Your close slows to a crawl when accounting lives in spreadsheets

Campfire automates the accounting work that slows finance teams down — transaction categorization, bank recs, revenue recognition, and reporting — so you can scale without hiring a bigger team.

Teams close faster, spend less time in spreadsheets, and actually see what’s happening in the business.

Interested in learning more? Book a demo with the Campfire team.

Send me your stickiest CFO dilemmas (anonymously if you wish), and I might answer them in the Mailbag.

👉 Send me your questions by filling out this form.

Now, on to today’s Mailbag.

We’ve got some great topics. Here’s what’s on tap:

Costing done the right way

Paying your bills on time

Not for sale

Now, let’s get into it.

What Even is Gross Margin from the US asked:

I am 6 months into a new CFO role at a PE-backed SaaS company. My predecessor used G&A as a dumping ground for costs that, in my experience, should be reflected in COGS (hosting infrastructure personnel, SQL licenses for servers, ticketing software, etc.)

The budget I presented to the board included those costs in COGS, but it tanked our gross margin, and they are now pushing back and would like me to keep the costs where they are. My worry is that when we exit any due diligence team worth their salt will realize what we are doing and discount us anyway. It also gives a (in my opinion) false view of the unit economics of the business.

How do you handle conflicts in reporting like this?

Love this question.

This is the dirty little secret of SaaS.

Yes, the unit economics are good. Often they’re great. But very often they’re not quite as good as the reported gross margin would lead you to believe. A lot of costs that behave like variable costs get magically parked in G&A so everyone can feel better about scaling.

Why does that matter?

Because the higher the perceived contribution margin, the more the answer to every hard question becomes “don’t worry, scale will fix it.” That story attracts capital, inflates valuation, and papers over real operational problems.

And you don’t need to guess where I land on this.

It’s bulls**t.

More importantly, it’s your credibility on the line. You are the one who will be sitting in diligence. You are the one whose name is attached to the numbers. And when the diligence team pulls the thread and the sweater comes off, nobody will remember that “the board asked me to keep it that way.”

You are right on both counts:

Any diligence team worth paying will see straight through this in about five minutes.

Internally, it gives management and the board a distorted view of unit economics, which leads directly to bad decisions about hiring, pricing, and growth.

There is a legitimate conversation to be had about how you present the business externally at exit. Framing matters. Storytelling matters. Fine.

What is not legitimate is a board that doesn’t want to see the economic truth of the business today.

That is weak governance. Full stop.

Boards lying to themselves is not “being commercial.” It’s ostrich behavior. Head in the sand, hoping scale magically fixes economics that aren’t actually there. That destroys value quietly and reliably.

And personally, I have very little tolerance for it.

If you’ve got the political capital, my instinct would be to call this out directly. Not theatrically, but clearly. This is not an accounting debate. This is about whether the board wants to understand how the business actually works.

If your style is less confrontational, there is a more subtle way to force the issue.

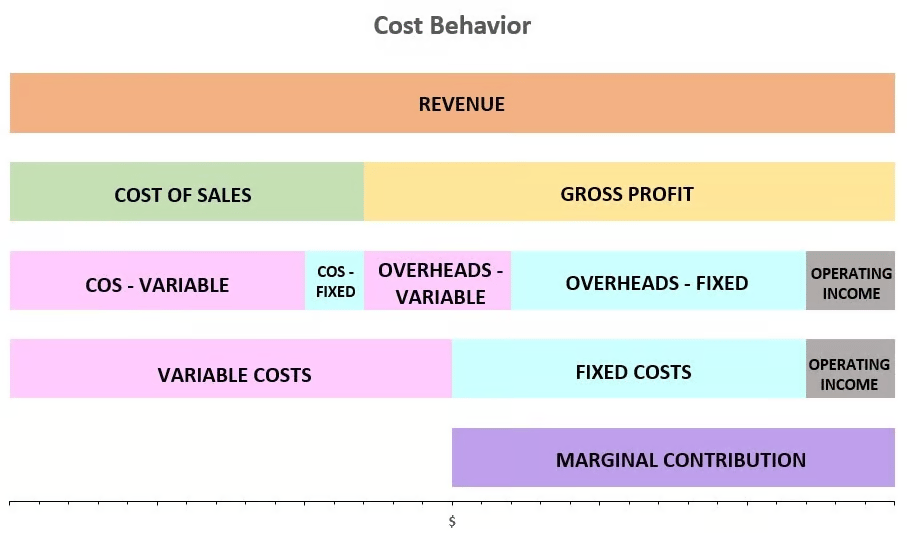

Reframe the discussion away from accounting labels and toward economic behavior.

“Gross margin” is an accounting construct. Cost of Sales under GAAP is a broad church, especially in SaaS. There is room for judgment. And yes, room for abuse.

What has far less room for interpretation is how costs behave.

Contribution margin is not a GAAP term, but it’s economically honest. Revenue minus costs that actually scale with customers, usage, or delivery. That tells you what incremental growth is really worth.

Here is an image that explains the difference (full piece here).

Gross margin is often used as a proxy for contribution margin. In SaaS, it’s frequently a weak proxy, applied inconsistently between businesses.

So instead of fighting about whether hosting engineers or infrastructure tooling “belongs” in COGS or G&A, present the business like this:

What we currently report as gross margin

What our true contribution margin looks like on a per unit basis once we reflect all - but only - the variable costs

A few scenarios showing how growth actually flows through to cash and EBITDA under both views

This moves the conversation from “you’re tanking our gross margin” to “this is how the business actually behaves.”

It’s harder to argue with. And it forces the board to confront reality without you having to accuse anyone of playing games.

But don’t lose sight of the bigger point.

There can be debate about external presentation. There should never be debate about whether the board sees the truth internally. A board that doesn’t want that truth is not harnessing value creation, and is not doing its job.

If they still don’t want to hear it, I’d be asking myself whether this is a table I want to sit at long term.

TLDR: Don’t let accounting optics hide economic reality. Diligence will see through it, bad unit economics lead to bad decisions, and a board that won’t face the truth is destroying value, not protecting it.

NewCFO from the US asked:

What is the appropriate speed to make AP payments? As we mature as a company, we have been trying to professionalize our AP process, including having a more structured payments cycle (closer to weekly instead of nearly hourly).

We have also been striving to make payments more slowly in general in an effort to improve our overall working capital dynamics, especially given we're often on the receiving end of it within our AR.

What's the right balance between pushing out payments to improve AP, and the friction it can cause with vendors?

Thanks for the question, NewCFO.

I’ve got a lot of scar tissue on this one, so I’ll try to keep it concise.

Moving from ad-hoc payments to a structured payment cadence is absolutely the right move. But expecting that change to only help working capital, without creating friction elsewhere, isn’t realistic.

Payment terms discussions are emotional. People instinctively assume the supplier is always the “little guy.” Sometimes that’s true. Often it isn’t. I’ve been in businesses where we mutually agreed on long payment terms with suppliers who had stronger balance sheets and cheaper cost of capital than we did. It turned out to be a masterstroke and rocket fuel for mutual growth.

There’s an important distinction here that finance teams sometimes blur:

Paying late is not the same as paying slowly.

If you are routinely paying suppliers later than agreed terms, that’s bad practice. It weakens your supply chain, damages trust, and over time, it will increase your costs. Suppliers price in uncertainty. If small suppliers are involved, I’d also argue it’s unethical.

Paying slowly means paying on time, but to terms that are longer or more favorable to you, and that were consciously negotiated. A supplier might be able to plan around 60 or 75 day terms if they know they’ll be honored. What they can’t plan around is randomness.

Unreliable payment behavior makes suppliers protect themselves. They do it quietly through higher pricing, lower service levels, tighter credit limits, or simply choosing not to work with you. None of that shows up cleanly in your working capital dashboard, but it absolutely shows up in your long term value economics.

One more thing that’s worth saying plainly: using AP as a crutch because AR is weak is the wrong move. If customers are paying late, that’s the problem to fix. Passing the pain down the supply chain just pushes risk into places that are less resilient, and eventually it comes back to you.

You’ll either:

Bully suppliers if you’re big enough, making them fragile and your supply chain brittle, or

Pay for it indirectly through price, service, or availability in ways that are harder to see and harder to unwind.

So what’s the balance?

Build a predictable payment cadence. Pay exactly when you say you will. Be thoughtful and segmented about where you push terms, and why. And focus your real energy on fixing AR and cash conversion upstream, not squeezing AP indiscriminately.

TLDR: Structured payment cycles are good. Paying late is not. Negotiate longer terms where it makes sense, honor them religiously, and don’t use suppliers to paper over AR problems.

The SecretFractionalCFO from the US asked:

This is a legitimate inquiry, and hopefully not offensive. I am interested in acquiring your business and brand. I own and run a highly profitable, bootstrapped tech-enabled fractional CFO firm for sponsor-backed companies.

I would keep this journalistically independent and keep everything mostly the same. If you are not ready or if this is a nonstarter, I’m happy to at least speak and convey my interest and plans.

Hi SecretFractionalCFO,

Not offensive at all. I’ve had a number of approaches and offers over time. I’ve responded to those privately, but since you asked through a public channel, I figured it deserved a public response too.

I’m not surprised by the outreach. I think more people are waking up to how powerful a direct relationship with CFOs can be when it’s built on trust, shared experience, mutual respect, and most importantly, a genuine love for the craft of being a CFO.

But I’m extremely attached to this thing. It’s not just built by me. It is me. So I wouldn’t sell it.

And even if I were open to that idea, the job isn’t done. Honestly, it’s barely started. I think it will take the better part of a decade to fully realize what I’m trying to build here. There is a whole ecosystem of tools, content, community, etc. for CFOs that should exist, but doesn’t… that makes me sad, and motivated as hell.

Coincidentally, the timing lines up with a decade in which finance functions are likely to change more than they have in the last fifty years.

That transition needs strong, experienced operator voices shaping it. Not consultants. Not LinkedIn imagineers. People who’ve actually sat in the chair and lived with the consequences of bad systems, bad incentives, and bad advice. I think I have an important role to play in that.

But more than anything, I’m having too much fun.

At this stage of my life, I’m optimizing for family, fun, and impact. I honestly can’t think of anything I could do that delivers on those three better than what I’m doing right now.

I appreciate the outreach, and wish you all the best.

TLDR: Thank you for the interest, but it’s a no.

A few of the biggest stories that every CFO is paying close attention to. This is the section you might not want to see your name in.

‘Cash doesn’t lie’ is one of the oldest tropes in finance. It’s also increasingly inaccurate, with the rise of working capital funding platforms specifically designed to trick the reporting. I wrote more about this in Saturday’s Playbook.

The company is taking digital strategy off of CFO John Murphy’s plate to “accelerate technology adoption across the organization.” I’ve been saying for a while that the CFO has no divine right to own the data and digitization agenda. I think we’ll see more of this kind of role splitting.

There are growing questions about the collective accounting of AI and ‘roundtripping’ of revenue. With OpenAI right in the middle of some creatively structured deals. So it’s not surprising to see a bit more transparency in the disclosure of financial performance. This is before the company introduces ads into its chatbots because AI’s real promise is as… another ad platform?

ICYMI, here are some of my favorite finance/business social media posts from this week. After all, with Warren Buffett gone now, where else are you going to get the fresh tea you need?

We’ve got all the pearls of wisdom you need right here!

@corporatecanadian Gtfoh and take that positive energy with you 😤 #CapCut #accounting #positivevibes #officelife #corporate #coworkers #finance #tgif #workhu... See more

If you’re looking to sponsor CFO Secrets Newsletter, fill out this form, and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

If you enjoyed today’s content, don’t forget to subscribe.

You can help make sure this newsletter always stays free simply by spreading the word. And when you share CFO Secrets with your finance friends, you’ll earn rewards, including a 50-page PDF guide on what it takes to be a great CFO. Start sharing your unique referral code today: {{rp_refer_url}}

Let me know what you thought of today’s Mailbag. Just hit reply… I read every message.

In Saturday’s Playbook, we gave you a (Cash) personality test. Check out the newsletter here. And in Tuesday’s Boardroom Brief, we asked if you should be using AI to prepare your annual report. Find out more here.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.