Most large language models weren’t built for finance

They’re trained on everything from Reddit threads to recipe blogs. So plugging them into your accounting workflows is a risky proposition.

That’s why Campfire, the company pioneering AI-native ERP, just rolled out the Large Accounting Model (L.A.M.).

It’s a proprietary AI model trained specifically for finance and accounting, and it's already achieving 95%+ accuracy on accounting tasks.

Sign up for a live demo of L.A.M. today to see how unicorn companies like PostHog and Replit are automating their finance operations

I’ve been inundated with reader questions since the start of this series. Most of them boil down to a single question:

“How do I become a Private Equity CFO?”

So let’s tackle that head-on.

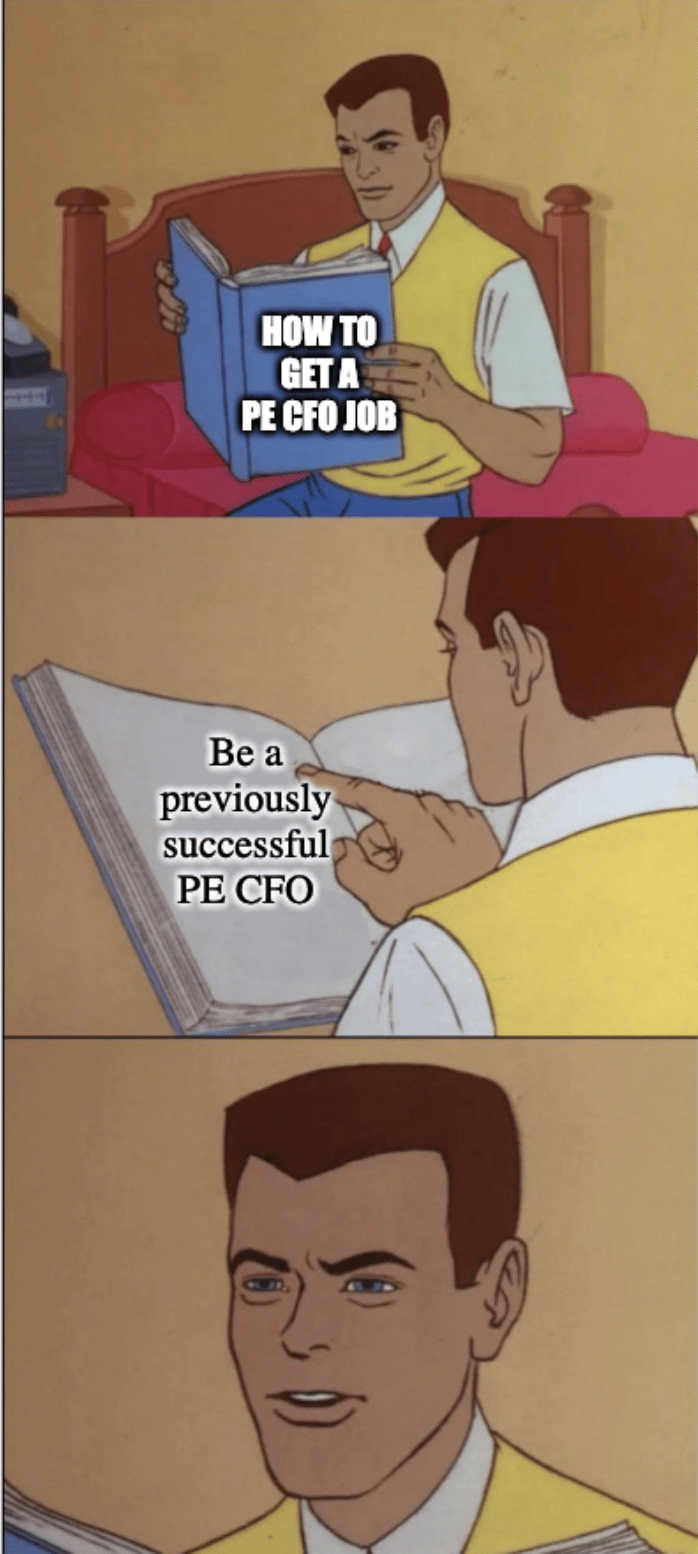

There is one (almost) fail-proof way to get appointed as a Private Equity CFO…

To already BE a successful Private Equity CFO.

Yes, I know. Possibly the most annoying answer of all time. But also true.

We’ve landed at the end of this series on the Private Equity CFO. So far, we have covered:

This week, we will round things off by shifting focus from the playbook to the player. You, the CFO.

So let’s get back to that question of how you break into PE as a CFO.

It’s a closed shop. An exclusive club that’s designed to be hard to get into.

“I don’t want to belong to a club that accepts me as a member.”

PE funds structure deals with a high degree of execution risk. Aggressive value creation plans. Heavy leverage. Slim margin for error. So everything post-deal is about de-risking that bet.

Nothing gets de-risked more aggressively than the CFO hire.

Does the CEO pick the CFO? Not really. The fund does. The CEO has to be comfortable, but this isn’t corporate, where leaders bring in “their guy.”

In PE, the CFO typically reports to both the CEO and the fund. Dual-track accountability. That’s non-negotiable.

You can hear it directly from a top operator here:

And the best way to de-risk their CFO bet is to find a CFO who has done exactly what they need before. Ideally, in one of their other portfolio companies. Hence, my annoying answer above.

So what happens when the fund can’t find a proven PE CFO?

That’s when the door opens. Your job is to be standing right in front of it. And how do you do that? Be the candidate that ticks every other box.

Even with the perfect profile, PE firms often default to known quantities: sponsor references, prior exposure to the fund, or endorsement by a trusted CEO/operator carry disproportionate weight. If you're not already on their deal team’s mental shortlist, getting on it should be a core focus. Build proximity, visibility, and trust within the PE ecosystem.

Let’s say the role is for a CFO to take a $100m industrial chemicals business and lead a buy-and-build to $500m+.

You want to be the person who’s done that exact play, just not in PE.

Every CFO job can be broken down into six core dimensions:

Sector/sub-sector

Size

Situation/Strategy (turnaround, growth, M&A, etc.)

Finance Function Maturity

Business Life Cycle Stage

Ownership Structure

Tick the first five and make the fund choose between:

You, who’s done the job in all but structure

Someone else, who knows PE but lacks sector depth or has never scaled at this level

PE funds place a huge premium on industry and situation experience. This also works if you’re one rung below CFO but tick all six boxes. It makes you the obvious promotion candidate. Especially if you reach them via a referral from a source trusted by the fund (operator, lender, recruiter, etc.).

Build your network inside the ecosystem you want to grow your career in.

Let’s go deeper:

Saying “I want to be a PE CFO” is weak…

Saying “I’m the go-to CFO for $100m+ ecommerce turnarounds” is specific, credible, and valuable.

Find your niche. Own it.

Make your career, your network, and your development choices align behind that positioning. It’s your USP. You’re building yourself as a category of one. I broke this down further in this piece on the CFO Skill Stack.

Once you're clear on the kind of CFO you are, and the kind of problems you solve, you can reverse-engineer the path:

What kind of companies?

What kind of deals?

Which recruiters?

Which funds?

And, of course, this thinking is valuable for whatever kind of CFO role you want. It’s just smart career management.

How to get fired

And if that’s how you get a PE CFO job, then what will make you lose it?

Here are 7 traps that could cost you your PE CFO job:

Lose Control of Cash. Blow the 13-week forecast or lose control of working capital, and you’ll run out of road fast

Miss the Numbers. Surprise the Room. You won’t get fired for missing the numbers, but you will if you don’t see it coming. Especially a covenant breach.

Lose Track of the Value Creation Plan. Value creation is what matters most in PE. Delivery is a responsibility shared by the exec. Tracking delivery is your responsibility alone.

Lose the Confidence of the Operating Partner. What your PE operating partner thinks of you is the single biggest driver of whether you’ll be in the seat in 6 months.

Lose the Confidence of the CEO. If you can’t work effectively with the CEO, then it’ll be impossible to get the rest of your job done

Lose the Confidence of the Lenders. While they have no direct influence over your position, lenders can apply a lot of pressure indirectly via your operating partner.

Lose Control of the Exit. Exit is the final exam. And even if you were the right CFO to execute the value creation plan, PE funds won’t hesitate to bring in a specialist if they don’t trust you to realize that value.

Why “Lose the Team” Didn’t Make the List

You’ll notice I didn’t include “lose control of the team.” In most other settings, I would. And yes, a strong team underpins much of the above. But in PE, CFOs are expected to be hands-on. If you can deliver as a high-performing individual contributor, even with limited strength underneath you and no real succession, most funds won’t care. That said, a weak team often becomes a leading indicator, especially when approaching the exit ramp, where there are two full-time jobs: running the business and delivering the exit prep.

And if you do get fired, don’t expect to be looked after. Odds are you’ll be booted as a bad leaver and lose the equity you were counting on. Most PE deals include Management Incentive Plans (MIPs) with clawbacks. Sidebar: CFOs should negotiate good leaver protections tied to performance milestones or partial vesting on time served, especially if their seat is high-risk. This is high-stakes stuff.

How not to get fired

Let’s wrap this series by turning those seven traps into seven ways to excel as a Private Equity CFO:

Make Cash a Religion

See Round Corners

Make the VCP the Nerve Center

Meet Your New Best Friend (The Operating Partner)

Keep Your CEO Onside

Own the Lender Narrative

Day One Exit Prepping

Diving in one at a time:

1. Make Cash a Religion

I won’t bore you with a sermon on why cashflow matters. You already know.

And yes, I’ve written plenty about 13-week cashflow forecasts. But in PE, the stakes are higher. The capital structure is tight. One bad swing in working capital and you’ve missed a debt repayment.

It’s the first thing your PE sponsor will ask for, and you need to know it inside-out, every week.

The same goes for working capital, especially DSO and credit control hygiene. If overdues start creeping up, the board won’t ask questions. They’ll assume you’ve lost control.

If that means getting your credit control team and sales account managers in a war room three times a week, so be it.

Pay down your revolver aggressively. Get the business used to eating from a smaller plate. And hardwire cash into function-level KPIs: procurement on DPO, sales on DSO, ops on inventory turns, etc.

2. See Around Corners

Great CFOs have X-ray vision. It’s not enough to just look out the windshield instead of the rear-view mirror. You need to look around corners. To see the unseeable.

That starts with a tight reforecasting cadence. Don’t overcomplicate it. Bottom-up models that depend on broad org engagement often break down under pressure. A light-touch, top-down forecast, backed by sharp business judgment, is often more reliable and faster in a PE environment. It also makes it easier to connect boardroom levers to outcomes. Your board will appreciate the responsiveness.

But for this to work, you need a deep understanding of the business and the ability to spot issues in leading indicators before they show up in the P&L.

Keep a rolling 18-month view of debt service, liquidity, and covenant headroom. Track ratios monthly and flag risks early. Map this against refinancing windows and stress test scenarios.

Report it to the board monthly. It won’t prevent a breach, but it turns a risk into a shared problem, not a surprise.

Build a no-surprises culture across your leadership team. Push for radical transparency between functions.

Surprises are a bad look in any CFO role. But in PE, if it’s something you should have seen coming, it’s probably fatal.

3. Make the VCP the Nerve Center

Translate the Value Creation Plan into a KPI tree. Be specific. What is the plan to take enterprise value from X to Y? Break it down by department, make it time-bound, and assign owners. You should be able to show which KPIs need to move, by how much, and over what period to create the value.

Then reconcile that plan into your forecasts and reported P&Ls. This kind of three-dimensional triangulation is utterly invaluable when preparing for exit. It makes the business improvements undeniable and builds the muscle you will need to sell the future opportunity when the exit process begins.

I have seen otherwise solid finance pros get caught out in sell-side M&A processes due to a poor grasp of EBITDA normalization and how to quantify it. That won’t happen if you build the habit of connecting KPI shifts to the P&L every month.

The VCP should anchor your long-range plan, budget, bonus schemes, and board reporting. Make it robust. Make it trackable.

And review it properly. Schedule a monthly one-to-one with the CEO to walk through the VCP and address slippage. Hold a formal review of the VCP with the operating partner every quarter, including a clear course correction plan where needed. It will help build confidence that you are addressing problems and don’t need ‘help’.

4. Meet Your New Best Friend (The Operating Partner)

We’ve talked about operating partners throughout this series. Now it’s time to meet them properly.

The operating partner is your main point of contact at the fund. Their job is to make sure the management team is delivering against the investment thesis. Some come from operational backgrounds. Others rose through the fund. Either way, they are very f***ing important to you.

Ultimately, they will have a major say in whether you’re still in the seat when it’s time to exit. The good ones are challenging and supportive in equal measure. But like any power dynamic, it varies. The closer you can get to them and the more you can keep them confident in you, the better.

They are much more hands-on than a typical non-exec. They’ll often have an associate working under them, usually a bright, overcaffeinated 28-year-old who floods your inbox with data requests and ideas for “opportunities.” Sometimes helpful, sometimes absurd. Either way, they’re building decks for the operating partner to present to IC. And you don’t want to be the one holding them back.

You’ll likely get hit with Saturday morning requests for an “early view” of last month’s numbers. Or sent a flagged $500k working capital opportunity that may or may not be real. This is part of the game. Don’t fight it. Manage it.

It’s political. So play it well. Build trust by being radically transparent, responsive, and proactive. Share early. Be generous with context. Earn credits, and only then push back, gently, on anything unproductive.

Pre-wire the associate team before every board meeting. They often attend as observers and may throw in curveballs. Better to shape their view in advance.

And remember, your CEO will judge you on how well you manage them, too.

One thing is certain: the more trust you build with your operating partner, the more space and autonomy you’ll earn. Just don’t expect that trust to be there at the start.

5. Keep Your CEO Onside

In PE, the CFO has two bosses: the CEO and the operating partner. You will often find yourself caught between them.

Each will use you to triangulate what the other is thinking. This gets especially intense in the lead-up to board meetings.

One tactic to manage this is to run a tight board cycle. Issue a well-prepared pre-read a few days in advance. Get alignment calls done, hold the board meeting, and close out actions quickly. Done right, this gives you a clear two to three weeks between board cycles to focus on the business and stay aligned with your CEO.

The tighter you and your CEO are on performance assessment, grounded in robust FP&A, and on resourcing decisions like capex and hiring, the better.

Stay aligned, but be careful not to appear overly loyal. If your operating partner senses that you lack independence, your opinions and influence will quietly get discounted, whether you realize it or not.

Make no mistake, you are critical to keeping both harmony and performance on track.

6. Own the Lender Narrative

You can also find yourself caught between your PE fund and your lenders. Often, the capital structure is not just designed by the PE fund, but also one they executed using lenders from their little black book. Those lenders are likely taking a portfolio-level view, not just a company-specific one.

That means, as an incoming CFO, you’re inheriting lender relationships where the real connectivity sits with the fund. Sometimes in the background. Sometimes in plain sight.

This is tricky. It’s critical that you pull some of that relationship into your corner. Because if things go wrong between the business and the bank, you can bet it will be seen as your fault.

Some operating partners will hand over the relationship and expect you to run it. Others will be more protective, especially if the lender is a trusted fund contact. Either way, you need to earn your way into that dynamic.

Start with the basics. Find a reason to spend time with the relationship managers at your key lenders. Offer them a quarterly call to walk through performance and outlook. Build strong foundations. And if you get a chance to build relationships further up the credit chain, take it.

Ultimately, you need to actively manage your credit story. Don’t let the fund be your proxy. Own the narrative around leverage headroom, cash generation, covenant compliance, and upsides.

This is your chance to earn real credit with lenders directly when things go wrong. If performance dips or a covenant is at risk, be transparent, proactive, and commercial. That is when trust gets built.

The goal is to have a seat at the table with the fund and the lenders when it comes to discussions on recapitalizations, amendments, or exits.

I’ve turned down PE CFO roles in the past because I didn’t feel I would have enough control over the lending relationships. I didn’t want to be a hired gun inside the business. I wanted to own the capital structure, or at least the execution of it.

7. Day One Exit Prepping

You should treat every board pack as if it could be re-purposed for a sell-side data room. From day one:

Track EBITDA normalization items monthly

Tie all major KPIs to value drivers (margin, retention, mix)

Build a ‘bridging model’ from GAAP to normalized earnings

Create a rolling exit-readiness checklist (clean IP, contracts, audit readiness)

Pressure test valuation multiples and align story to current buyer appetite

A CFO who is already exit-prepped de-risks the process. And makes themselves indispensable when the time comes to execute.

Treating every board or investor meeting as a ‘soft diligence’ exercise. A 4-year hold period with monthly board meetings means 48 times to rehearse the story. That will compound and make you finely tuned when the moment comes.

But it’s about more than the numbers. If you are on a buy-and-build platform, it might be that an ERP rollout/integration is key to your exit story. As I’ve said many times before, ERP rollouts are among the most difficult challenges a CFO faces. A thankless, difficult grind.

I’ve seen CFOs get fired who did a great job on the VCP but botched the ERP rollout needed to secure the equity story.

For bigger platforms, exit could mean a ramp to IPO, which is a different beast altogether (we’ll tackle going public in another piece).

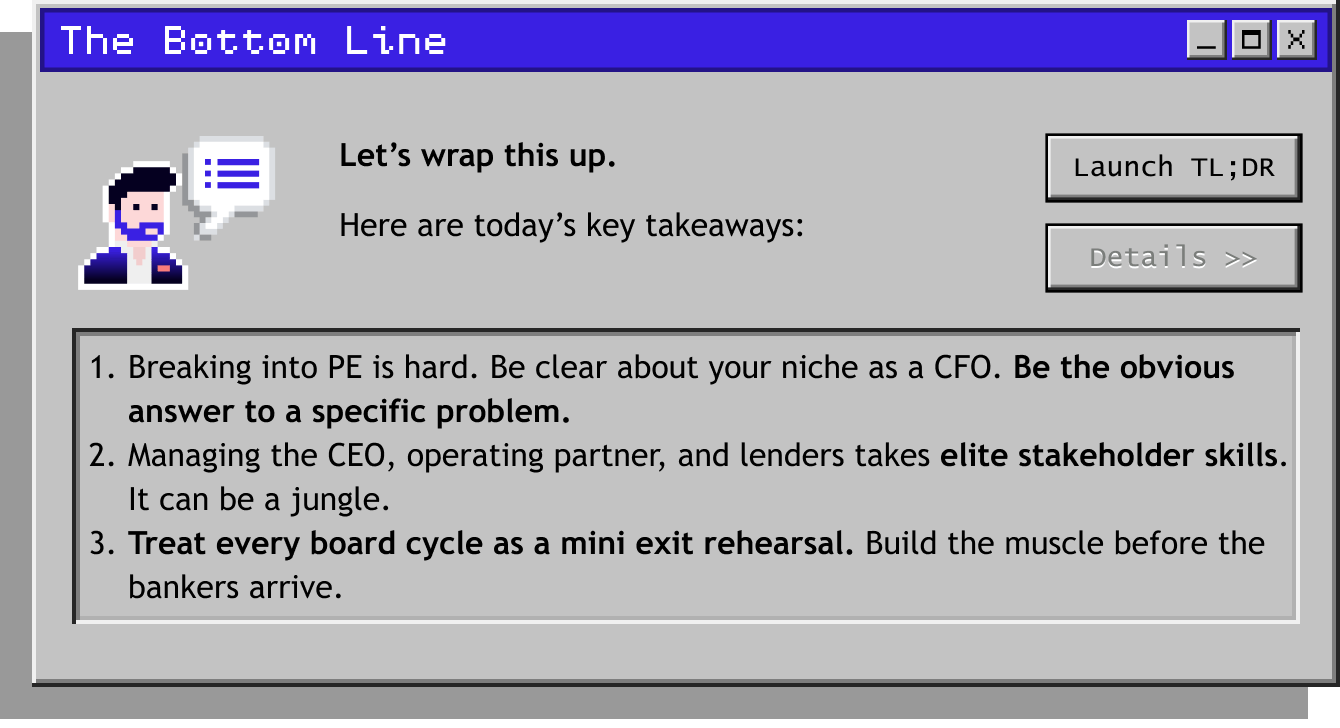

Net-net

A private equity CFO job has many of the challenges of other CFO roles, just on steroids: acute stakeholder dynamics, cashflow pain, but with massive fixed loan repayments baked in, an exit clock ticking. And with the Value Creation Plan in the middle of it all. It is a fascinating and, for many, rewarding test of your skills.

It requires all-weather skills that are rarer among finance leaders than most realize.

And that wraps up this series. Next up, we have a five-week walk-through scaling a finance function.

If you’re looking to sponsor CFO Secrets Newsletter fill out this form and we’ll be in touch.

:::::::::::::::::::::::::::::::::::::::::::::::::::

:: Thank you to our sponsor ::

:: Campfire ::

:::::::::::::::::::::::::::::::::::::::::::::::::::

What did you think of this week’s edition?

If you enjoyed today’s content, don’t forget to subscribe.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.