Finance teams using Tabs close 50% faster

Tabs automates the entire contract to cash process across billing, collections, and revenue recognition. No spreadsheets, no manual reconciliations, no disconnected tools. Just accurate revenue, faster cash, and full visibility into every contract. Finance teams using Tabs close 50% faster, cut DSO by 80%, and save hours of manual work every month.

Answering your questions is one of the most fulfilling things I do. Hit me with your most challenging CFO issue, and you could be featured in next week’s Mailbag.

👉 Send me your questions by filling out this form.

Now, on to today’s Mailbag.

We’ve got some great topics. Here’s what’s on tap:

Surviving a DTC winter

Inflection points in scaling finance

“Lights out accounting” goals

Now, let’s get into it.

Chris from Los Angeles asked:

I’m the CFO for several omni-channel businesses, primarily D2C, that sell discretionary products. Over the past three years, many of us in this space have faced the same challenge — excess inventory, increasingly price-sensitive consumers, and rising online traffic costs that aren’t translating into proportional conversion.

From your perspective, how can a CFO best guide the business to stabilize revenue while continuing to acquire customers efficiently?

The tension I’m struggling with is that when you focus purely on improving unit economics, top-line revenue tends to decline — because stabilizing typically requires deeper discounting (lower margins but steadier sales) and tighter control over CAC, which usually means less marketing spend. It’s been a tough balance to strike, and I’d love your insight on how you’re approaching this.

Chris, I’ve heard this story from a lot of D2C operators lately.

It’s brutal out there. Inflation has squeezed margins, consumers have less discretionary income, and the paid ads ecosystem is oversaturated. Everyone’s bidding for the same eyeballs, and Meta, TikTok etc are taking a bigger cut of the value chain. The entire unit-economics equation is heading the wrong way.

This is a zoom-out moment for the whole D2C space.

For the past decade, D2C has been built on a kind of medium-effort arbitrage. Find a product from China, validate it with small paid campaigns, scale the ads, import or dropship, and print cash. That arbitrage is being traded away fast. Product cycles are shorter, competition is faster, and ad platforms have captured all the alpha.

The businesses that survive this next cycle will be the ones that build brands, not acquisition machines. Brands that create direct, compounding relationships with their customers.

Look at AG1, Gymshark, Ridge. Differentiate the product, deepen community, expand lifetime value, drive referrals, and lift EBITDA multiples through brand strength. In consumer, long-term unit economics are downstream from brand equity.

From a CFO’s seat, that translates into a few non-negotiables:

1. Control what you can

Right now, your biggest short-term lever is cash. Inventory discipline is non-negotiable. Every extra day of stock on hand is trapped marketing spend. Tighten reorder logic, rationalize SKUs, improve forecasting accuracy, and push your cash conversion cycle down. You can’t always control CAC, but you can ALWAYS control working capital.

2. Measure properly

Get serious about data quality. If you can’t measure LTV by cohort and acquisition channel, you’re flying blind. Cohort and payback analysis will tell you where growth is still profitable, and where it’s just noise.

3. Focus on brand and storytelling

Performance marketing is table stakes now. Brand storytelling is what creates organic reach, repeat purchase, and word-of-mouth efficiency. It’s what turns customers into advocates. It’s your best insurance policy against long term CAC inflation.

4. Be realistic

Control the controllables - cash, inventory, data, discipline - and accept that not everyone will make it through this cycle. The easy D2C years are over. The operators who survive will be the ones who evolve fast, build better products, tell better stories, and build genuine brand equity around their product.

If you want inspiration, listen to the Trader Joe’s breakdown on the Acquired podcast. Their relentless focus on differentiated products and storytelling is a stellar example (outside, but adjacent to D2C) for D2C operators to aspire to.

TLDR: The D2C arbitrage golden age is over. Focus on what you can control: cash, inventory, and data in the short term. Long term, those who can turn customers into compounding relationships will be the winners.

BacktoBasics from New York, USA asked:

I work as a fractional CFO supporting several growing B2B SaaS clients, service businesses, etc., and I’m fascinated by how the finance function evolves as companies scale. For example, what changes between $10M ARR, $25M, and $100M ARR?

I often find myself wondering when it’s the right time to implement an ERP, overhaul FP&A systems, or invest in better systems/processes to reduce maintenance headaches. I’d love to hear how you think about these inflection points. When and how does finance truly level up? Any resources around these that you believe are valuable to reduce the learning curve?

Well… BacktoBasics, I’ve got great news for you.

Right now, I’m writing a series on exactly this topic. It started this past Saturday. You can find it here.

I’m not a fan of hard revenue or headcount thresholds as rules for scaling. It’s the mix that matters more than the scale.

Take two businesses that both sell pocket knives. One manufactures components, manages inventory, and sells through multiple channels. The other drop-ships straight out of China. The former will need much deeper finance infrastructure much earlier than the latter.

The real inflection points happen when decision-making starts to decentralize inside the business. A $10M company with one brilliant founder making every call can survive on spreadsheets and instinct. But the moment decision rights start to spread, you need systems, processes, and data discipline.

That’s the signal.

If you want sales to manage pricing decisions (inside a framework), you need reliable gross margin reporting by product and customer.

If you want to delegate some authority to spend money, you need cost centers, purchase order workflows, and budget-to-actual reporting.

If you want to optimize labor efficiency or unit productivity on automatic, you need near-real-time dashboards and integrated data flows.

And putting these kinds of things in place isn’t just a job to be done. It implies a stage of maturity underpinned by a certain level of system maturity, conscious design, and data integration. It’s HARD.

So, instead of watching for revenue milestones, watch for shifts in where decisions are made (or should be made). If you see growth being choked by central bottlenecks, then it’s a sign that the systems to enable growth aren’t in place.

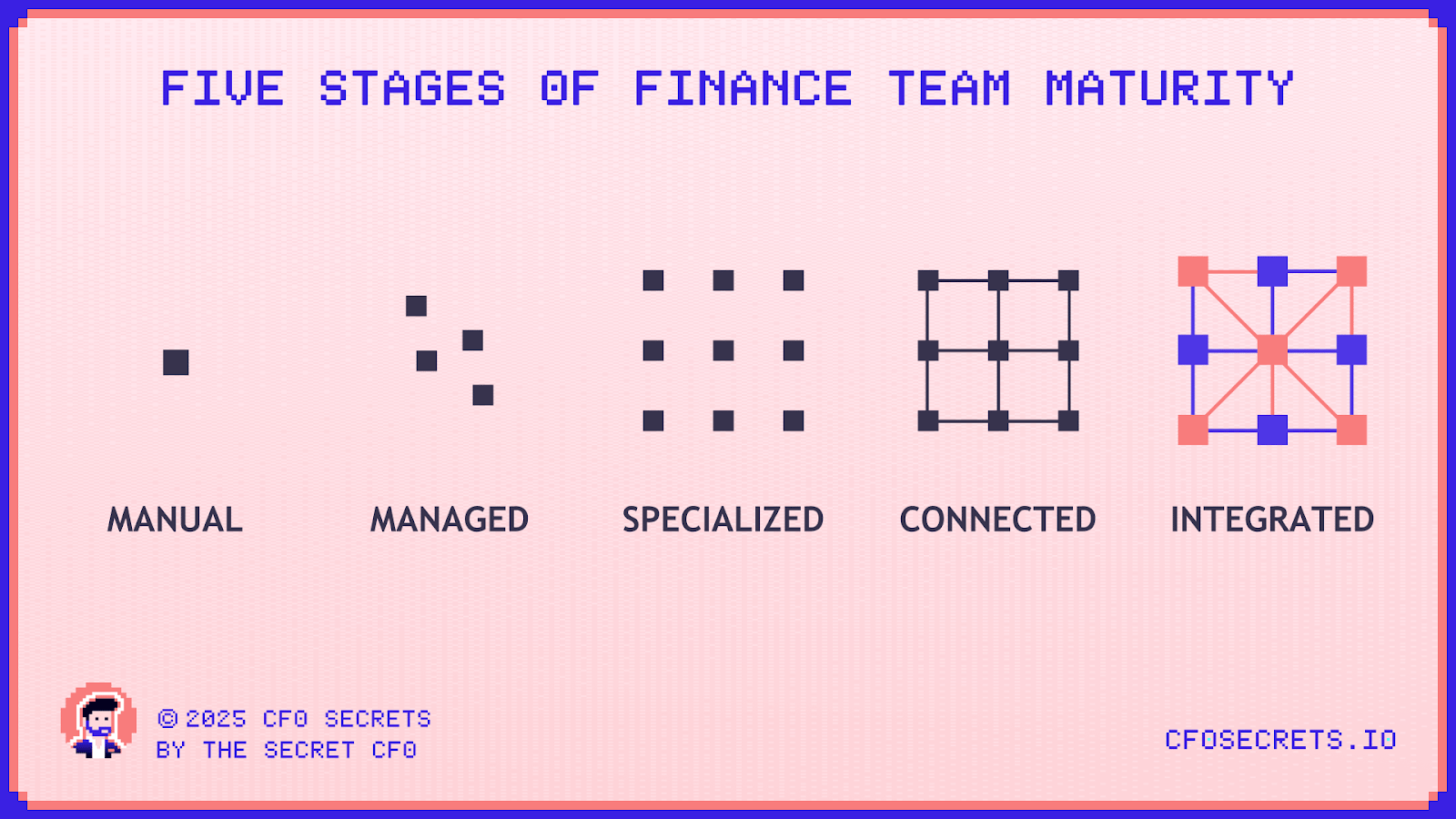

In this month’s Playbook series, I’ll be breaking down each stage of finance maturity, where the bottlenecks show up, and how to solve them.

TLDR: Every time authority decentralizes, your systems, controls, and insights need to step up a level.

CFO that’s not an accountant from Atlanta, GA asked:

Is there such a thing as “lights out accounting” and should it be all of our north stars?

“Lights out accounting” was a new one for me.

I had to look it up. It sounds like the kind of jargon that gets churned out by Gartner or a Big 4 content team written by someone who’s never actually run a finance function.

Apparently, it means running accounting with perfect automation and zero people. So perfect, you don’t even need to turn the lights on.

For all the silly terminology, I actually think it’s the right aspiration. In every part of the CFO domain, but especially accounting, we should be chasing the highest level of automation possible.

Let’s dream for a moment. A perfectly automated, 100% accurate accounting engine would transform a business. Not because of headcount savings (those are trivial), but because of what it does for speed, control, and confidence in decision-making.

I’ve seen dozens of finance operations up close through turnarounds and integrations, and there is always a clear correlation between the speed and quality of the close, and overall business performance.

A fast close doesn’t guarantee success. But a slow close guarantees missed opportunities and sloppy decision-making.

Now, back to reality. We’re not there yet, but we’re getting closer. And AI technology is definitely steepening the gradient.

Continuous close processes, automated reconciliations, real-time dashboards, etc., are credible ambitions for finance teams. Not just fantasies from finance voyeurs…

Even if “lights out accounting” turns out to be finance’s version of chasing the horizon, the pursuit is worth it. Because the pursuit itself builds better systems, better data, and better finance teams.

So buckle up, and start dimming those lights.

TLDR: “Lights out accounting” may never be fully real, but chasing it forces you to build faster, cleaner, and smarter finance systems. The goal is to remove friction.

A few of the biggest stories that every CFO is paying close attention to. This is the section you might not want to see your name in.

This blew my mind when I saw it. The CRO of Snowflake was so pleased to be interviewed in the street by a hustle-p*rn TikTokker he blurted out material non-public information. He proudly announced a big revenue goal for 2027. Shortly after Snowflake had to issue an 8-K to say (I’m paraphrasing): “please don’t listen to that idiot.” Add it to the long list of reasons to hate on sales people…

We’re seeing the new standard develop in real time. Mandated AI usage, performance reviews to justify AI investment, and reskilling across the board. Things are changing quickly out there.

Speaking of rapid change… ON Semiconductor has been using AI to write MD&A sections of its 10-Ks and Qs. I think this is a good example of a current practical use case for AI in accounting.

In my experience, ChatGPT is excellent at parsing large amounts of information and summarizing the key points (which is the job here). And review controls tend to be very heavy on these disclosures; controller, CFO, corporate audit, external audit, audit committee. Why not let the robots have a go at the first draft?

ICYMI, here are some of my favorite finance/business social media posts from this week. In the words of Kendall Roy, “all bangers, all the time.”:

Key economic indicator here…

Almost as irritating as the AI hype is the backlash to it. Measuring AI on short-term ROI completely misses the point.

If you’re looking to sponsor CFO Secrets Newsletter, fill out this form, and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

If you enjoyed today’s content, don’t forget to subscribe.

You can help make sure this newsletter always stays free simply by spreading the word. And when you share CFO Secrets with your finance friends, you’ll earn rewards, including a 50-page PDF guide on what it takes to be a great CFO. Start sharing your unique referral code today: {{rp_refer_url}}

Let me know what you thought of today’s Mailbag. Just hit reply… I read every message.

On Saturday, I launched a new Playbook series on scaling the finance function. Specifically, how to make sure finance doesn’t become a handbrake on the business... Check out the newsletter here.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.