Add FP&A transformation to your 2026 resolutions

Make 2026 the year that finance finally stops wrestling with messy data and manual, error-prone processes. It’s not too late.

Aleph’s AI-native FP&A platform connects your data, strategy, and spreadsheets within hours, fully automating all those reporting and analysis tasks that consumed your calendar in 2025.

The time has come to let the busywork die so strategic decisions can survive and thrive.

Secret CFO readers can try Aleph’s AI-native platform for free with their own data.

Can we talk about relapse?

In January 2000, 70-year-old Graham Reeves went into surgery at a hospital in Wales for what should have been the routine removal of a troubled kidney. Instead, surgeons mistakenly removed his only working kidney.

Attempts to fix the error failed. Reeves was placed on dialysis and, five weeks later, died from the cascade of complications that began with that single, unforgivable, mistake.

It turns out cases like this were shockingly common at the time.

By the early 2000s, the World Health Organization took action after research found that major surgical complications were running at around 11%, with inpatient mortality at roughly 1.5%.

Digging into the details, they found far too many of those complications were avoidable. Antibiotics not administered. Surgeons operating on the wrong side. Scalpels and sponges left inside.

Following the WHO’s intervention, those rates fell to around 7% and 0.8%, respectively. A reduction of roughly 35% in major complications, and the death rate nearly halved, according to 2009 results published in The New England Journal of Medicine.

Similar improvements were seen as the recommendations spread across rich and poor healthcare systems alike, all over the world.

By any measure, it was a tremendous success.

So how did they do it?

A massive retraining program for surgeons and their teams?

Hospitals sacked the weakest performers and started again?

New technology? Automation? Some expensive, complex breakthrough?

No, no, nope, and no.

In fact, there was only one material change made during the study period. They introduced a simple 19-step surgical safety checklist.

That’s it.

Since then, versions of that checklist have been adopted across healthcare systems around the world. Not perfectly. Not universally. But widely enough that it’s now considered standard practice in serious operating theaters. It’s no exaggeration to say it has saved millions of lives since.

I had reconstructive surgery on my knee around this time. I laughed as the surgeon drew a huge arrow on my bad leg with a medical-grade Sharpie. I must have been asked a dozen times that day which leg they were operating on. At the time, I found it ridiculous and somewhat concerning. It makes much more sense to me now.

The reason the checklist worked is important.

It didn’t make surgeons smarter. It didn’t teach them anything they didn’t already know. What it did was remove reliance on a whole chain of fragile habits and replace them with one robust one: Follow the checklist.

Instead of expecting people to remember dozens of steps, under pressure, repeatedly, it collapsed success into a single behavior. The checklist reduced cognitive load at exactly the moment cognitive load is highest.

You might reasonably ask how anyone could ever operate on the wrong leg. Or forget to administer antibiotics. Or leave a tool inside a patient.

On any one operation, with time and space, it seems unthinkable.

But surgeons don’t do one operation. They might do several in a day. Hundreds in a year. Thousands over a career. Fatigue sets in. Familiarity breeds confidence. Pressure compresses attention.

After all, Michael Jordan missed 1,447 free throw shots in his career.

As James Clear later popularized in Atomic Habits, people don’t fail because they lack discipline. They fail because the system makes the wrong behavior easy and the right behavior fragile.

Welcome to this final part of the 4-week series on leading finance transformation:

This week is about what happens next. How to make transformation stick once the adrenaline wears off and the project team has moved on.

(Not-so) Temporary Exceptions

Every big finance transformation, whether it’s a system rollout or a process change, hits the same sliding-doors moment. Often more than once.

The new way has gone live. It might be a new ERP. Or a budgeting and planning tool. Or a new PO approval process. The honeymoon period is over. The back-slapping is done. The implementation team has disappeared, and the bills have been paid.

Meanwhile, your team is under pressure to get a quarter-end out or pull together a board deck at short notice.

They’re trying to get what they need from the shiny new system. Twisting and turning queries in a tool that is unquestionably more powerful than the old one. If only they were ten percent as familiar with it. This particular cut of the data wasn’t something anyone thought about during the implementation.

Now they’re under pressure. The support framework isn’t really there anymore. So they hit “export to Excel”. Just. This. Once.

They pull in a mapping table to the old chart of accounts, because it’s what they know. They run an INDEX-MATCH or an XLOOKUP, or whatever formula the kids are arguing about this week.

And in seconds, the problem is solved. The board deck goes out just in time. Crisis averted.

You’d forgotten how easy it was.

You tell yourself you’ll fix it properly before next month-end.

But like any addict, it’s never just once…

Before you know it, you’re back where you started. Same spreadsheets. Same workarounds. Just sitting on top of a much more expensive and capable system.

And that “Excel-killing” promises the software vendor made now feel like a fever dream.

Sound familiar?

Zombie Spreadsheets: Back from the dead?

There are few better signals of a failed transformation or system effort than the humble spreadsheet. It could be any manual process, but in practice, we all know how this shows up. Somewhere on a shared drive as a Book1.xls.

Don’t get mad at Excel. It might be the greatest piece of software ever written.

Its ability to step in and fill the gaps left by broken processes, half-implemented systems, or unfinished transformations is remarkable. It runs the last mile. It delivers the output that the shiny new platform promised, but can’t quite manage.

Excel is never the problem. It’s the solution.

The solution to a problem your systems, processes, or transformation were supposed to solve, but didn’t.

Demonizing Excel, as many software vendors push you to, is like blaming duct tape here:

Counting the duct tape

You have to accept that some manual workarounds, Excel bridging, and process reworks are inevitable. Probably more than you’d like. But inevitable is not the same thing as permanent.

Every piece of duct tape is feedback. Every offline spreadsheet is information.

They’re signals telling you something about where your system, process, or implementation is falling short. That means the worst thing you can do is ignore them.

So it’s vital that every manual workaround, however small, is logged.

This is something software implementation consultants are shockingly bad at. Yes, they’ll maintain an issues log. But the truth is, they don’t always want to know. Their incentive is to get off the job and onto the next one, especially on fixed-fee implementations.

You need to make sure every single workaround is captured in a simple table, without judgment.

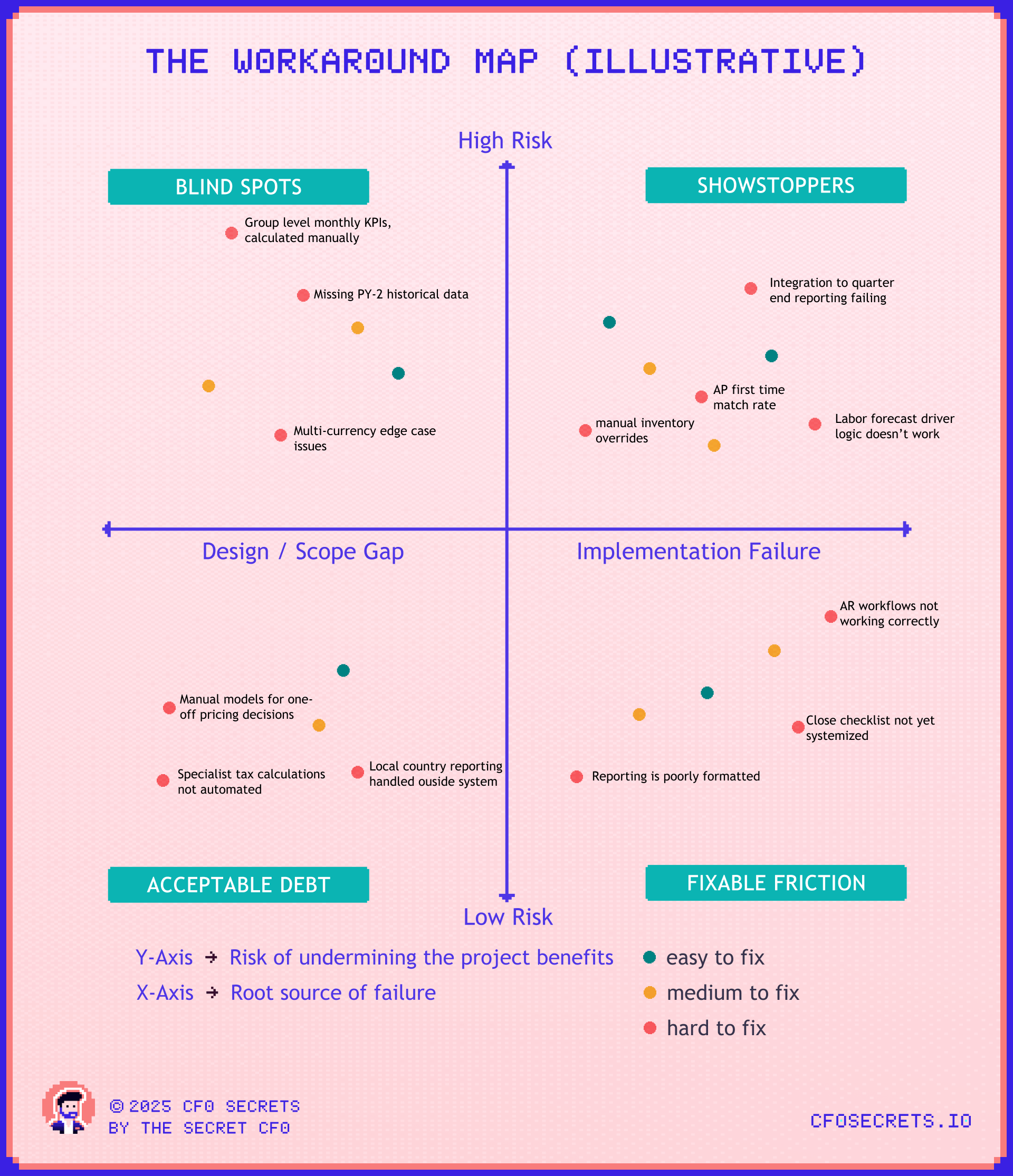

That’s where the Workaround Map comes in.

Mapping the workarounds

If you do this properly, the list will get long very quickly. Too long to manage as a flat register.

So you need a way to categorize and prioritize what matters. There are lots of ways to do this, but this simple approach has worked well for me:

The idea is that every workaround is recorded and assessed across three dimensions:

Root cause (X-axis): The workaround arisen because of which one of the following?

Design/scope gap (it was out of scope or genuinely unforeseen)

Implementation failure (it was in-scope, promised, or reasonably implied to be, but wasn’t delivered)

Impact (Y-axis): How serious is the workaround?

Does it materially increase effort?

Introduce control or audit risk?

Undermine the original benefit case?

Ease of fix (color-coded): How hard is it to fix, in time or money?

Green = easy

Amber = medium

Red = hard

Plot those three things, and patterns emerge very quickly.

Showstoppers: These are high-pain implementation failures. They were meant to work, and don’t. These must be tackled with the same urgency and intensity as the original go-live. Do not close the project while anything sits in this box. Often, the root cause here is training and skills gaps.

Fixable Friction: These were in scope, but inflict low levels of pain. They still need fixing, but they can be handled with a more post-project rhythm rather than emergency mode.

Acceptable Debt: Low pain and out of scope. These were conscious trade-offs. Park them. Don’t even think about them while the other boxes are still busy.

Blind Spots: These are the tricky ones. High pain, but out of scope. Often, they’re things that should have been scoped but weren’t. In a perfect world, you’d go back in time. In the real one, you triage. Sometimes that means trading fixes here against Fixable Friction elsewhere. Tolerate some in-scope noise to free capacity for the things that really matter.

Making the Workaround Map work for you

By making the Workaround Map a core part of project tracking and keeping it highly visible to both the team and your internal and external implementation partners, you turn it into an accountability tool. Visibility matters.

If I had a penny for every time a critical transformation failing was waved away as “out of scope” by someone on the project team, I’d have enough money to fix all the half-assed implementations I’ve seen in my career (including the ones I was responsible for).

When this map is live, visible, and used as the primary way you manage the tail of the project, it becomes much harder to hide behind ambiguity. Scope decisions get tested in the open. Implementation failures can’t be relabelled as design choices after the fact.

This doesn’t guarantee you’ll eliminate manual workarounds. But it does mean they can’t creep in by stealth. You can never say you didn’t know they were there.

Used properly, the Workaround Map acts as a kind of truth serum for project effectiveness in the short term.

Yes, in the long run, you have the benefit case to measure against. But that’s a lagging indicator. By the time benefits don’t show up, the damage is already done, and the team has moved on.

This tool gives you a fighting chance to see the cracks early, while the project is still live, and you can actually do something about them.

Ok, now stick the transformation landing

After go-live of a major transformation initiative, every day presents hundreds of small opportunities to regress to old habits. That’s why the Workaround Map is the most powerful tool I’ve found for spotting problems early and fixing them before they calcify.

A few other things I’ve found helpful.

1) Elevate process KPIs

CFOs don’t typically spend much time on process KPIs for finance. We focus on outcomes like DSO, DPO, close time, and forecast accuracy. But if you care about whether a transformation actually sticks, you need to surface the upstream process metrics that drive those outcomes.

In one faster-close program, we measured the percentage of balance sheet reconciliations signed off after working days five & seven. The goal was to drive both down aggressively. We could see progress clearly and jump on issues early by socializing the KPI before, during, and after go-live.

This matters even more further upstream, at the transactional level. Invoice match rates. Failed matches. Exception volumes. If those start to drift, you’re already leaking value - and compromising your transformation project - whether you can see it in the headline metrics yet, or not.

2) Don’t obsess over the benefit metrics too early

One common failure I see is when top-down pressure to prove the benefit case overtakes the reality on the ground. The CFO, controller, or VP of Finance doesn’t want to look like they can’t deliver their own project, so they force the headcount out before the work is actually stable.

I’ve seen this too often, and it’s a mistake.

Put your big pants on. Benefits are downstream of good work. Focus on getting the new way embedded and resilient first. Then reap the rewards. If that means hard conversations now, so be it.

3) Keep project rituals going

During a good transformation program, you usually fall into a strong rhythm of project meetings, steering committees, and reporting. Cadence builds focus. Issues surface quickly. Decisions get made faster.

The danger lives after go-live.

Once the system is live and you’re “90% of the way there”, discipline around those rituals starts to slip. Meetings get pushed. Agendas thin out. Attention drifts back to the day job.

Don’t let that happen.

Those first few months after go-live are when new behaviors either harden into habit or quietly dissolve. You may change the focus of the meetings, but not the cadence. Keep the intensity high long enough for the new way of working to become normal.

James Clear makes the point that habits don’t form overnight. They require repetition, reinforcement, and a stable environment. And remember, you’re not trying to build habits in one person. You’re trying to do it at an institutional level.

That takes longer. And it requires more structure than you think. Your base assumption should be that it will be incredibly difficult to do so. If it feels easy, you are probably failing.

Drop the rituals too early, and the organization will revert to whatever it was before. Exactly where you don’t want to be.

Net-net

Good finance transformation discipline is incredibly hard to get right. And it’s a skill that’s becoming more important than ever.

You can think of the AI revolution as a finance transformation project on steroids. Not just because of its generational potential, but because it cuts both ways. Weak implementation compounds faster. Small failures multiply. And once they spread, they’re harder to unwind.

That’s why you can’t think about transformation like an event. It’s a regime change.

And as we sign off this month’s finance transformation series (and the final playbook of the year), I’ll leave you with this:

The stronger the change muscles you build in your finance organization, the faster and more safely you’ll be able to absorb the exponential power of new technology, and supercharge finance and the business.

If you’re looking to sponsor CFO Secrets Newsletter fill out this form and we’ll be in touch.

:::::::::::::::::::::::::::::::::::::::::::::::::::

:: Thank you to our sponsor ::

:: Aleph ::

:::::::::::::::::::::::::::::::::::::::::::::::::::

What did you think of this week’s edition?

If you enjoyed today’s content, don’t forget to subscribe.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.