As a finance leader, you face a choice...

You can choose spreadsheets, manual reconciliations, and disconnected tools.

Or you can automate the entire contract-to-cash process across billing, collections, and revenue recognition with Tabs. Let their automation workflows and agents, built for modern finance teams, do the heavy lifting for you.

Finance teams using Tabs close 50% faster, cut DSO by 80%, and save hours of manual work every month.

I love answering your toughest questions. Hit me with your most challenging CFO issue, and you could be featured in an upcoming Mailbag.

👉 Send me your questions by filling out this form.

Now, on to today’s Mailbag.

We’ve got some great topics. Here’s what’s on tap:

Software vs manufacturing finance

Marketplace promotions as an acquisition tool

Separating essential spend from discretionary spend

Now, let’s get into it.

David from Iowa asked:

For a finance leader who’s spent their career in software, what breaks first when you step into a traditional fabrication or manufacturing business?

The shift so far has been drastic: I moved from forecasting ARR, tracking expansion and retention, to managing work-in-progress, utilization, and earned value. The teams I join are often deeply tenured, 10, 20, even 30 years in, with a different rhythm, vocabulary, and set of values than tech.

What kind of mental rewiring and finance-thinking overhaul does it take to move from “growth mode” to “earned-value discipline”? Any favorite resources or frameworks you’ve used to operate finance effectively in this world? I feel completely out of place with a lack of experience in processes, even technical finance and systems in this business (which, by the way, feels great).

David, it’s great to hear you’re loving the challenge of being a noob in a new industry. Exciting stuff.

I should declare some bias up front here… in manufacturing - in my opinion - finance plays a far more critical role than in software.

Software, especially SaaS, is one of the best business models ever created. Giant gross margins, recurring revenue, and a whole ecosystem of capital built around it. Yes, there’s heavy upfront investment, but the rewards are huge.

What makes the winner in software?

Product teams

GTM teams

Everything else is a distant third. Finance is important, but it’s the supporting cast.

In manufacturing, everything’s just tighter. Margins are narrow, and capital availability is tied to real things - assets, cashflows, working capital.

A tiny shift in raw material costs, waste, or labor efficiency can swing profitability in a big way. And there’s no pot of gold at the end of the rainbow. Enterprise value is basically an annuity of current cash flow performance. That’s why manufacturers are valued on EBITDA, not ARR.

Finance truly has a front row seat in manufacturing:

Margins shift daily based on a dozen moving variables

Everything’s interconnected: pricing, ops, freight, shifts, waste

Working capital lives and dies on inventory discipline

You’re exposed to commodity prices, FX, and freight volatility

And you’re trying to hold it all together on a 10% EBIT margin (if you’re lucky). It’s impossible to do that without outstanding finance.

So, how do you make the leap? You’ve got to get out of the spreadsheet and into the business. Walk every part of the factory. Spend a day working in each if you can. Learn the operational language. See how product (i.e., money) actually moves through the system.

When an operator tells you “spoilage is up 10 basis points,” do the math. It’ll blow your mind how big that is in real dollars. And that’s how you start to see the business properly in 3D, not in cells. The benefit of a tangible industry like manufacturing is that once you see it, it’s much easier to understand it.

Thanks for the question.

TLDR: Moving from software to manufacturing is a full mental reboot. Turn your laptop off, pick up a hard hat, and learn how the business really makes money.

Cash Warren from Toronto/Canada asked:

Our new VP has raised concerns about frequent promotions on marketplace channels, suggesting they erode margins and dilute brand equity. Given that these promos also drive volume and customer acquisition, how do you think we should balance short-term sales gains with long-term brand and margin health across DTC and marketplace channels?

Your new VP sounds smart, Cash Warren.

Frequent promotions on marketplace channels absolutely erode margins and dilute brand equity. But yes, they also drive short-term sales. The real question is whether the trade-off is worth it.

This goes right to the heart of something I wrote about last week on the state of DTC. If your sales are dependent on someone else’s channel - Meta Ads, Google, TikTok Shop, Amazon - you should assume that, over time, most of the value will flow to them, not you.

Those platforms have the smartest people on the planet working full-time to capture as much of your margin as possible, while leaving you just enough to keep coming back. And even if they don’t, there are thousands of capable operators who can reverse-engineer your product, undercut your price, and crowd out your niche before long.

So even if your marketplace engine is throwing off great cash right now, it’s fragile. Your economics are in the hands of the platform.

My advice would be to listen carefully to your new VP. They’re probably not saying “no promotions ever.” They’re saying: build a brand, not a discount habit. Use promotions as an acquisition tool, not an operating model.

When promotions become the only way to hit your number, that’s dependency.

TLDR: Marketplace promos can be a tactical part of your plan, but not your whole strategy. Build a brand and direct relationship with your customers.

Banker turned operator from NYC asked:

How do you approach reforecasting with respect to department leaders' budgets? For example, if IT has a $1M budget for a year, and we decide not to proceed with a $100K project within that, how do you decide whether to take that budget back or let them spend up to the initial $1M?

By default, should they have to justify the new spend, or have the flexibility to operate within their initial budget amount?

If the former, how do you avoid departments holding on to spend for fear of not being approved to re-allocate dollars if they cut a project? Also, when we report budget vs. actuals, is it best to compare vs. the latest reforecast or the initial budget (or both)? The initial budget is the board-approved number, but sometimes it doesn't reflect the reality of decisions subsequently made.

Lol. With a question like this, you’re a real operator now, my former banking friend.

Great question.

There are a few principles here.

First up, I’m a bit of a zero-based budgeting (ZBB) fanboy. And not the nonsense version you see floating around on LinkedIn. Proper ZBB means every department starts from zero each year and has to justify spend from the ground up as part of the budget process. Painful, yes. But it’s the best discipline for avoiding budget bloat.

Within that, I like to separate essential spend from discretionary spend.

Essential spend belongs to the budget holder. It’s the stuff that keeps the lights on and operations running. If they save money because a key role was vacant for a couple of months, you don’t punish them by clawing that back. You still expect them to fill it and deliver the plan.

Discretionary spend, on the other hand, is “on loan” in the budget. It was agreed because, at the time, it looked like the best use of the company’s capital. But that might not be true when you come to spend the money. Things change.

Maybe the budget holder thinks there’s a better way to spend that money within their department. Fine, but that flexibility cuts both ways. If they can reallocate, so can their boss, and the CEO, and ultimately the board. Otherwise, you end up with a dozen little silos of capital that no one optimizes.

This is the bit most people get wrong: budgeting is not the same as spend approval. Just because something made it into the budget doesn’t mean it’s an automatic green light to spend. Think of it like CapEx. You can budget a project, but you still need a proper CapEx approval before spending.

So how do you operationalize that?

I’ve seen several ways:

Reforecast monthly/quarterly and reset budgets to reflect what’s actually going to happen. This keeps reporting tidy and real.

Separate owned vs. “on loan” budgets. Owned budgets can be spent at the manager’s discretion. On-loan budgets require an approval process before they can be used.

Personally, I prefer option two. It keeps accountability clear and improves transparency. You’re not taking money away. You’re just making sure it gets deployed to the highest priority across the company at a point in time. And bringing that decision to the right forum.

And it’s your job to define that forum. Otherwise, you’ll frustrate department heads and lose trust. Set a clear monthly cadence - a discretionary opex forum works well - where those spends can be reviewed and approved without slowing the business down.

And remember, this is not an excuse to play god over who can spend what. Your role is to present the trade-offs clearly, at the right time, so the business makes the best decisions. You are one voice in that, not the only one.

TLDR: Budget ownership isn’t blanket approval. Separate essential from discretionary spend, make teams re-justify discretionary spend at the point of commitment, and redeploy freed-up capital to where it adds the most value.

A few of the biggest stories that every CFO is paying close attention to. This is the section you might not want to see your name in.

This is a masterful performance in front of the media by the Disney CFO. Reeling off his numbers to demonstrate improving underlying cashflow. Tying it back to dividends and investors. Taking questions from all sides on business strategy and financial policy. Calm, charismatic, uneventful. This, ladies and gentlemen, is how you do it. Bravo.

No wonder they pay Hugh the big bucks… and just extended his contract.

Being rude to audit teams is C-player behavior. They’ve got a job to do, and that job is way harder than most give it credit for. Using them as a punch bag because you are short of time and don’t have your own sh*t under control is weak. So, next time you run into your auditor, give them a little love. Maybe even buy them a nice gift … (don’t do that).

ICYMI, here are some of my favorite finance/business social media posts from this week. In the words of Kendall Roy, “all bangers, all the time.”:

Finally, a chart that isn’t all bad:

Note to self: never take dating advice from a hedge fund billionaire…

Refusing to give guidance a month after your IPO is a great way to destroy Wall Street’s confidence in your management team. Very poor…

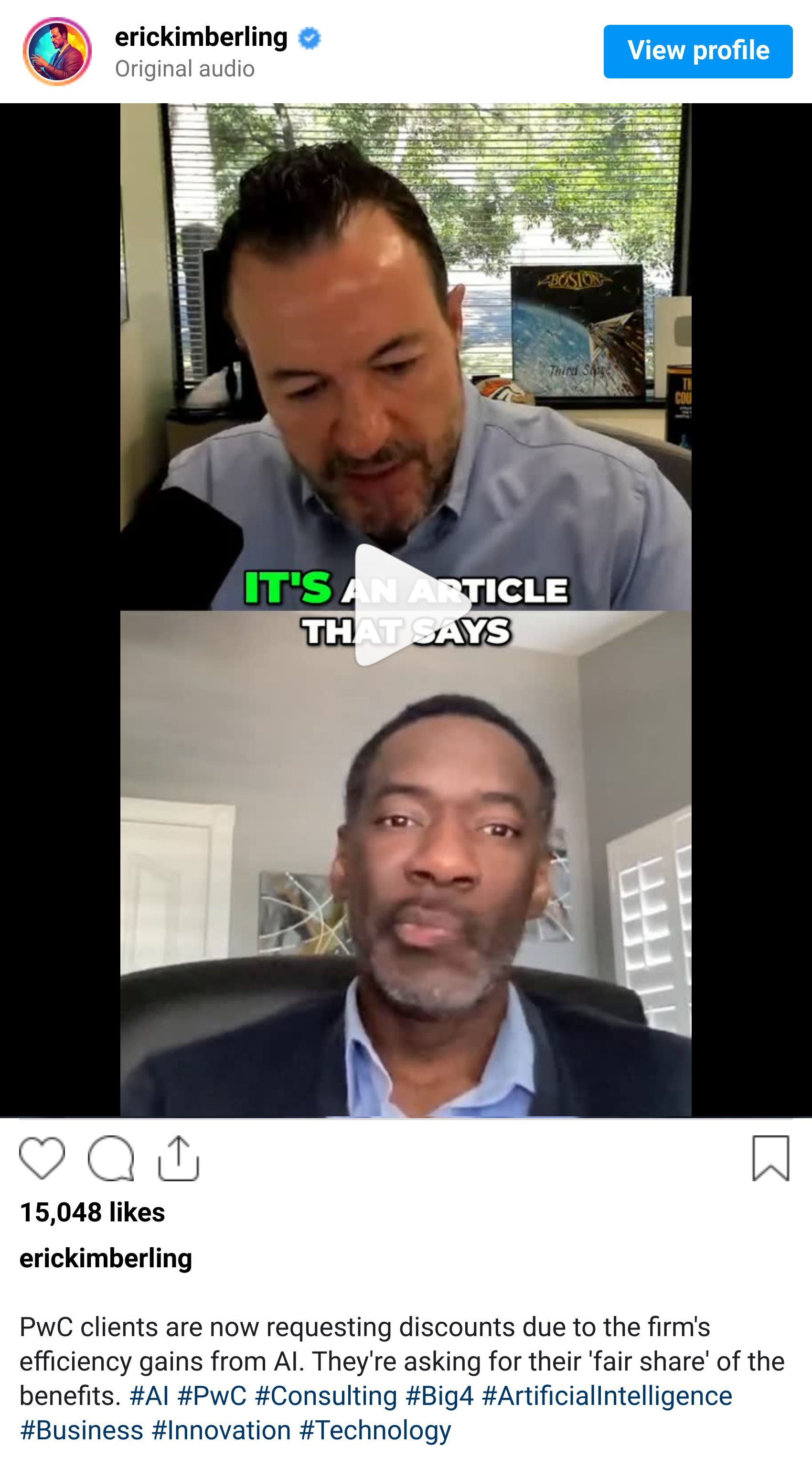

Damn right soldiers … get out and demand AI efficiencies are shared back into your fees on Big 4 engagements:

If you’re looking to sponsor CFO Secrets Newsletter, fill out this form, and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

If you enjoyed today’s content, don’t forget to subscribe.

You can help make sure this newsletter always stays free simply by spreading the word. And when you share CFO Secrets with your finance friends, you’ll earn rewards, including a 50-page PDF guide on what it takes to be a great CFO. Start sharing your unique referral code today: {{rp_refer_url}}

Let me know what you thought of today’s Mailbag. Just hit reply… I read every message.

In the most recent Boardroom Brief, we investigated the PE invasion into the accounting industry and how it’s disrupting things for the Big 4. Check it out now.

And on Saturday, I continued this month’s Playbook series on scaling the finance function from a team of generalist finance pros to a team of specialized sub-functions: reporting, FP&A, treasury, and more. Check out the newsletter here.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.