“So what’s our AI strategy?”

Every board asks it, vendors oversell it, and CFOs are left to separate hype from reality. Brex’s CFO Guide to AI Strategy helps you meet your AI mandate faster. Learn how to plan, budget, and adopt AI in finance to automate 71% of expenses and accelerate month-end close by 3x.

Get the guide to unlocking AI results faster

When Finance = Thinking

If your LinkedIn DMs look like mine, they will look like this…

The state of your LinkedIn DMs right now

Over the last fifteen years, I have sat through more vendor pitches than I care to count. Different logos, same promise. A supersonic vision of what your finance team could be if you just bought their thing.

I passed on nearly all of them. In fact, I actively blocked some projects, even when my own team wanted to push ahead.

I became the “no” guy. Not because the technology couldn’t do what it promised, but because we didn’t have the muscle to make it work yet. And the muscle required was enormous. Most tools were built on the assumption they would live on an island, ignoring the quirks, edge cases, humans, and politics that make real businesses messy.

At the center of it all sat the legacy ERP, everyone’s favorite villain. Hard to integrate, does most things (but never everything), and ultimately, Excel fills the gaps. Replacing or rebuilding it felt like open-heart surgery while running a marathon.

The dream (real-time dashboards, continuous close, fully automated finance) has been dangled in front of CFOs for a decade. And a few companies have come close to cracking it. But they are the giants: deep pockets, elite talent, and engineering-first cultures.

It has been a privilege reserved for the few.

But something’s shifted.

A new generation of vendors understand the implementation problem. AI is lowering implementation costs. The economics are flipping fast.

The things I used to protect the business from are now becoming possible. And will soon be accessible to more than just the world’s elite businesses.

And for the first time in my career, I’m excited about frontier CFO technology.

Welcome to the final part of this five-week series breaking down how to scale a finance function:

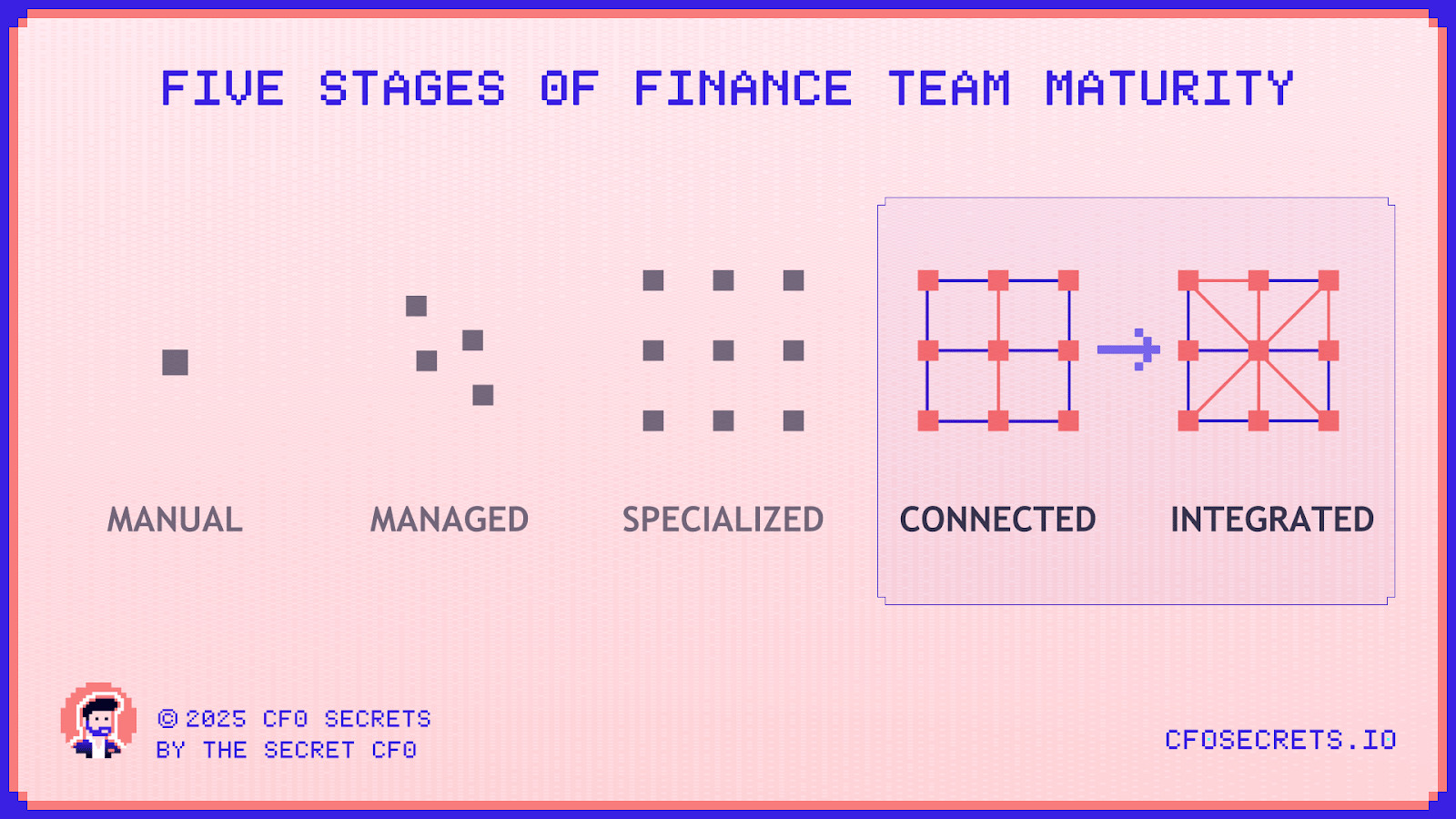

Week 1 set out the Secret CFO Finance Maturity Framework (FMF)

Week 2 explored the first steps in building a finance function

Week 3 broke down when it’s time to specialize finance into different sub-teams, i.e., controlling, FP&A, etc.

Last week, we moved finance closer to the business and showed how to develop real business partnering

And in this final week, we will be staring into the future and what the final step of finance maturity looks like. Let’s talk Integrated Finance:

So let’s start by defining what a finance stage 5 maturity finance function looks like.

What is an ‘Integrated’ Finance Function

Stage 4 ‘Connected’ Finance was defined by finance fleeing the nest, moving closer to the business. Stage 5 flips the direction. The business moves closer to finance. The walls between finance, data, and operations start to blur.

Finance logic becomes part of how the business thinks. At this point, finance stops being a department and becomes a capability of the organization.

When I interviewed Siqi Chen (founder of Runway), he described it simply as finance as thinking.

One way to frame it is this: the core job of finance has always been translation. Raw inputs go in - invoices, cash movements, system data - and insight comes out the other side. In Stage 4, we pushed that insight into the front line and made it actionable.

Stage 5 asks a different question… what if translation were no longer required?

Imagine a sales rep asking a chatbot for margin impact by SKU, region, and discount level while building a quote in real time, with guardrails, validation logic, and escalation built in. And if something needs approval, the CRO or CFO joins the chat immediately to authorize on the spot. With their friendly chatbot supporting and challenging their decision-making just as a real, human finance business partner would today.

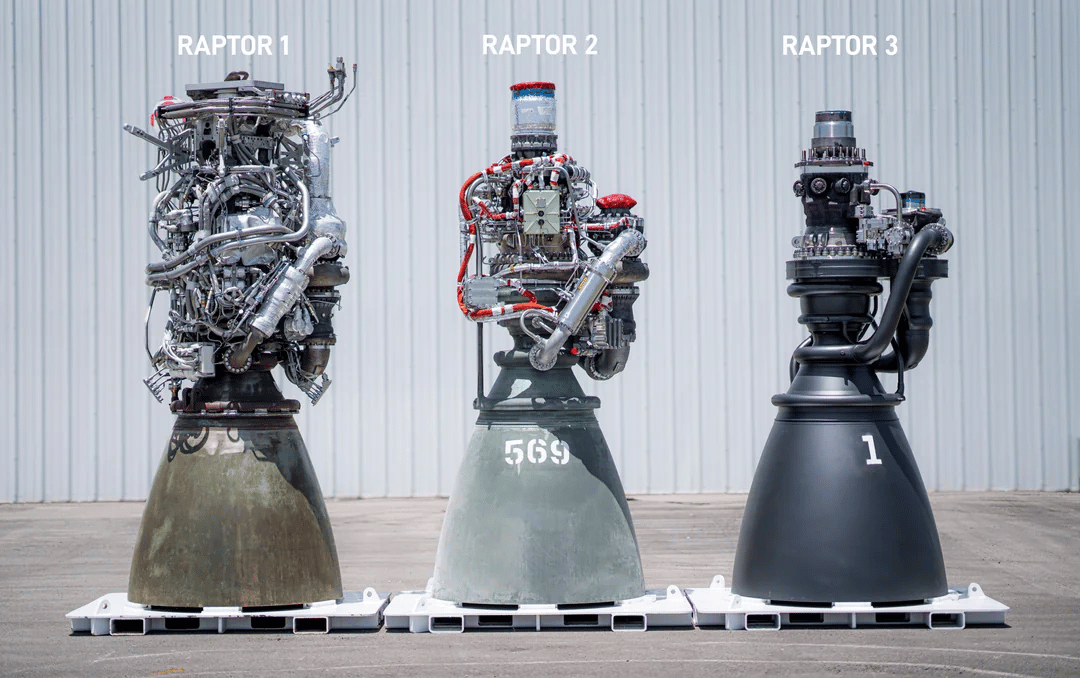

Because sometimes the best part is no part at all…

The five-year evolution of the Raptor engine used to power SpaceX’s Starship

Of course, someone has to govern the intelligence behind this. Someone has to tune assumptions, protect accuracy, and deal with the edge cases that automation will not catch. So this is not a prediction of finance disappearing. Far from it.

But it is a recognition that the traditional role of finance as the translator of truth is on borrowed time. Not months. Probably not even years. But eventually.

A Confession

I’ve never led a finance team to Stage 5.

I don’t actually know of a finance team anywhere that is fully operating there. The closest I’ve experienced is a strong Stage 4.

I was held back by scar tissue. Years of vendor over-promising. Beautiful demos that fell apart on contact with reality. And until recently, the benefit case was thin: fragile processes, brittle integrations, high change costs, and low incremental return.

But something has changed.

AI can now reason like a human across thousands of small decisions - low judgment, not no judgment - and that moves the frontier of what a finance function could be. Checkout the video in this tweet thread of an agent converting a management P&L model into a GAAP template:

This was only published this week, which is why Stage 5 shouldn’t be treated like a destination.

Think of it as a mindset. A way of building so that when the capability arrives, we are ready for and embrace it.

So with that, suspend disbelief, and forget your ERP rollout trauma for a moment. And imagine what this could look like if we get it right.

What could an Integrated Finance Function look like

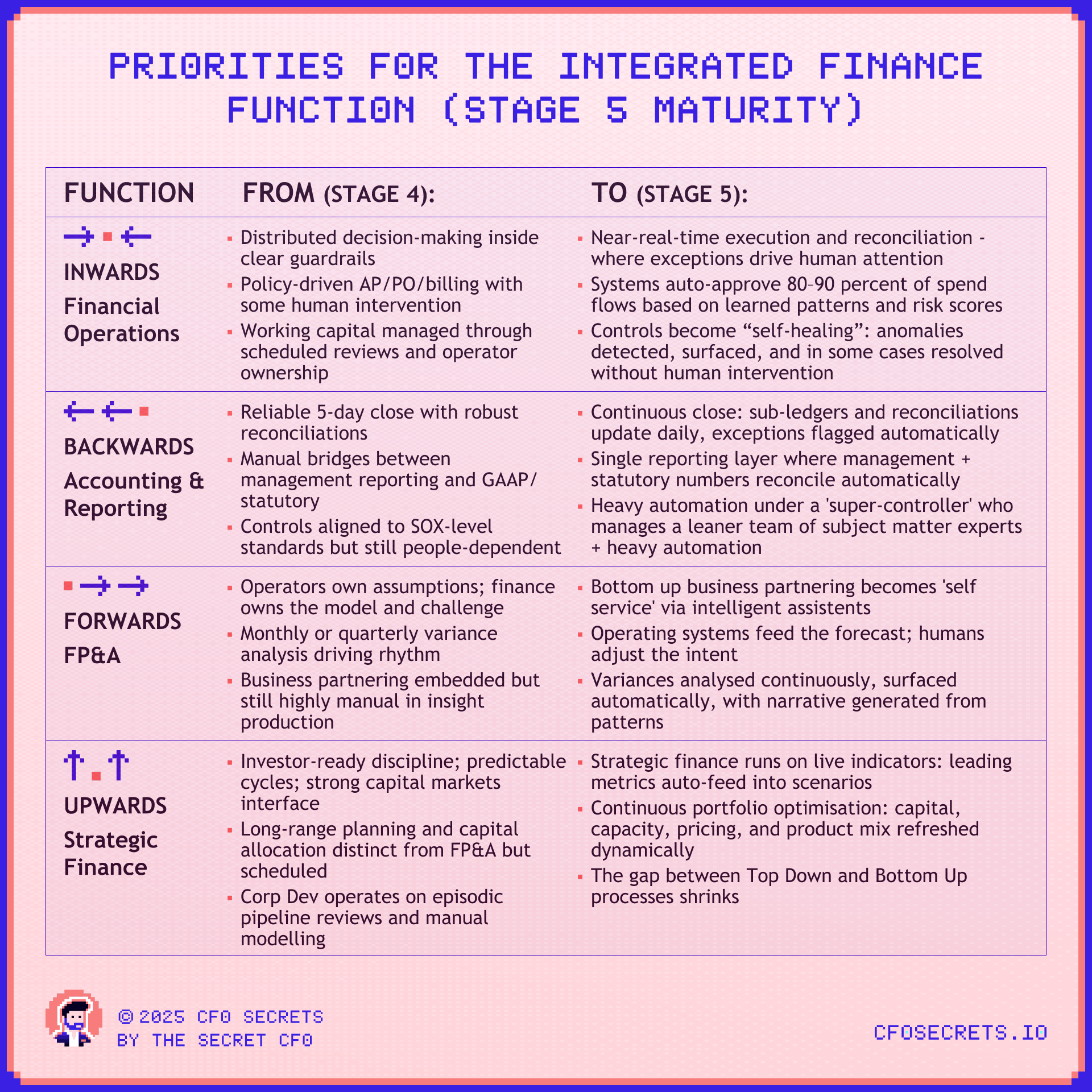

Throughout this series, we’ve broken down the priorities of the finance function at each stage using the same model:

Inwards (Financial Operations; AR, AP, Cash, etc.)

Backwards (Accounting & Reporting)

Forwards (FP&A, Business Partnering, etc.)

Upwards (Strategic Finance, Corp Dev, Fundraising)

I was in two minds whether to map this for Stage 5. As it’s a somewhat hypothetical exercise. So anything I write here will likely age like milk. And the target is moving fast enough that next year’s version may look nothing like this year’s.

BUT… this newsletter is here to push senior finance leaders forward. And by God, as we move into this new frontier for finance, I’m not sitting quietly and letting the Big 4 whitepapers and LinkedIn fantasists shape the narrative alone. I’ll be damned if my big ugly cartoon ass isn’t going to punch a dent in the narrative too…

So here’s my take on what a Stage 5 Integrated Finance Function could look like across the four lenses in the somewhat near future:

Yes, this is high-level. And yes, you probably want something more practical. We will get there over time. As I get clearer on what this looks like in practice, I will share it with you

I fundamentally disagree with the loud corner of the internet screaming that CFOs must "act now or be irrelevant." Serious finance leaders are not stampeding into shiny toys. They are predators. They make major upgrades in the right order at the right time.

As I get clearer on where the real tactical opportunities are, I will bring them to you in the same level of detail as any other Playbook. I have some new things coming in 2026 that will help you stay ahead of the curve on AI in finance without buying into hype or fiction.

The Three Muscles For An Integrated Finance Function

Where we can get more tactical, though, is on which muscles you should build in the business, and how to make sure your finance function is ready to push frontiers at the right time. We’ll use the same ‘3 muscle’ framework as we have throughout the series: People, Tools & Data.

The People Muscle

I am convinced of two things:

First, a Stage 5 finance function will deliver the current workload with fewer people

Second, entirely new roles will appear inside finance and across the business: prompt engineers, data stewards, control architects, model governors… roles we do not yet have proper language for

Trying to net out the impact is pointless at this stage. The only certainty is that the mix of skills shifts dramatically. And it will be our generation of finance leaders who architect that shift.

And while it’s too early to be drawing out org designs you can actually use, you can be intentional about the skills and capabilities you are building in your team. Both through who you hire and how you develop them.

Here’s where I would be focusing:

1) Non-finance people will become more financially fluent: Folks in other functions will need financial context to make decisions without someone holding their hand. Finance will have to teach the business, not just serve it. Upskilling operators becomes part of the job. Finance becomes a capability, more so than a department.

2) Everyone needs to think in systems: Most companies are powered by heroic individuals. People with tribal knowledge locked in their heads. Stage 5 requires that knowledge be codified so technology can scale it. Like turning the genius chef’s secret burger into a franchise process that any Five Guys kitchen can execute (yes, they are the best burgers). System-thinkers are rarer in finance than they should be. We need to learn how to grow them.

3) A generation of tinkerers: Breakthroughs in Stage 5 will not come from boardrooms or McKinsey slide decks. They will come from a 23-year-old analyst who disappears for a weekend, re-emerges with a wild prototype. And you’ll stare at their screen and say, “how the f*ck did you do that?”*

Early in my career, that was me, automating processes with Excel and VBA when no one else was doing it. It accelerated my early career, and it gave the business unit I was in a new framework for producing faster insight for the business.

This is why we must keep hiring specifically for curiosity and innovation at an entry level. If someone doesn’t have that curiosity in their early 20s, they’re NGMI in the AI economy.

4) The rise of the Super-Controller: Controlling has been unfashionable for years, overshadowed by FP&A glamor. But in a world where AR, AP, close, internal reporting, external reporting, and cash can be automated at scale, someone must stand over the logic. Someone must govern edge-cases, escalate judgment, and keep the system honest.

That someone is the super-controller. Right now, it looks like the safest place to build a finance career. Architecture-minded, data-literate, automation-obsessed. If you are an accounting-rooted leader, and you do not lean into systems, data, and AI now, you are missing the moment.

5) Leadership must reward decisions made at the edge, not escalations to the center: Evidence of Stage 5 working will be when the business makes financially excellent decisions without finance hovering over them. Leaders need to be ready to believe that’s possible AND let that happen once the capabilities are built.

The Tools Muscle

This feels like the right point to separate automation from AI.

Put simply:

Automation = computers doing what humans already do, just faster, inside rules

AI = giving the computer judgment, not just instructions

That distinction makes AI adoption a much more open-world risk evaluation than automation ever was. It explains why it feels thrilling and terrifying in equal measure, particularly to those of us who could lose our reputation over one big robot f*ck up.

Automation in finance is not new. Optical Character Recognition dates back to the 1950s. Robotic Process Automation hit the market about a decade ago, promising “machine learning.” And to an extent, it delivered. When my shared service center first trialled cash-matching automation, I thought it was magic. Matches happened even when bank line descriptions were garbled beyond recognition. Efficiency improved roughly 70%, and we rolled it out across AR, AP, and expenses.

Then we experimented pushing it further, into management and financial accoutning: reconciliations, intercompany, parts of the close. But it never got past the trial stage.

Not because the tech was bad, but because widening the guardrails far enough to catch the edge cases would have taken more work than it saved. We would still need review controls, exception reporting, and oversight. The economics didn’t stack. The tech had hit its ceiling, in my business, at least. Cue a decade of skepticism of tech promises on my part…

So, AI certainly isn’t new:

So, what’s changed? Why should CFOs care now?

Broadly, it’s two things:

Two reasons:

LLMs changed the game: November 30, 2022, genuinely split time into before and after, when ChatGPT was launched. It blew the Overton window wide open on what machines could reason about. We’ve now had three years of compounding reps and new models.

A new generation of CFO tech is landing: When Silicon Valley gets obsessive, it keeps firing money and talent at a problem until the problem breaks. Accounting and finance inefficiency is now the ‘thing’ being hunted by some of the smartest computer dweebs in the world, armed with monster war-chests.

And, of course, these two things coming together is the lightning in a bottle. I have seen some technology beyond the scenes (call it internet cartoon privileges) that has blown my mind.

The most exciting part is that these products break the ERP frame. They treat the ERP as a data exhaust, not the layer everything revolves around. Brex is one example… designed around how spending decisions actually happen, while the complexity of ERP mapping is handled in the product, not dumped back onto finance.

This is where many finance pros are misjudging AI. They ask ChatGPT to run a variance bridge and get nonsense back, shrug, and assume the whole space is overhyped. But LLMs are the raw engine. It only becomes useful when wrapped in context, controls, workflow, and structured accounting logic. And that is what the new generation of CFOTech vendors are busy doing.

So yes, I do believe behind all the nauseous hype, this is a real moment.

Have a big appetite for possibility, watch the product demos, run cheap experiments (start with financial operations and accounting/reporting), learn fast, and when something proves it works for your business, buy it and scale it hard.

The Data Muscle

For most businesses, access to Stage 5 finance maturity will be gate-kept by the strength of their data muscle.

Structured data is the oil for automation. AI can help convert messy data into structured data.

A decade ago, the most capable data thinkers sat in finance or IT. Problems were solved in spreadsheets, and if they got painful enough, they were handed to IT to fix upstream. Analytics was mostly basic statistics. Quartiles. Trend lines. Rolling averages. Helpful, but shallow.

While many businesses still run this way, the world has changed. A new generation of talent is being trained in data science at Masters and PhD levels, and they are applying real mathematics to real commercial problems. Surge pricing. Weather-driven inventory forecasts. Customer intent modeling.

It is not hard to picture the future FP&A pro. Someone who sits at the intersection of finance, data science, and AI reasoning, who treats models as living systems.

But I don’t think we’ll be short of that muscle in the future; its sexy enough to attract the talent and capital it needs. The limitation, more likely, is data governance.

Best practice data governance is not a committee, a set of rules, or a SharePoint folder that no one reads. It is the daily habit of treating data like cash - controlled, reconciled, versioned, and owned. Every core metric has a single definition. Every data source has a named adult who is accountable for its hygiene.

AI adoption will be limited by the worst important data in your business, not amplified by the best. And over a long enough horizon, companies that master data will outrun those that do not. They will forecast faster, price smarter, act earlier, and learn more with every cycle.

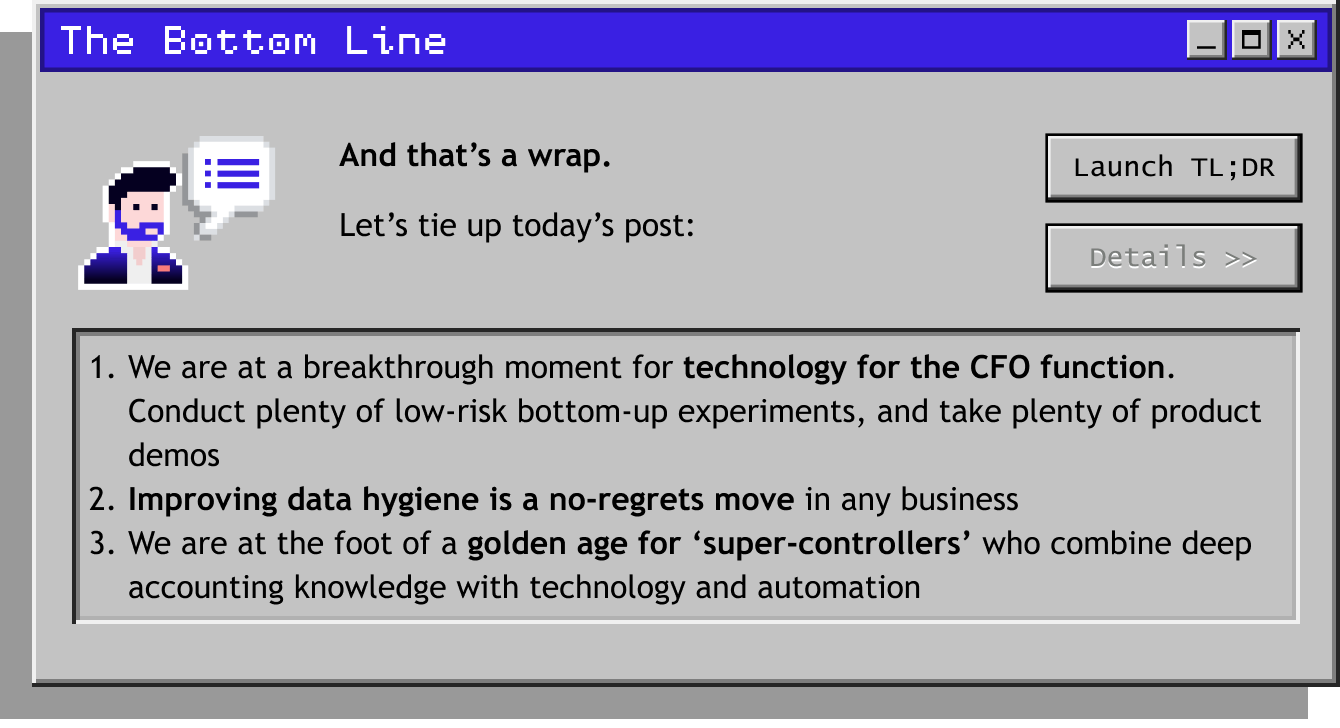

Net Net

Stage 5 finance maturity is thrilling because it has no finish line. It is a pursuit, not a destination. No one knows exactly where it leads, which is what makes it so interesting. And while you may be looking for something more actionable, the answer for many will be to first focus on getting your business to Stage 4 maturity (as I wrote last week.)

This piece will raise more questions than it answers. That’s good. The future of finance is too big for one article or even one series. And I definitely don’t have all the answers. But… I will be introducing new formats next year to go deeper, explore the frontier in real time, and figure it out together.

And what does all this mean for the CFO? Ironically, less will change about the job than people think. The role evolves more in how it is done, not what it is. I wrote about that here.

That’s the end of our five-part series on scaling a finance function.

Next, we shift gears into how you actually drive change through finance with Finance Transformation (Unplugged).

If you’re looking to sponsor CFO Secrets Newsletter fill out this form and we’ll be in touch.

:::::::::::::::::::::::::::::::::::::::::::::::::::

:: Thank you to our sponsor ::

:: Brex ::

:::::::::::::::::::::::::::::::::::::::::::::::::::

What did you think of this week’s edition?

If you enjoyed today’s content, don’t forget to subscribe.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.