What would your employees do with an extra $1,200/yr coming into their paycheck?

And how about shaving 1.3% off company payroll?

Flex Health helps W2 employees max-out pre-tax IRS deductions, all while keeping their current coverage - thanks to new preventative-health policies passed by Congress.

Save $600/employee annually, without coming out of pocket (or adding work to HR’s plate).

We’ve got some great topics today. Here’s what’s on tap:

Calculating “Squad ROI” — yes, it’s a thing

Rebuilding a finance team in turnaround

The game plan for raising capital as CFO

Now, let’s get into it.

Eli Martorana from Nashville, TN asked:

In an established business, how do you approach calculating Squad ROI when multiple teams are simultaneously maintaining and optimizing existing revenue streams?

Eli, I can’t believe I haven’t heard the term “Squad ROI” before. I’m stealing it. Love it.

But the challenge of attributing revenue to different operating units has been around since Luca Pacioli passed the first journal entry.

Let’s start with what doesn’t work… anything overly clever or complicated in trying to apportion revenue and costs across multiple squads. I’ve seen it so many times before. A complex apportionment spreadsheet built in finance that no-one understand (or engages with) except the ‘genius’ that built it.

Metrics at this level need to have a clear, direct causality between input and output. Especially for sales or ops, where people need to see the link between their actions and results. If it feels fuzzy, it won’t drive behavior.

So ask yourself: at what level can you actually attribute revenue? If it's not working at the current level, maybe you need to zoom in or out. Maybe your current definition of “squad” is the wrong unit of analysis.

And here’s the kicker. If these questions are hard to answer, it’s often a sign of unclear accountabilities. That’s not a metrics problem. It’s an org design problem. If you can't directly link revenue to parts of the org, how do you know who's pulling their weight?

And if it’s not revenue, maybe you can attribute activities or outcomes. i.e., features shipped, upsells supported, incidents resolved, etc.

So the goal is simple, but not easy:

Define revenue reporting units that line up with squad responsibilities. Then measure ROI only where there’s a direct, defensible link between what the squad does and what the business earns.

If you can’t do that… the squad might be odd.

Thanks for the question, Eli, and the new word for my lexicon!

Sian from Los Angeles asked:

How would you rebuild a $500k finance org in a $12M turnaround business?

We’re a $12M growth equity business mid-turnaround — close to breakeven after a lot of cleanup. But Finance (excluding me, the CEO, who’s playing quasi-CFO) hasn’t raised to the level of the rest of the org: total department cost of $500k+ and just doing accounting (Controller, AP, AR) - not supporting any sort of FP&A or performance management (I do that).

We have a lot of “accounting debt” and low confidence in the current team’s output (there have been a number of issues I’ve caught). I want to rethink the org for better performance and lower cost. Options I’m considering:

Outsourced accounting + in-house analytical VP/Director of Finance

“Upgrade” Controller but re-bundle AP/AR more cheaply

Or something else entirely

What would you do here, and what does “great” Finance look like in a <$20M business?

P.S. I’m a former consultant who has experience with PE — decent financial instincts but not an accountant — and your blog has been a lifeline while wearing the CFO hat.

Sian, congrats on the turnaround progress so far.

At $500k, you’ve got a solid budget for a $12M business. So the problem isn’t money. The real red flag is the “accounting debt” and low confidence in output. That tells me your immediate priority isn’t FP&A. It’s fixing the Controllership. Because FP&A built on bad numbers is a waste of time.

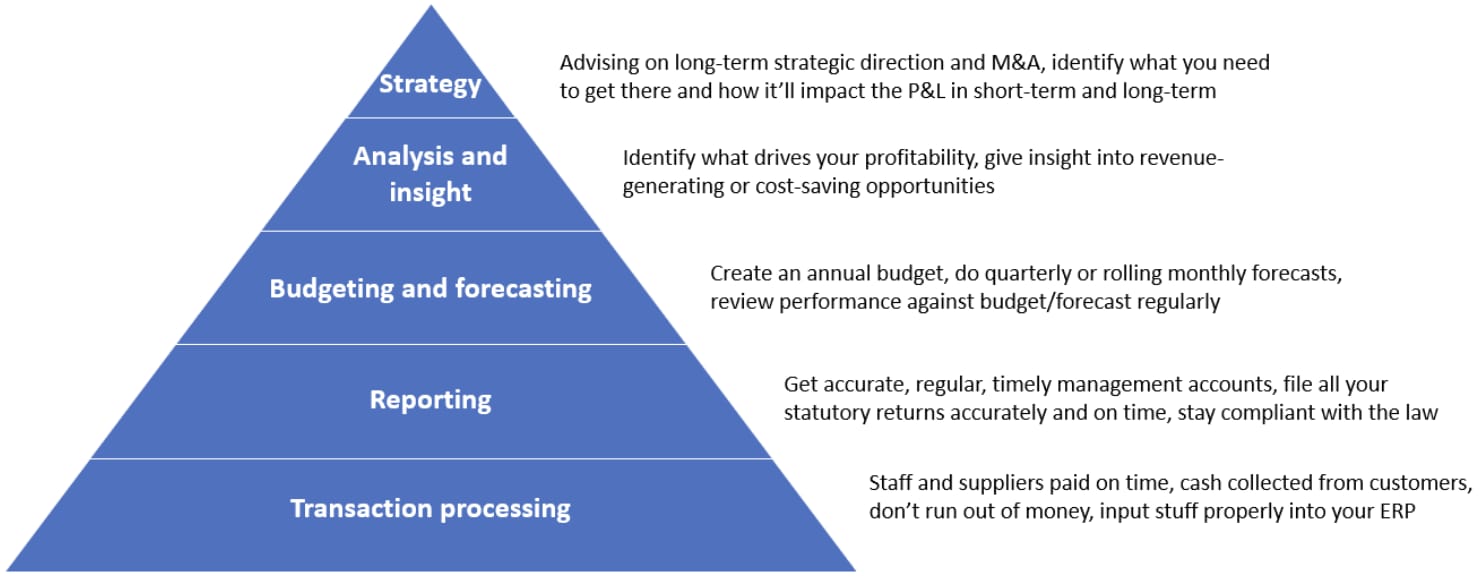

This reminds me of the finance pyramid my friend Andrew Lynch uses: a foundation of Controllership, then FP&A, then Strategic Finance.

I wrote more about this pyramid here.

Right now, you need to focus on the bottom two layers of that pyramid.

Here’s how I’d rebuild:

1. Skip outsourcing

At $12M, you’re past the point where outsourcing your core finance makes sense. Especially in a turnaround, where agility and depth matter. You need someone in the trenches.

2. Replace the Controller with a proper operator

You need someone with a track record of cleaning up finance messes, ideally in your sector. Someone who can build structure, simplify reporting, and automate wherever possible. Make sure they are hands-on and capable of managing offshore support for transactional tasks (AP/AR). Skip AI experiments for now. This needs to be simple and reliable.

3. Offshore transactional work

Leverage offshore for AP/AR and basic accounting tasks. That’s where you can get more horsepower for your $. This allows your Controller to focus on higher-value work without being bogged down.

4. Keep owning FP&A - for now

You’ve been doing it, and it sounds like it’s working. In a turnaround, the business should be finance-led, so it makes sense for you to stay close to the numbers. And your job gets easier as the quality of input data improves.

5. Hire a fractional CFO as your next upgrade

Once the foundation is stable, use any remaining budget to bring in a fractional CFO. Someone strong who can give you 1–2 days per week of high-quality input. Much better than 5 days of mediocrity. They can take FP&A off your plate and likely improve it. It’s scalable, too. When you grow and the budget allows, you can move to full-time.

In short: rebuild the base, stabilize the core, and scale support as the business earns it. That’s what “great” looks like at your size.

Good luck.

HighTower from London asked:

Just a quick note to say how much I enjoy and value your insights. They’re consistently relevant to the challenges I face in my own work.

I’ve recently stepped into a contract assignment as CFO for a European energy infrastructure business. One of the key objectives is to secure a third-party equity partner to invest alongside the current shareholders.

I’d welcome your thoughts on how best to approach getting a deal done within that time frame—what’s worked for you in similar situations, and what pitfalls to avoid?

Thanks in advance, really appreciate any steer you’re able to give.

Thanks for the question, Hightower.

This is a timely question, as I’ll be starting a new series on capital structure design this Saturday.

There’s a lot to unpack here, but let me give you the key principles.

First, get forensic on the need for capital. Is this equity raise essential for survival, or is it growth fuel? What does the business look like with and without the investment? You need to understand and clearly articulate the delta that the investment delivers. That’s the core of the pitch.

For infrastructure, I assume you’re pitching a classic J-curve: cash out now, returns later… probably much later.

Get precise about time to cash generation, predictability of cash flows, downside protection, and asset security. This helps you match the risk and return profile to the right type of investor.

Also, ask yourself, are you sure it should be equity? Infrastructure loves debt. Hard assets, clear collateral, predictable cash. Is equity the best source of capital here, or just the easiest narrative? Make sure you’ve considered other options like mezz, preferred, or asset-backed facilities before defaulting to equity.

Before you run into the market, make sure your house is aligned on the deal structure. Will this be minority equity or co-control? Are you open to board observers, veto rights, or exit preferences? Are waterfalls going to be pari-passu or stacked?

If your CEO or founders are allergic to giving up a single board vote, it’s best to find that out now, not after you’ve spent six weeks courting infrastructure funds.

Once you’ve locked the proposition, the next step is matching. Finding the right investor. An equity investor is for life, not just for Christmas. So choose wisely.

And if you want decent terms, avoid going exclusive too early. Fish in the right ponds to increase your odds of creating competition. That’s what protects you from being re-traded at the last minute.

Best of luck, Hightower.

A few of the biggest stories that every CFO is paying close attention to. This is the section you might not want to see your name in.

God forbid the Big 4 have a little fun… A snitch whistleblower claims EY “knowingly permitted the Firm to provide audit and other professional services to companies, particularly in the gaming, casino, and hospitality sectors, that were controlled by or closely connected to organized crime syndicates and other criminal groups and activity.”

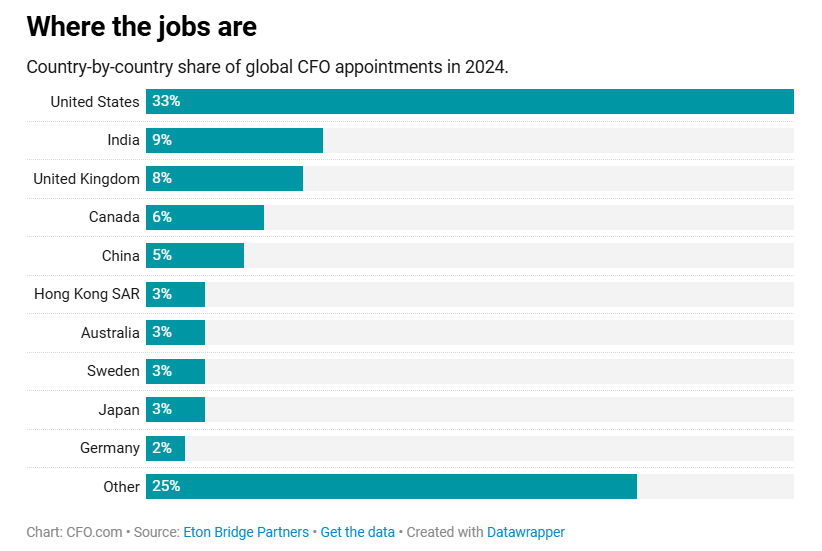

This stat surprised and delighted me in equal measure. It is a great testament to the quality of emerging finance talent that 6 in 10 CFO roles are filled with internal moves. I wonder how many read CFO Secrets 💭

Some other stats from the survey that stood out to me:

The average age of US CFO appointees was 51 in 2024… not that HR allows us to think about age

29% of the CFOs hired in the US in 2024 took on the title for the first time

ICYMI, here are some of my favorite finance/business social media posts from this week. In the words of Kendall Roy, “all bangers, all the time.”:

Weird, I don’t see “Moving logos around on PowerPoint slides”…

If you’re looking to sponsor CFO Secrets Newsletter, fill out this form, and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

If you enjoyed today’s content, don’t forget to subscribe.

Let me know what you thought of today’s Mailbag. Just hit reply… I read every message.

On Saturday, we discussed what happens when data gets weaponized in the AI age. Is it the end of finance? Or do we just have to play a smarter strategy? (Spoiler: it’s strategy.)

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.