Most FP&A teams know what needs to change. The hard part?

Digging out from the pile of manual data cleanup, tool overload, and spreadsheet chaos that’s built up over time.

Meet Aleph: the AI-native FP&A platform that is transforming how finance teams centralize and work with cross-system data to achieve 10X the output and impact without adding headcount.

With “time-to-value” measured in hours, there’s plenty of time to automate away the busywork before 2026 even starts.

The Soft Stuff is the Hard Stuff

When Paul G. Whitmore coined the term ‘soft skills’ in the late 1960s, he wasn’t thinking about quarterly business reviews and team building exercises. He was building a framework for the US military in the middle of the Vietnam War.

In that context, “soft skills” were the leadership and communication muscles needed to motivate and mobilize thousands of young men to run willingly into battle.

They stood in contrast to the hard skills required to survive the Vietnamese jungle while an enemy soldier dropped out of the trees and ambushed you in a hail of AK-47 fire.

Calling leadership and communication ‘soft’ skills made sense in that world.

But whoever stole that valor for use in business has a lot to answer for…

‘Soft skills’ make them sound warm and fluffy. Like they are easy and gentle. But in practice, we are talking about leadership, influence, and judgment.

And we call those ‘soft’ in contrast to hooking your budget model up to a data source? Or ticking off year-end tax journals and making a board deck look pretty?

Please.

There are no hard skills in finance in the Whitmore sense. Nobody is fighting through the jungle under fire, although the LinkedIn thought leaders might want you to think they are. The hardest skills in our world are the ones we write off as soft.

Welcome to part 2 of our four-week series on finance transformation. Last week, we stripped it back to first principles. What finance transformation actually is. Why most attempts fail and the traps CFOs fall into.

At the heart of any transformation is cultural change. People call this “getting buy-in.” I get “I have a great plan, all I’m missing is the buy-in to do it” messages all the time.

But the truth is, if you don’t have buy-in, then you don’t have a great plan. That’s like saying you have a great strategy to break the 100m sprint record… and all you need now is the ability to run at a top speed of 28 miles per hour.

Buy-in is the work.

All aboard?

In The 7 Habits of Highly Effective People, Stephen Covey wrote that all things are created twice:

First is the mental creation. The envisioning. Seeing what’s possible.

Second is the physical creation. The execution. Making it real.

Former England and Manchester United striker Wayne Rooney used to talk about lying in bed the night before a match and visualizing himself scoring goals over and over again until it felt real. He described it as creating a ‘memory’ before the game.

That’s an acute example, but the same idea applies at scale. You need to help other people see the future. What the world will look like after the transformation. What it means for the business. What it means for their team. What it means for them.

And it needs to be so clear and compelling that the whole finance function, and anyone else you need on board (looking at you, HR and IT), is willing to follow you up the mountain to deliver it.

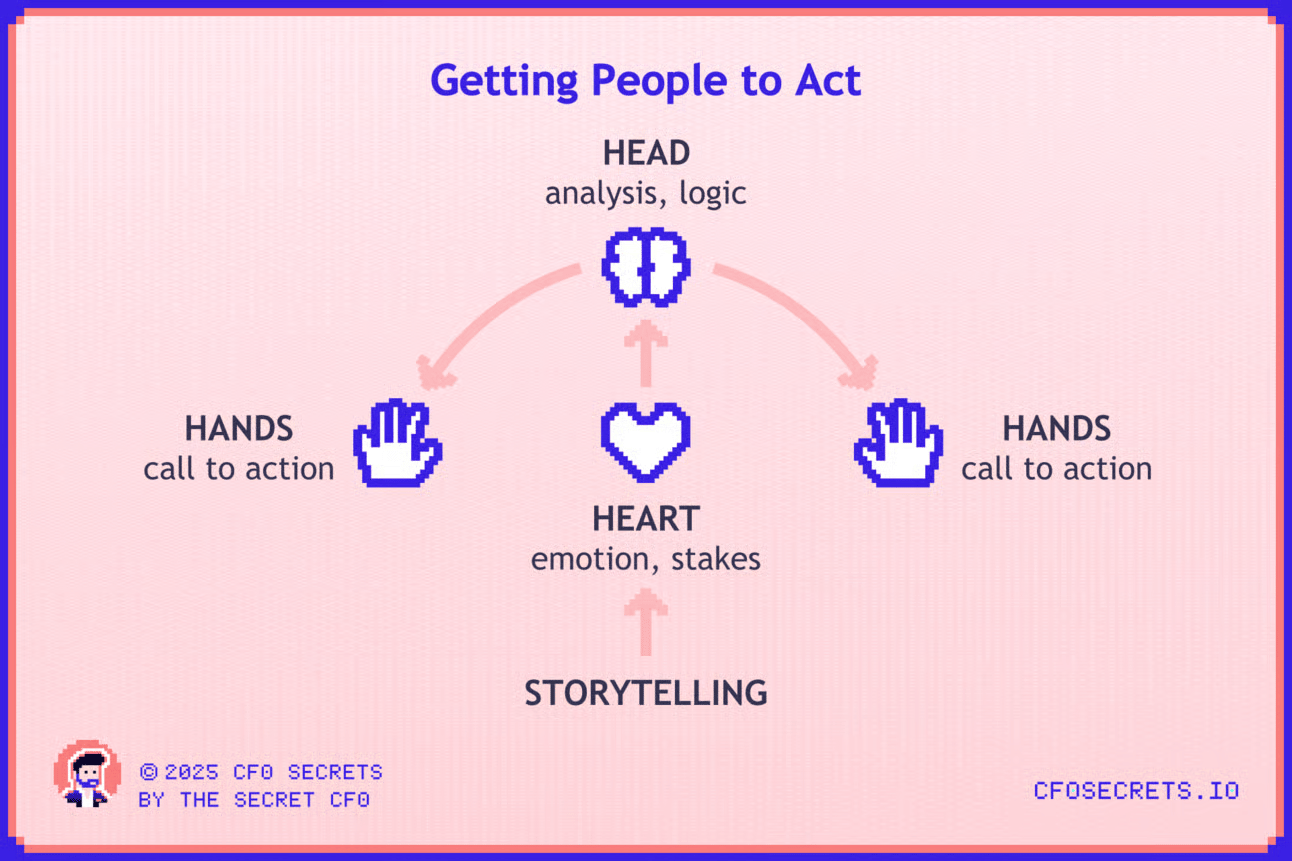

That means winning Heart, Head & Hands

Business bookshelf favorite Jim Collins said leadership is the art of getting people to want to do what must be done. For CFOs, that is never more true than at the start of a transformation.

If transformation is a priority, it means you are dissatisfied with the current state of finance. There is inertia to break. People have to shift from “this is how we do things” to “this is how we will do things.” Never a small ask.

Whenever I need someone to take an unexpected action, or a long series of them, I go back to the Heart, Head, and Hands model:

I’ve written about this several times before in different contexts, so I won’t beat a dead horse. But the principle is simple. For any meaningful change, you have to engage people in the right order:

Start with the Heart. Acknowledge the emotions. Show them why this matters. People act when they feel something.

Then go to the Head. Lay out the logic. The facts. The rational case. Make it make sense.

Then go to the Hands. Only after heart and head are aligned do you ask them to do the thing you need them to do.

It all starts with your finance strategic plan

Of course, there isn’t a single magic one-pager or all-hands meeting framework that will unlock your team’s heart, head, and hands. But a simple document can be the starting point that anchors the plan. Mobilizing a larger team will require something a little more visual and sharable, though.

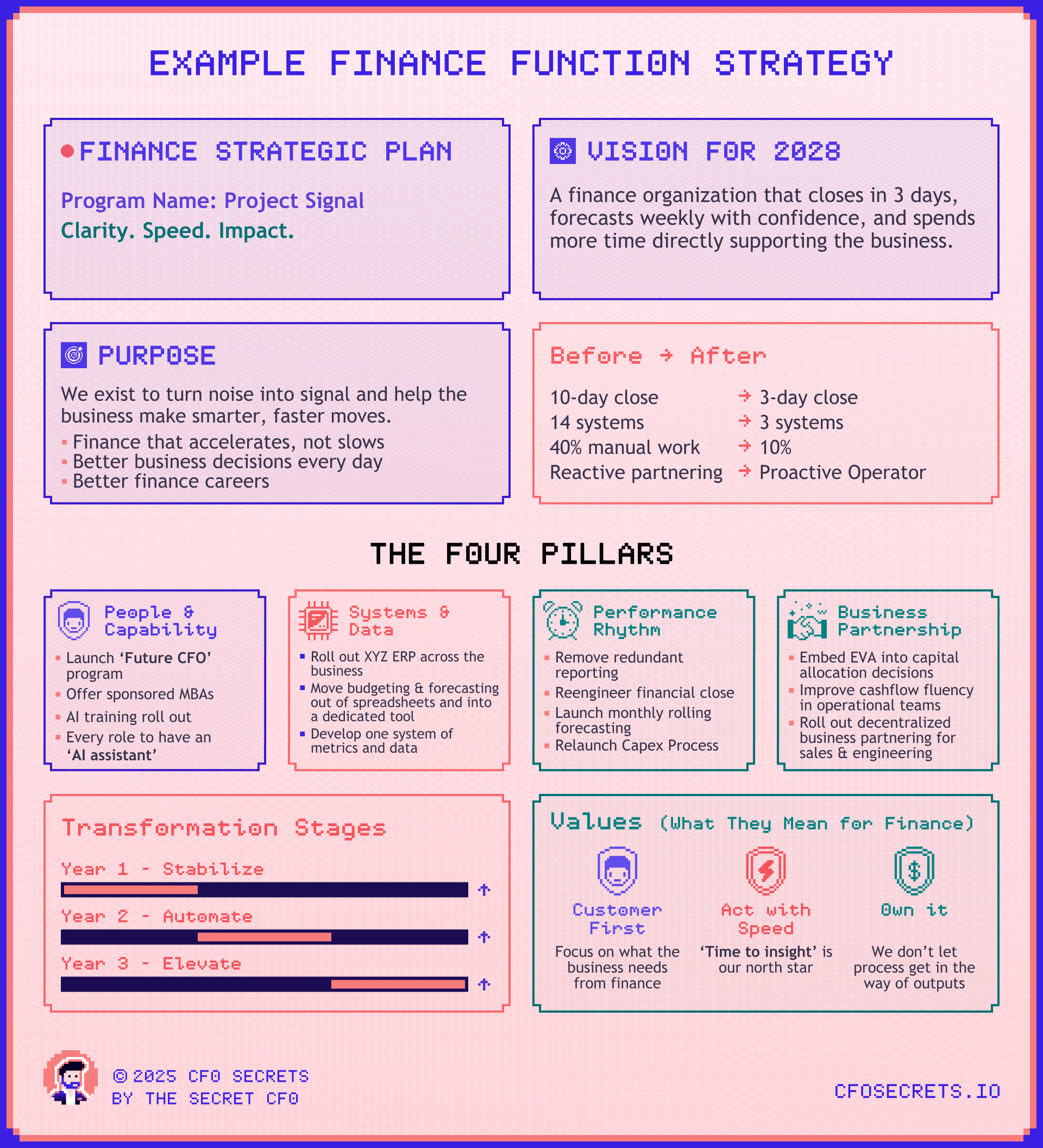

To give you an example of how I like to present this, it could look something like this:

A word of caution: Too many transformation programs show up as 100-page slide packs and immediately descend into bureaucratic paralysis. Classic finance behavior. All head and hands. No heart.

The exact elements you need in this plan will depend on your business, but let’s break down some common ones:

Name. Give the program a name. Microsoft called theirs ‘One Finance’. A little cheesy, maybe, but it was memorable. Inspiring. Quotable. When Amy Hood wanders among her finance team, quoting ‘One Finance,’ everyone will know what she means and why they are doing it. Bonus points if it's a name your team won’t make fun of at happy hour.

Purpose. A short, enduring, and inspiring statement on why your finance team exists. It’s normally some variant on delivering value for the business and building better finance careers. A never-ending pursuit worth chasing. The purpose grounds the whole transformation in something meaningful.

Vision. Not to be confused with purpose. A vision for what finance will look like at the end of the transformation window, usually 2–5 years (but be specific about the time frame). That’s long enough to be ambitious, but not so vague that it becomes meaningless. Include some ‘before’ and ‘after’ statements. These are a great way of showing the expected transformation.

Pillars. These are the major workstreams. Finance talent almost always appears as one. There’s usually a systems and data pillar too. And closing faster features in most transformations. Be specific about your actual pillars. AI adoption will be huge here, or it might sit inside every pillar. These are the kinds of choices you need to make. Think of them as analogous to the ‘muscles’ in the previous series.

Stages. You also need to break the transformation down into manageable chunks. This is where it becomes real for people. Show the milestones and sequence. Years can work nicely as a sensible interval, with a few headlines on what you’ll achieve in each. Think carefully about the phasing. Be too ambitious in year one and quickly make it acceptable that things are late. Not ambitious enough, and the boulder won’t move at all.

Values. These are the behaviors you hold dear while doing all this. You don’t have to start from scratch. Your business will already have its own values. What you can do is make them specific to finance. If one of your corporate values is ‘Act with Speed,’ then you could make a statement like: In finance, Act with Speed means defaulting to the simplest path to insight. Give examples: “Ship something useful today instead of polishing something perfect next month.”

You MUST have a credible version of your plan that fits on one digestible page. Something that can be put on every office wall and desk that finance touches in the business.

How you document this depends on your resources and the size of your transformation. A simple slide or even a bullet-point doc might be enough for a small team. I prefer to invest a little in design (like the example above). A day from an internal designer or a couple of thousand dollars can give you something that looks great. It signals that this is serious and, more importantly, it hits the heart, which gets the hands moving faster.

We are not trying to communicate the details of the steps here. You can go into much more depth on individual elements in separate decks and workstreams.

What does the relationship between finance strategy & business strategy look like

I once worked for a divisional president, as his BU CFO, who did not like that I had a ‘separate strategy’ for the finance function. He believed all strategy had to run through a single central workstream. He did not like the idea of more than one “vision” in circulation - even if it was clear it was specific to finance.

The business strategy was fine, good even. But my finance team needed something sharper and more directly relevant to rally around. I had sixty people across several locations. They needed clarity, not a slide buried in a bigger corporate deck. I was confident everything pointed in the same direction as the broader strategy, even if it didn’t fit neatly into one of his boxes.

He told me he wanted to shut down my program and roll it into the single strategy. Not because he didn’t like it, in fact, he loved it. He simply wanted to put it in a different box.

I told him I respected his view, but I wouldn’t be doing that. He told me that wasn’t acceptable. I told him I understood, but I’d be doing it anyway.

Every quarter, he’d say it again. This went on for about eighteen months. By then, I could point to all the progress we’d made while the other support functions (CTO, CHRO, etc.) were still stuck in the central framework that (correctly) prioritized sales, marketing, and operations. We had momentum. They didn’t.

We still speak from time to time. I remind him he was wrong. He reminds me what a f*cking pain in the ass I was. He’s not wrong. Throughout my career, I’ve been perfectly happy being mildly insubordinate when I’m confident in the direction.

Not Jimmy-McNulty-season-5 levels of insubordinate, but insubordinate nonetheless.

This certainly won’t work for everyone. It worked for me because of three things:

a) I am stubborn,

b) I was confident in the plan, and

c) I knew we were in lockstep with the business strategy, even if the paperwork didn’t match.

Your transformation vision for finance has to connect to the business’s strategy. Transformation costs money, time, and focus. Until you get the function to a place where it operates as TAU (transformation as usual), like Amy Hood pulled off at Microsoft, there is a real opportunity cost to a big change effort.

OK, so how to produce your finance strategy

The final output might look simple, but the thinking behind a credible finance strategy is anything but. This is not something you set and forget on your first morning in the job. It cannot be a handful of generic statements. It has to be specific and relevant to your business.

If you say you are going from eleven systems to three, you don’t need to name the exact three. But you do need to explain why three, what those three will do, and broadly which of the eleven they replace. People follow clarity. They don’t follow vibes.

That means you need solid analysis behind your strategy before you put pen to paper. In a simple business, you’ll get there quickly. In a complex one, this takes time.

At some point, you will need to bring your key people together. I’ve always preferred a one or two-day offsite. Your goal is to walk out with 95 percent of the strategy done. The last 5 percent is wordsmithing.

Going in, you (+ the people in the room) should have a good sense of about 70 percent of the output. That lets you validate, refine, and structure your thinking, while creating space to find the remaining ideas in the room and make the strategy stronger.

If you don’t feel you are at that hurdle yet, it might be a little early for you to set it. Go and do more work to understand your business, your finance function now, and where it needs to go.

After the session, you take a few days to tighten the language and clean up the narrative.

You also need to time this properly. There is no point launching a finance strategy if the business strategy is about to change three months later and make yours obsolete. Refreshing your strategy annually is good hygiene. Rewriting it because you were careless with timing is not.

Now it’s time to securing sponsorship (not an easy task)

I’ve seen plenty of functional strategies that looked great on paper, but were dead on arrival simply because of how they were introduced to the business. I remember working with a CTO who presented a brand new, total IT strategy overhaul to the main board (while he was their new playtoy) just 30 days into the role. He made a bunch of promises and commitments that were totally unvalidated.

He didn’t know it at the time (nor did the board), but he signed his own death warrant that day.

How you secure sponsorship will depend on the complexity and politics of your organization. In a smaller business, this might be straightforward. If so, delete the steps that don’t apply. But I’m writing this for more complex situations, with more stakeholders. Here’s the approach that’s generally worked for me:

Start with a clear understanding of the business strategy. If you don’t know where the business is heading, you cannot credibly say what finance needs to become.

Build a mental picture of the finance strategy required to support that direction. Talking to people on the shop floor of the business and the finance function to understand the real pain points is critical. Your personal visibility in the finance function will be valuable later when you present the solutions.

Develop the strategy to the “95 percent stage” with your top team and key stakeholders. It should be a collective view, guided by your vision. This builds buy-in and truth-tests your assumptions.

Secure support in principle from your CEO or relevant +1 sponsor. You want alignment at the top before you start making promises to everyone else.

Get commitment from supporting functions for the resources you need. IT, HR, Data, Operations, etc. I prefer doing this after the CEO alignment, while making it clear that the plan is subject to those resource commitments actually turning up.

Lock in the one-pager with some smart looking design. A polished one-page visual puts a marker in the sand. It signals seriousness. It prevents the document from living in a sort of “draft” purgatory.

Once you have sponsorship and commitments locked down, you can move on to activation.

Note - you will also need board commitment to your plan. Sometimes, you might include them early in the journey and involve them in the build. In other situations, you might just take it to them at stage 6, as more of a ‘’for information only.” It depends on the structure of your board, how hands-on they are, and how much you need their support.

How do you activate the strategy?

By this stage, you have a sharp, simple plan. Now you need to bring it to life. Culture change needs two things:

A strong, consistent message from the top

Lots of small steps in the direction of that message

This is where you tap the power of the organization. You need to launch the strategy to your whole team and any stakeholders directly affected by it. If you can get everyone in the same room, do it. Whether it’s ten people in a meeting room or hundreds in a conference center, this is the moment to create a shared story.

If that’s not practical, run a virtual launch. It’s a distant second preference, but workable. Another option is a roadshow: a series of smaller sessions where you travel to the teams. Think of it like a PR tour.

Whichever route you take, be ready to repeat yourself. A lot.

A common mistake inexperienced leaders make is assuming that because they’re bored with hearing themselves say something, everyone else must be too. They won’t have heard it anywhere near as often as you think. You are trying to interrupt patterns and break inertia. That takes endless repetition.

Put the message everywhere. Talk about it in every all-hands. Add it to your email footer. Record short videos. Celebrate small steps in the right direction. Tie it to your team’s bonus structure.

If you want people to take the strategy seriously - and eventually reach that TAU state - they need to see you living it consistently.

Here come the skeptics

If there isn’t a combination of excitement and resistance when you launch, you probably haven’t been ambitious enough.

Here are some common objections you might hear and how to handle them:

These concerns are natural, and you need to take them seriously. Part of your job is to acknowledge the skepticism and earn commitment. Quiet skepticism is normal.

Active resistance is different. You need to spot it early and deal with it quickly. If someone refuses to get on board, replace them. Sometimes you need to send a clear signal that this is happening.

Net Net

Transformation projects aren’t born out of endless Gantt charts. They are built from a clear vision and momentum. If you get this right, the tiny steps taken across the finance function every week will compound into something huge.

But every transformation also has big, hairy-assed projects that need more than just strong leadership and good intentions. Every finance transformation I’ve ever seen eventually runs into a major systems component, sometimes even the dreaded ERP upgrade.

And that’s what we’ll tackle next week.

If you’re looking to sponsor CFO Secrets Newsletter fill out this form and we’ll be in touch.

:::::::::::::::::::::::::::::::::::::::::::::::::::

:: Thank you to our sponsor ::

:: Aleph ::

:::::::::::::::::::::::::::::::::::::::::::::::::::

What did you think of this week’s edition?

If you enjoyed today’s content, don’t forget to subscribe.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.