks,” but truthfully, stress management is deeply personal (and often comes back to diet, exercise, and sleep). What works for one person might be useless for another.

That said, there’s one philosophical lens that’s helped me. And it might help you too:

What we do just isn’t that important.

We’re not performing open-heart surgery. We’re not defusing bombs. We work in clean offices, mostly behind screens, and get paid well for our time. That’s not stress, it’s a privilege.

The toughest period of my professional life coincided with a personal tragedy. One day, I’ll tell the full story. But during that time, work suddenly felt… trivial. And weirdly, that was liberating. Because once I stopped inflating its importance, my performance actually improved. I became sharper, calmer, and more efficient.

I reframed work as: the highest-stakes thing in the category of low-stakes things. Compared to your health or family, a board meeting just isn’t that big a deal.

And look, I know my content can make some of these stories sound like life or death. But they’re not. They’re critical inside a narrow window of privilege and relatively unimportant things. That's the point. We operate in a high-drama bubble, but it’s still a bubble.

That framing changed everything. Work still matters, but it’s fun, not fatal.

It reminds me of the Pope John Paul II quote:

"Among all unimportant subjects, football is by far the most important."

Same goes for work, if you are lucky enough to work in finance.

Take it seriously. Just not too seriously.

ChunkyMonkey from North Carolina asked:

The 100% owner is looking to sell the business. I'm exploring a management buyout option, but I need help understanding typical loan and capital structures. I would most likely use bank debt, seller financing, private equity, and management investments.

What are typical loan terms? What should an investment from a PE firm look like? Also, what is the max cash flow to debt payment ratio, so I don't put the MFCF at risk?

Thanks for the question, Chunky Monkey. I can only assume you’re named after the best Ben & Jerry’s flavor.

The exact structure will depend on the business, sector, and cashflow profile. But here are the key principles to guide your thinking:

1. Seller Notes Can Be the Unlock

If the current owner is open, a seller note can be a game-changer. I’ve seen deals like this closed with 100% seller financing, especially when the owner wants to ease into retirement and trusts the management team. Rare, but it does happen.

Seller notes work in your favor, too. They’re usually flexible and from a “friendly creditor” if the relationship is solid and the terms are clean. Understanding the motivation of the seller is key. If they want their money out to buy a boat … a seller note won’t work. If their priority is taking care of employees and customers, but they want their time back - a seller note dominated deal might work.

2. Prioritize Deal Terms Over Valuation

A lower multiple doesn’t always mean a better deal. Paying 4x EBITDA over 5 years may be more attractive (to you, and the seller) than paying 3x over 18 months. Model it through the lens of cash coverage and see what structure is actually sustainable.

3. Know Your Risk Tolerance

Decide how much capital you’re willing to risk. Enough that it hurts if you lose it, but not so much that it wrecks you. And remember, capital isn’t just cash. If you’re agreeing to personal guarantees, that’s real exposure, too.

4. Use SBA Financing if You Qualify

The SBA program can give you leverage by backing a portion of the loan. This makes banks more comfortable and helps you raise more capital. Use a loan broker who knows the SBA system to maximize your options.

5. Keep Debt Service Within Reason

When I underwrite these deals, I aim for no more than 50%, or maybe 60%, of MFCF going toward total debt service (seller note plus bank debt). That should be based on current MFCF, not assumptions about growth unless it's fully locked in.

6. Backsolve to the Equity Need

Once you model the debt and seller note structure, you’ll know how much equity you need to plug the gap. That tells you whether you should be talking to a PE firm or whether you can fund it ,or even syndicate it from your network. Plenty of folks want exposure to the SMB/ETA space without lifting a finger. Those can be great silent capital partners if the deal is right.

7. Don’t fall in love

If the deal just doesn’t pencil, you need to walk away. Don’t get emotionally connected.

These are the general rules of thumb. The actual shape of your structure will depend on the specifics of the business and its cash flows. But this framework should give you a path to start building the deal.

Here I share a book or podcast I loved or found useful.

Hearing 6,000 people at the Radio City Music Hall this week for the Acquired podcast interview with JPMorgan Chase CEO Jamie Dimon was inspiring. (Life Goals for CFO Secrets?)

The interview was great. Not least he talked about how he used his approach to accounting for the banks’ balance sheet as a competitive advantage for his bank through crises periods.

A few of the biggest stories that every CFO is paying close attention to. This is the section you might not want to see your name in.

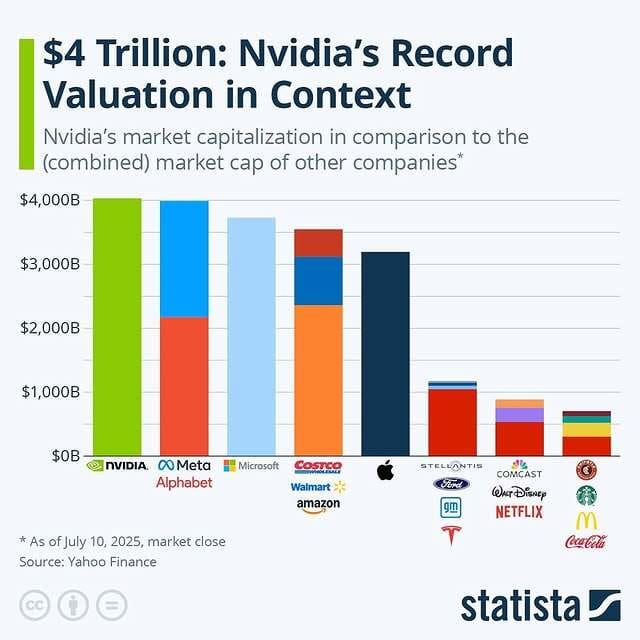

It is much easier to sell that AI capex when you just reported another stellar quarter.

Turns out “Clothing-as-a-Service” was a zero-interest rate phenomenon… who knew?!

ICYMI, here are some of my favorite finance/business social media posts from this week. In the words of Kendall Roy, “all bangers, all the time.”:

To be fair … I think you’ll see that pants and shoes combo quite a bit at a Coldplay gig.

If you’re looking to sponsor CFO Secrets Newsletter, fill out this form, and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

If you enjoyed today’s content, don’t forget to subscribe.

Let me know what you thought of today’s Mailbag. Just hit reply… I read every message.

On Saturday, we discussed the moments when politics hit hardest, what I call a “Big Reset Moment.” These are those sliding door moments… when everything shifts overnight. New ownership. A change in CEO. A sudden restructuring…

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.