Financial control doesn't have to slow things down

Control usually means red tape, speed usually means chaos. CFOs have been forced into that tradeoff for too long. Brex changes that with finance built for speed and control (finally).

Expenses flow in real time, enforcing your rules, absorbing busywork, and accelerating Finance’s impact. It’s why 30,000+ global businesses trust Brex’s intelligent finance platform to spend smarter and move faster.

“We don’t really use the P&L. That’s just something we do for Corporate.”

It nearly knocked me off my chair.

I was meeting my new team for the first time, freshly appointed as CFO of the Business Unit. My first gig at this level. If I’m honest, I’d landed it partly because no one else wanted the job.

The business had rocketed from zero to $1B in revenue in a little over a decade. A blur of organic growth and bolt-on acquisitions. My mandate was to professionalize the finance function. I was told none of the acquisitions had been integrated, mostly because there was nothing to integrate into.

Still, I assumed at least some basics were in place.

They weren’t.

What I found instead was a small set of things that, while inefficient, were somewhat effective:

They invoiced customers fast and collected cash quickly. Even if it was manual and needed a lot of people.

They were thrifty to the point of obsession. The divisional president personally approved every discretionary expense.

They managed cashflow tightly. The whole company was run off a 13-week cashflow forecast and the bank balance.

Everything else was nonexistent.

The “systems” were a patchwork of spreadsheets. Each operating unit keyed numbers into a local file, emailed it to head office, and two ‘accountants’ (Sarah and Maria) merged everything into one monster workbook. That sheet drove two things:

A weekly consolidated KPI report

The 13-week cashflow model

Isaac, the financial controller, reviewed it and passed it to Jason, my predecessor, who took it to the exec meeting.

At month-end, Isaac reverse-engineered the P&L from the KPIs, eyeballed it with Jason, then sent a list of journals back to Maria and Sarah to make the books agree. Only in preparation for year-end did they look with any interest at the balance sheet. Just enough to survive an audit.

The ‘ERP’ system they used was a basic bookkeeping tool (whose name I can’t even remember), which wasn’t fit for a $10M business, let alone $1B.

The corporate team had been hands off and had no idea how it operated. Jason had been able to do just enough to blunder through budget and business reviews. Eventually they woke up, Jason got fired, and I got brought in to rebuild.

Suddenly, it made sense why nobody else had wanted the role.

Over the next few weeks, I crawled under the hood expecting chaos, misstatements, uncollected receivables, maybe even fraud. But that wasn’t what I found.

For all its dysfunction, the system kinda worked, at least for what they were trying to achieve. Cash was real, collections solid, and profits roughly right (even if the cost classification was a mess). The fundamentals were hand-cranked, but weirdly effective, at least in a material sense.

That wasn’t the issue.

The issue was that only two or three people in the entire business understood the numbers, even at a basic level. And the president, the puppet-master of this whole setup, was the only person empowered to make decisions. A billion-dollar business run like a corner shop.

It had worked up until now, but they had finally run out of road.

Isaac sensed his time was up and tried to rally the president against me. I made sure he was gone within two weeks. Maria and Sarah tried to help, but they didn’t have the muscle for what came next. Over time, they would have to go too.

This was a company that had skipped multiple stages of finance maturity and somehow kept growing. But the model had hit its limit. They’d lost agility. And from a risk perspective, it was just a matter of time before a big issue would show up; a major misreporting, bad debt, or fraud.

To unlock the next chapter, we would have to speedrun the whole accounting and finance maturity curve.

This was going to be fun…

When Finance Grows Up

Welcome to a new series on Scaling the Finance Function. This is another hotly requested topic.

I’ve held off until now because I have so much to say and wanted time to codify my thoughts:

How should I define the different stages of maturity?

What are the predictable inflection points that businesses face as they scale finance?

What is important at each stage?

What are the pain signals that tell you it’s time to move up the curve?

It’s not as simple as using revenue or headcount thresholds. I know e-commerce brands exceeding $100m in revenue that have fully outsourced finance. And there are manufacturers with only $2m of revenue who need full-time costing accountants.

Number-based thresholds are too crude.

It’s about decisions. Specifically, where and how they’re made. A business that is content with one person making all the calls, using only backward-looking information, can ‘survive’ to a fairly large scale with the most basic finance infrastructure. As we saw earlier.

And while an extreme example because of the scale reached, it’s a common story. Especially in bootstrapped founder-led businesses, where they are most susceptible to the ‘what got you here, won’t get you there’ fallacy.

But if you want to empower decentralized decision making, and unlock the full power of the business. Finance has to figure out how they can enable that while keeping control.

Every scaling business learns the same lesson: if you don’t grow finance on purpose, it becomes the handbrake. And as CFOs, we should feel affronted by the idea that our own function could be the bottleneck.

Early on, finance’s job is to support velocity. To keep things legal, funded, and moving, without friction. But as complexity grows, so must our impact. It becomes too big to run on the brilliance of a few people.

Agility must come from a new place; one of discipline. Finance has to grow up and figure out new ways to help the business move faster and smarter.

This is more important than ever pandemics, inflation, supply chain chaos, tariffs. These are all things that demand rapid pivots.

And with companies now able to blitzscale faster than ever before: speed is the new currency for CFOs.

Introducing… The Secret CFO Finance Maturity Framework

So what do the awkward teenage years look like for a finance team?

In this series, we’re going to map them out across three dimensions:

Five stages of maturity

Four core activities of finance

Three enabling muscles

I’m calling it The Secret CFO Finance Maturity Framework. What can I say… I’m a narcissist. But from here on out, we’ll just call it the FMF.

Let’s break down each of those dimensions in a little more detail.

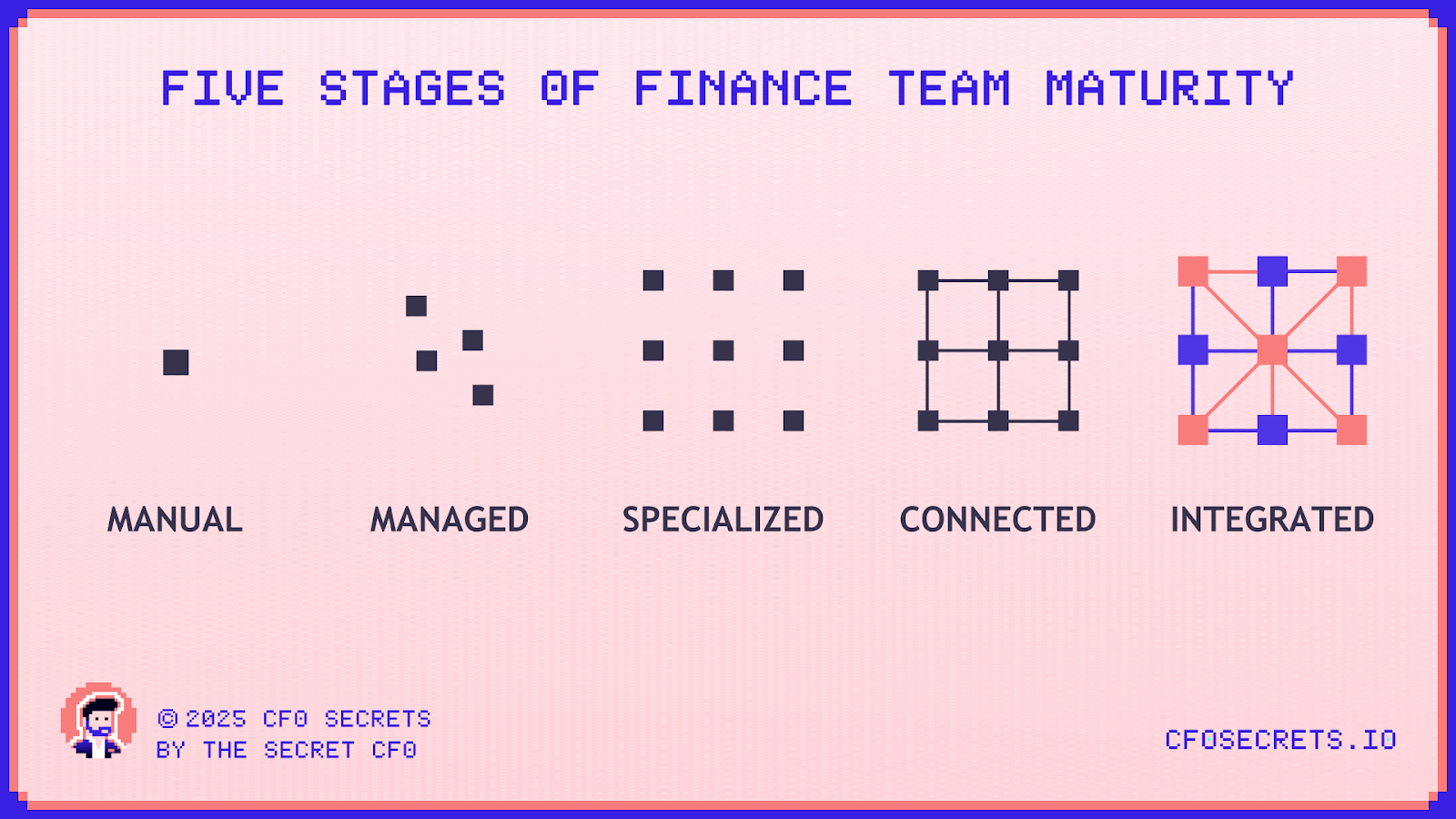

The Five Stages of Finance Team Maturity

Mature finance functions will go through 5 stages:

Stage 1: Manual. Finance = founder

In its earliest stage, finance decisions are founder-dominated.

Unable or unwilling to afford a finance specialist, the founder outsources basic bookkeeping and tax to an external firm or hands it to a general admin in-house. ‘Finance’ has no delegated authority to make decisions.

Every financial decision is made on the instinct, judgment, and common sense of the founder rather than financial insight. Results may vary.

Control comes from the founder’s omnipresence. They approve payments, chase overdue invoices, and monitor cash (often daily) from their iPhone app.

You can think of it as a lone raft, powered by the founder’s effort and intuition. Eventually, the water gets too rough, and one person can’t paddle alone.

Stage 2: Managed. Generalist finance

At this stage, the business has started to establish a finance team. It might have one person it calls a Controller, Head of Finance, or even a CFO. They could be rowing solo or have a couple of people underneath. To everyone else in the business, they look like specialists.

But in reality, they are finance generalists. They’re able to do a bit of everything to a reasonable standard: transaction processing, closing the books, building a forecast, and dealing with the bank.

Monthly P&L reporting starts to form. Spend is approved through defined channels. Some rhythm begins to appear, though much of it is still manual.

Some decision-making on finance starts to move from the founder’s head into the hands of finance.

You can think of it as a larger boat with a small crew, paddling in rhythm rather than chaos. There is still plenty of manual effort, but now there’s a bit of coordination.

Eventually, the limits of generalist finance start to show. The crew can paddle harder, but what they really need is a better boat.

Stage 3: Specialized. Finance divides to conquer

As the business grows, the generalists begin to hit their limits.

The volume and complexity of transactions increase. Reporting, forecasting, and compliance start to demand deeper expertise.

This is when the finance specialists begin to appear. A true Controller. An FP&A specialist. Maybe a treasury or systems head. The finance team starts to divide by discipline, each with clearer ownership and accountability.

While business decisions remain centralized, they now extend to an exec team of trusted leaders, supported by far better information.

The close becomes faster and more reliable. Forecasts move beyond static budgets. The business reports variances to budget, and the business takes actions on them at a macro level. Systems start to do more of the heavy lifting.

You can think of it as a speedboat: lean, built for purpose, and able to move quickly over short distances. Eventually, the challenge becomes coordination. The boat moves fast, but not always in sync with the fleet.

Stage 4: Connected. Finance goes frontline

Finance has now specialized into a team of teams.

It can step out from behind the numbers and move closer to the business, partnering with operations, sales, and product to help them make better decisions rather than simply record them.

The finance team can now understand variances and performance at a far greater level of detail, improving attribution of issues and actions to specific places within each function. And ultimately helping each department make decisions through a finance lens.

Decisions that affect finance no longer sit solely at the center. They start to distribute across the business.

Rather than every single price change needing executive approval, the sales team now has the tools and frameworks to make its own pricing decisions confidently within set boundaries.

The whole business starts to run on dashboards (rather than just the exec). Budgeting and forecasting capability improves radically as deeper engagement between finance and the functions brings operating assumptions and financial planning closer together.

You can think of it as a yacht: fast, stable, and built for longer ranges. The crew is skilled, the instruments are connected, and everyone is on the same course. But it still relies on coordination and communication to stay on track. There is a final frontier.

Stage 5: Integrated. Finance becomes the nerve system

Finance is now fully embedded in the business. It’s no longer just a function. It’s a way of thinking embedded into every decision.

Consequently, decision-making can be well distributed throughout the organization, unlocking the full power of the business. Putting the decision making closer to the customer and the front-line operation.

Everything that can be automated is. And decisions can be made quickly, fully informed by the impact on the numbers.

Information no longer moves up and down the organization. It moves through it. Finance has facilitated a new way of thinking for the business.

Think of this like a high-tech ocean liner. The crew is as important as ever, but now they are navigating the horizon, not patching a hole in the boat.

And a reminder… stage 5 is not the goal for every business, or even for most businesses. It’s about being fit for the business you are, and the business you want to be.

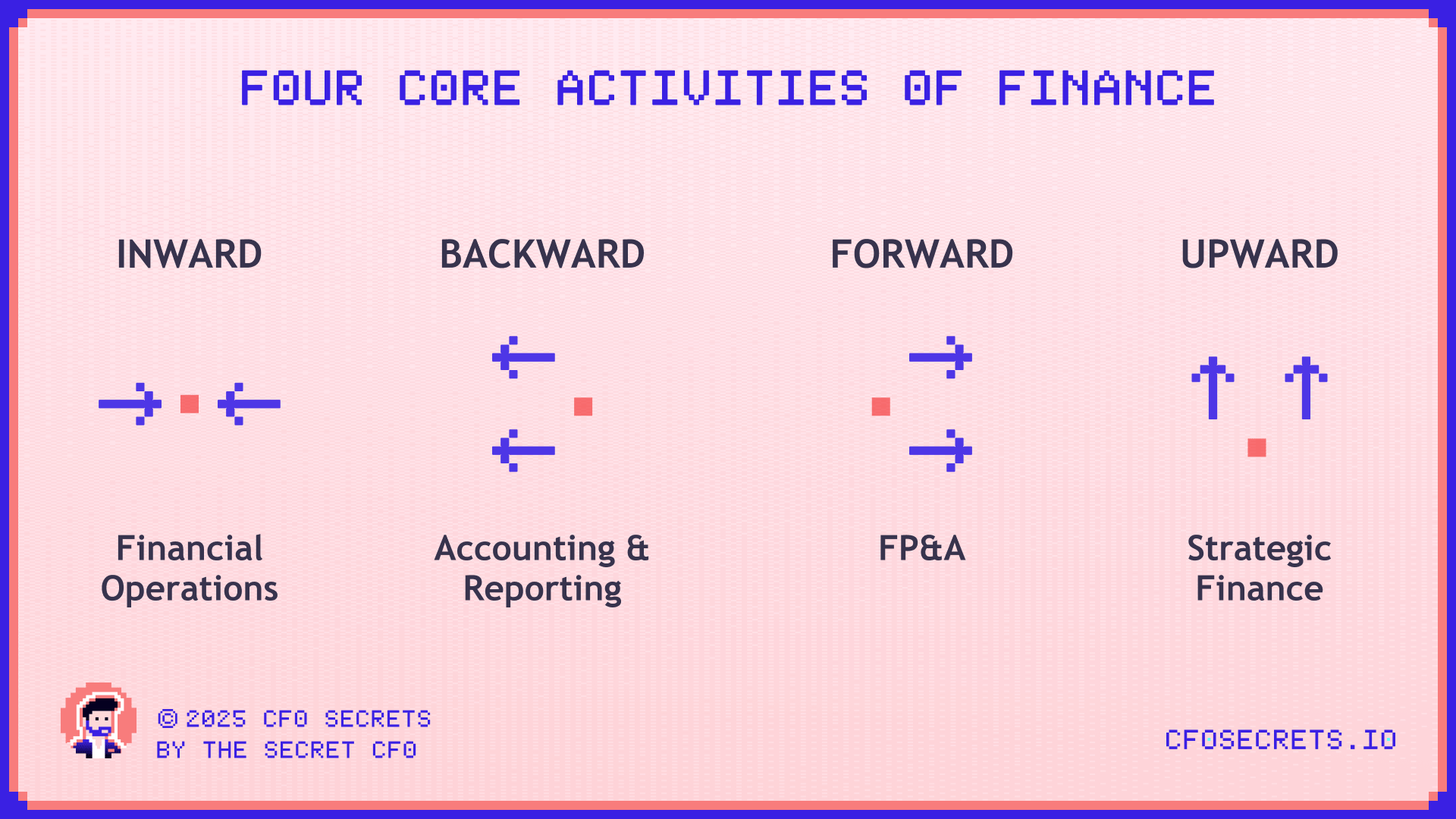

The Four Core Activities

Over the next five weeks, we will explore these five stages of maturity in much more depth, specifically what it means across the four key activities of finance.

As a reminder, they are:

Financial Operations. Covers the core cycles of Order-to-Cash, Procure-to-Pay, and Cash Management. This is the day-to-day engine that moves money through the business, protects working capital, and keeps liquidity under control.

Accounting & Reporting. The foundation of financial truth. Converts business activity into consistent, trusted numbers for management and investors. I avoid the term “controlling” because it means slightly different things on either side of the Atlantic.

Financial Planning & Analysis. Building budgets, forecasts, and performance rhythms that turn data into decisions and keep the business on plan.

Strategic Finance. Shapes capital allocation, fundraising, value creation, and M&A strategy to drive long-term shareholder value. Distinct from FP&A in its longer-term, forward-looking focus.

Another way to think of these four activities are inwards, backwards, forwards, and upwards:

How these activities are organized into teams and functions depends heavily on the business and its stage of maturity. We’ll explore that in more detail throughout the series.

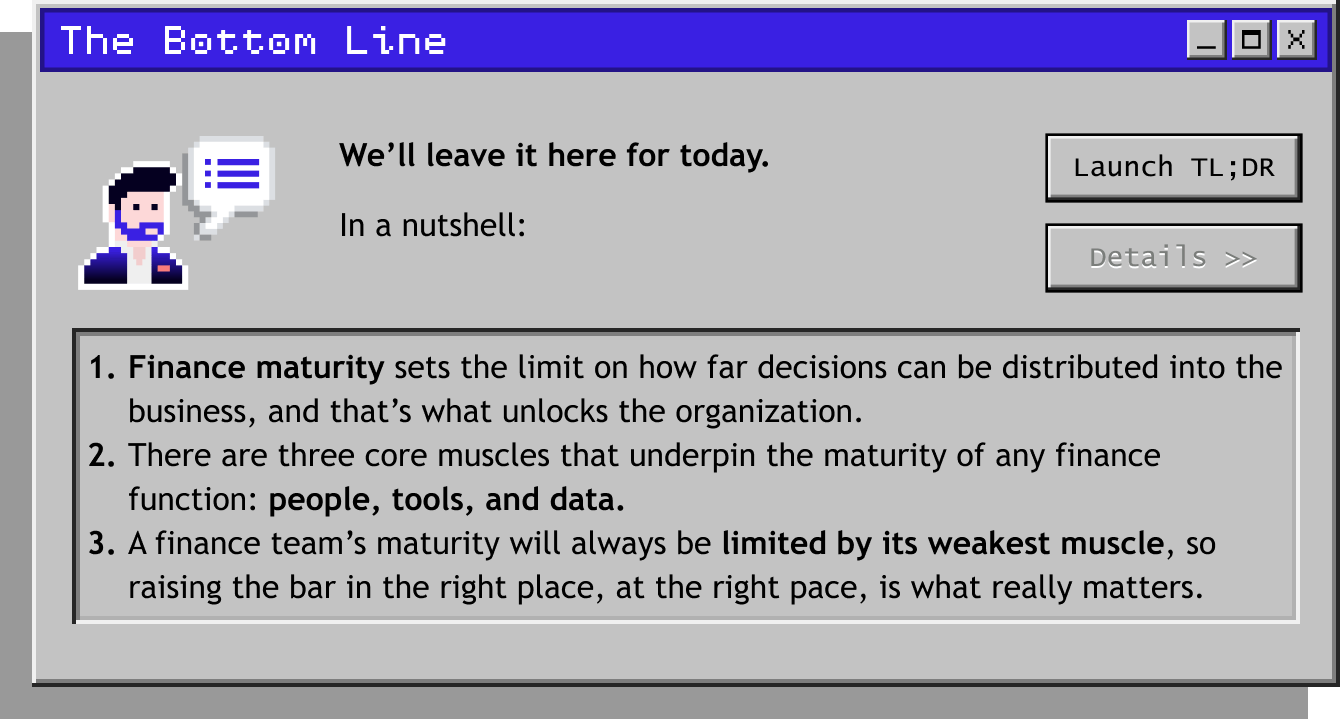

The Three Muscles

Underpinning all of this are the key enablers of any finance function, and, in truth, any support function.

For years, I thought of these as people, process, and systems.

Those three have historically been the bottlenecks to maturity. And as CFO, it’s your job to take the handbrake off by building capability across all three.

The ‘people, process, systems’ model is commonly used and has worked well for me throughout my career.

But it’s starting to feel outdated. Technology is too important to be thought of narrowly as ‘systems.’ It cuts across everything. Process and systems often work hand in hand. And somewhere between them, data gets lost, even though it’s more important than ever, especially as we enter the era of AI.

So I’ve started thinking of these enablers as three muscles:

People. The talent and capability within finance and across the business that drive maturity. It extends beyond skills into culture.

Tools. The systems, processes, and ways of operating that make things happen.

Data. The quality, structure, and governance that turn information into insight. If tools are the pipes, data is the water.

Building these muscles is a job for the whole business, not just finance. They’re business-wide capabilities. Crucial to finance, but not necessarily owned by it.

Throughout this series, we’ll view finance maturity through the lens of the constraints of its three constraints: people, tools, and data. And how to turn a skinny kid into a hulking beefcake.

And like any muscle group, they work together. And will be constrained by the weakest. As a powerlifter will tell you, your strength is limited by your weakest muscle. So getting stronger is about growing the relevant muscles together, and targeting weak muscles to unlock new levels.

In the opening story, weak muscles were the core issue; incapable people, weak culture, poor technology. The work that followed was simply building the right muscles at the right pace. As that happened, the maturation took care of itself. We’ll unpack some practical examples as the series unfolds.

What’s in store for this series

Over the coming weeks, we’ll break down each stage of the journey. How to recognize where you are, what signals it’s time to level up, and what to focus on to move forward.

Each week, we’ll explore one of the key transitions in detail, showing how it plays out across the four sub-functions of finance. And how you know when the three muscles (people, tools, and data) are ready.

Here’s what we have in store:

Week 1 (Today): Introducing the Secret CFO Finance Maturity Framework

Week 2: From Manual to Managed: The first finance hires

How to keep control through the manual period

How to recognize when the founder model has hit its limits

‘Outsourcing’: Fractional CFOs, Bookkeepers, etc.

Defining an MVFF: Minimal Viable Finance Function

Week 3: From Managed to Specialized: Building a function

How to structure finance for specialists

Who does what and where to prioritize

Developing tools at the right pace

Repeatable processes and clear ownership

Week 4: From Specialized to Connected: Distributing decision-making into the business

Establishing business partnering

Getting FP&A beyond spreadsheets

Building guardrails to distribute decisions

Embedding finance thinking into commercial choices

Week 5: From Connected to Integrated: Finance as the nervous system

Moving from a function to a way of thinking

What technology now enables, and what it can’t replace

The role of data quality and governance

How AI and automation reshape finance work

Through each stage, we will help you with a checklist so you can place where you are on the maturity curve across your function.

Net-net

Scaling a function is about doing the right things in the right order, and at the right pace. The common mistake is not progressing quickly enough. Or - just as common - the opposite: trying to lift a weight that the business just doesn’t have the muscles for.

But it all starts with the first few crucial steps.

Next week, we’ll dive into how to establish an early foundation and a minimum viable finance function.

If you’re looking to sponsor CFO Secrets Newsletter fill out this form and we’ll be in touch.

:::::::::::::::::::::::::::::::::::::::::::::::::::

:: Thank you to our sponsor ::

:: Brex ::

:::::::::::::::::::::::::::::::::::::::::::::::::::

What did you think of this week’s edition?

If you enjoyed today’s content, don’t forget to subscribe.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.