Stop wasting your time with generic AI advice

Introducing Finance Forward – the first-ever AI Summit designed for modern finance and accounting teams.

This isn’t your typical conference. We’re gathering the sharpest minds for a day of tactical sessions, real-world insights, and actionable strategies to help you thrive in the AI era.

Join us this Fall in San Francisco and connect with a community that’s building for what’s next in finance.

Sign up here for updates.

When Data Gets Weaponized

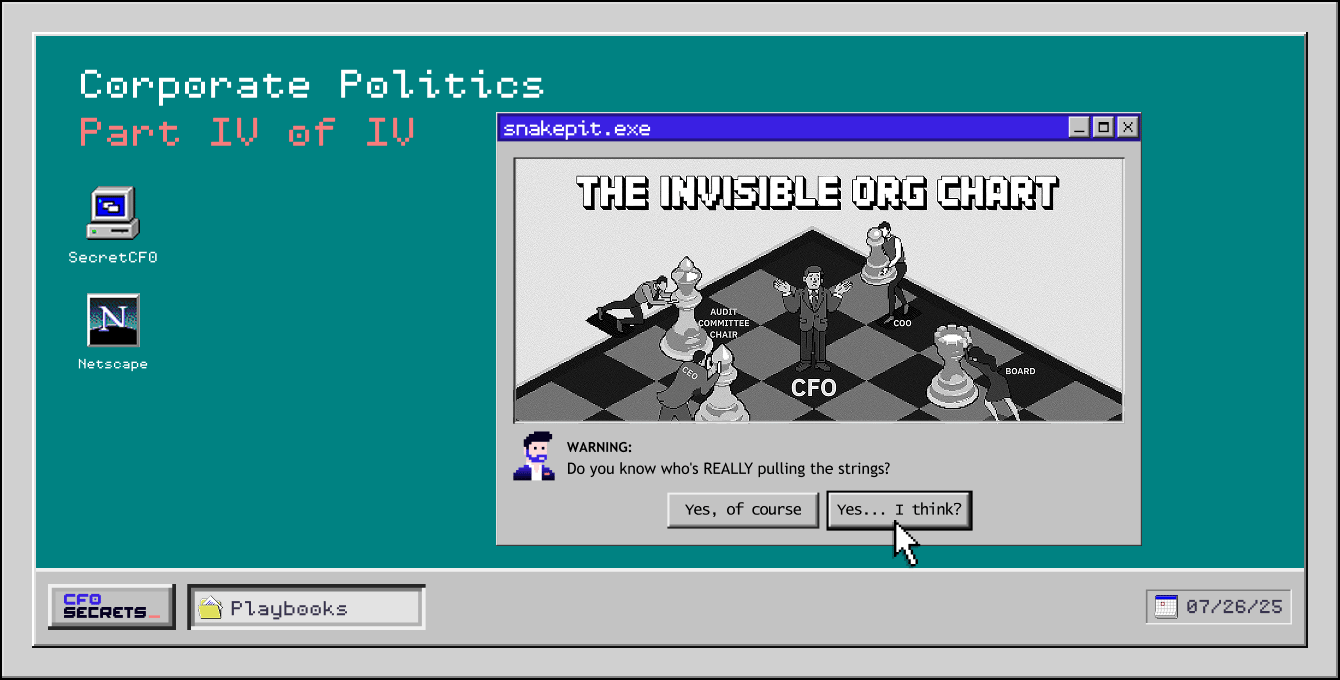

Welcome to the final part of this four-part series on boardroom politics and the invisible organization chart:

In week one, we defined the different political archetypes you’ll find in your business.

In week two, we broke down the invisible org chart and the less obvious hands of power.

Last week, we examined how to conduct yourself through those big transformational moments, like a CEO change or new ownership.

And to wrap this series up, we are going to take a glimpse into the future and talk about the next big battleground in corporate politics: the war for data ownership.

Now, I can already hear you thinking: "Come on, Secret, departments scrapping over data ownership is hardly breaking news…"

That's certainly true. I remember back when I was just a Secret FP&A analyst 🐣. I had to work closely with a planning team who were masters of hoarding data. This team was headed by a lady named Ruth, a terrifying, intimidating character. The whole business was scared of her, even the execs a rung or two above her.

I thought business partnering with the planning team sounded cool, so I wondered why the other analysts didn't want the gig. Within a week, it was clear why.

She was rude, unpleasant, but most of all… not very good at her job. And yes, here I am 20 years later, calling her out in front of 52,000 people.

OK, yes, her real name isn't Ruth, so I'm not that brave…

Anyway… Ruth's MO was to hoard the source data for the business like a greedy little truffle pig. Her team, which was supposed to be responsible for operational planning for part of the business, had somehow gotten primary control of a large chunk of the operational data for the whole business.

And if anyone (like the product team, the actual operations team, or even a young, naive finance analyst) needed access to that data, she would horse trade it for leverage at every opportunity.

Her team was instructed that they were not to share anything directly with anyone unless it had gone through her first. She made herself a single critical choke point in the flow of data through the business.

With this data came a certain type of power.

So yes, it's certainly true that weaponizing data inside a business is nothing new.

So what is new then?

AI… of course.

The Great Exec Shake Up

I wrote recently about Amara's law phenomenon and how people tend to overestimate the impact of new technology in the short term.

Even era defining technology like AI.

We are definitely in that phase right now. With LinkedIn AI Finance gurus telling us that if we don't fire our whole finance team and vibe code our way to glory immediately, we're going to get bundled into a cannon by our robot overlords and fired into the sun before 2025 is done.

But the other side of Amara’s law is that we UNDERestimate the impact of new tech in the long run. I also believe this will be true.

If we think on a ten-year time horizon, I'm certain businesses will look very different. And I don't just mean departments that are 20%, 50%, 70%, or even 90% smaller than they are today. I mean, whole functions could be eliminated entirely.

The core functions of sales, operations, product, finance, HR, IT, procurement, etc., have been well established for decades. Entire ecosystems have evolved around these horizontal specialisms: education programs, consulting firms, recruitment agencies, software vendors, the works.

But over the next decade, those 'traditional' functional lines will be challenged. We'll see them get consolidated, merged, or just plain wiped out. And new functions will emerge: Chief Prompt Engineers, Algorithm Auditors, Robot Whisperers… god knows?!

When I spoke to Siqi Chen (founder of Runway) back in January, he even speculated whether the concept of a ‘Company’ would exist in the same way it does today once we are on the other side of AGI.

In short, there is a lot to play for. For functional leaders, the stakes couldn’t be higher.

And where will the power lie? It will lie with those who control the data. Data is oil for AI… and at a micro level, those who understand and control it inside organizations will be the ones who dictate the agenda inside businesses.

As folks start to figure that out at varying speeds over the next few years, the scrambling for control will start. And with it, will come some fairly painful corporate politics (+ associated bullsh*t).

What does this mean for the CFO?

The CFO’s relationship with data has changed a lot over the last 15 years.

For a couple of decades, finance was the default owner of business data.

The 1990s and 2000s were about cramming everything into ERP systems. Mostly financial and operational data, with finance naturally at the center. Yes, the data was sh*t… but it was centralized.

Then came the explosion in data (as more business became more digital), and the advent of SaaS software to help make that data useful. Or at least that was the goal.

Over the last 15 years, business data has been unbundled across specialized platforms. Marketing, product, and customer teams now sit on mountains of their own data. Especially in internet-based businesses, tracking real-time usage and analytics.

So the CFO no longer has default control over the data domain as they once did.

And now the pendulum is swinging back. Businesses need a single source of truth, a master data hub that unifies financial and non-financial metrics. To ensure that AI has the richest source of oil to feed on.

The question is where and how that happens?

The LinkedIn finance ‘experts’ will tell you that that is finance. That CFO stands for “Chief Future Officer.”

But they are saying that because it’s what you want to hear.

The truth is that the future custodian of data in a business will be whichever function earns the right. That could be under finance. Or it could be under IT. Or a Chief Data Officer. Or any one of a number of possible futures.

Finance does have data credentials around governance, controls, and discipline. But it also has a history of treating financial data with more reverence and seniority than it does non-financial/operational data.

If finance wants to be the default owner of business data in the future, it’s got plenty to prove. Otherwise, there is a scenario in which finance becomes one of those functions that gets it’s wings clipped by AI. And gets stripped back to an even more back-office function. Back where it was in the last century, just with fewer people and more bots… And with all of the fun, strategic / insight led work performed in other functions.

Food for thought.

Don’t misunderstand me… I’m not saying the future for finance the finance mandate will be as bleak as this. Far from it.

Just that the role of finance in non-finance data is far from assured - and the stakes are high. And that complacency and apathy are the biggest risks.

How CFOs can win the data mandate

So, what can CFOs do to secure their role in enterprise-wide data in the future? And with it get more control over the org wide AI agenda.

Well… let’s be honest, finance isn’t walking into a vacuum here. In most businesses, data infrastructure lives under IT, data science reports into product, and governance is already fragmented.

But here are 7 practical steps CFOs can take:

1) Win through competence, not politics

I could suggest a bunch of shenanigans that will help. Political maneuvers to make it harder for other functions to own data, and easier for finance.

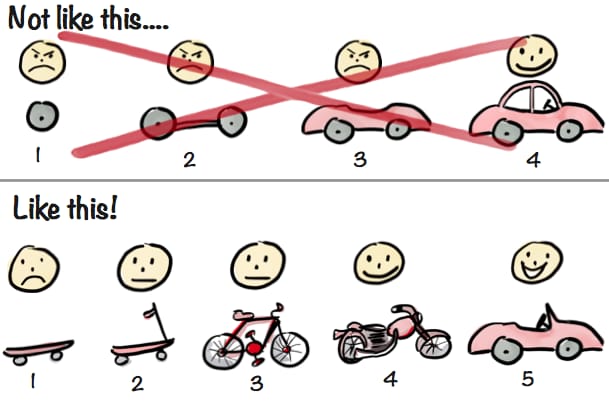

But that's the wrong approach… and you'll remember in part 1 of this series, the importance of being a 'put the business first' person.

And ultimately, I believe the politics around data will be irrelevant in the long run. The data (and therefore the power) will consolidate wherever it's best stewarded.

And finance needs to win its part of the argument on merit, not birthright.

2) Co-own data beyond the ERP

Your ERP is great at what it was built for: compliance, control, and being the financial system of record. But today's decision-making depends more on data that lives outside the ERP: product usage, sales funnels, shipping delays, churn curves, etc.

We've talked about data warehouses for a long time in finance: "Wouldn't it be great if everything were in one place?" Most businesses got partway there and gave up, or they continue to develop while new data emerges even faster than the existing data can be codified.

Well… now is the time to stop talking and deliver. A single, irrefutable source of truth for all business data… finance AND non-finance.

If that isn't happening in your business, take ownership and work more closely with your IT function to solve the problem. And if IT reports to you? The problem is already yours anyway.

Yes, unifying business data is technically hard. APIs, pipelines, and systems integration are not native finance territory. But CFOs and their teams can lend their skills. Not to become a full-stack engineer, but to architect the governance model and ensure that investments in data actually deliver decision-grade output.

Mentally promote yourself: from ERP guardian to joint architect of the full data stack.

3) Bring accounting quality governance to all data, not just finance

CAC, NPS, churn, on-time delivery, employee engagement… these aren't "soft" metrics. They are the operational truth of the business.

Most accounting and finance teams have such a hard time getting the numbers published at month end, the non-financials are an afterthought. Scrambling around to explain the KPIs in the two hours before the books are closed and the management accounts are published.

That isn’t good enough.

Unless you're happy to see finance sit in the back office for the rest of eternity, you'll have to find a way.

We need to get the same caliber of close, cut-off, reconciliation, and governance around every key data source in the business. We're good at it for financials. Now we have to apply that same mentality of positive assurance to non-financial data.

4) Create the KPI bible

I wrote about this in the recent series on performance reporting. The importance of having a documented ‘KPI bible’.

That means building and enforcing a single taxonomy for metrics across the business. Clear definitions, consistent methods, unquestionable source of the truth. I’ve seen a stunning amount of time wasted on unclear metric definition and data sources.

If your team owns that bible, and it’s a useful living document in the business, you are the de facto owner of the most important data in the business.

Embed it in planning cycles, board decks, product reviews, and investor updates.

5) Finance has to get real about data capability

We like to think we're good with data. Once, we were. But that was before “data” meant pipelines, version control, and LLM tuning. Back then, being good at Excel was enough. It isn’t now.

Today’s analytics layer is owned by product managers, data engineers, marketing ops leads, etc. The people running attribution models in real time and pushing code to production. Most finance teams are still buried in Tableau refresh issues and manual Excel reconciliations.

If finance wants to stay in the conversation, let alone lead it, we need to level up. That doesn’t mean turning your FP&A team into engineers. But it does mean hiring real data specialists into finance. Not to mirror what product or marketing teams are doing, but to embed analytical horsepower directly into the function. So we’re not just consuming insight. We’re creating it.

The big risk here? Pretending we can do this with the team we already have.

We can’t.

6) Drip feed output and value

The problem with high-impact, high-complexity projects, like centralizing non-financial data, is that they’re slow. Months can go by buried in systems architecture, governance frameworks, and data plumbing, with nothing tangible to show for it. And if the business doesn’t see real output, confidence erodes fast.

You can’t disappear into the weeds for 18 months and expect people to stay patient. You have to build the plane while flying it:

That means creating visible progress loops and delivering real value along the way.

The best way to do this? Pick a single, strategic corpus of data, something you can ingest quickly and use to stand up real reporting and analytics. Don’t chase breadth. Go deep on one area and get it right end-to-end.

Centralize it under your long-term architecture

Build useful dashboards or data products around it

Get feedback, iterate, show progress

Use it as a live proof-of-concept for how the full system will work

This pilot-first approach keeps the business engaged, accelerates learning, and helps everyone think with the end state in mind. It also disciplines your internal team. It reminds them that the goal isn’t just integration, it’s output. It’s usable insight. It’s better decisions.

And that should be visible at every milestone.

7) Lead the data ethics and governance mandate

It’s possible that finance won’t own all corners of business data, and that’s OK. But governance, control, and assurance? That’s our lane.

Let’s be honest: finance hasn’t always treated non-financial data with the same rigor as the P&L. We’ve underinvested in it, deprioritized it, and ceded influence to other functions. That needs to change.

But with automated decision-making comes regulatory scrutiny, model risk, and ethical accountability. Data lineage, explainability, and bias detection aren’t just technical concerns, they’re board-level issues.

Regardless of where the data stack sits, finance must lead on governance. That means setting the standard for accuracy, completeness, and auditability across the business.

If we don’t claim that lane, someone else will. Likely without our standards.

The Role of Insights

While we jostle for who controls the data, the real threat is subtler: finance risks losing its role as the voice of insight in the boardroom.

Data science, product analytics, and marketing ops are rapidly outpacing finance in analytical sophistication.

If finance doesn’t upskill, we won’t just lose ownership of the data, we’ll lose the mandate to explain what the data means.

And that would be bad for the finance profession and the scope of the CFO role…

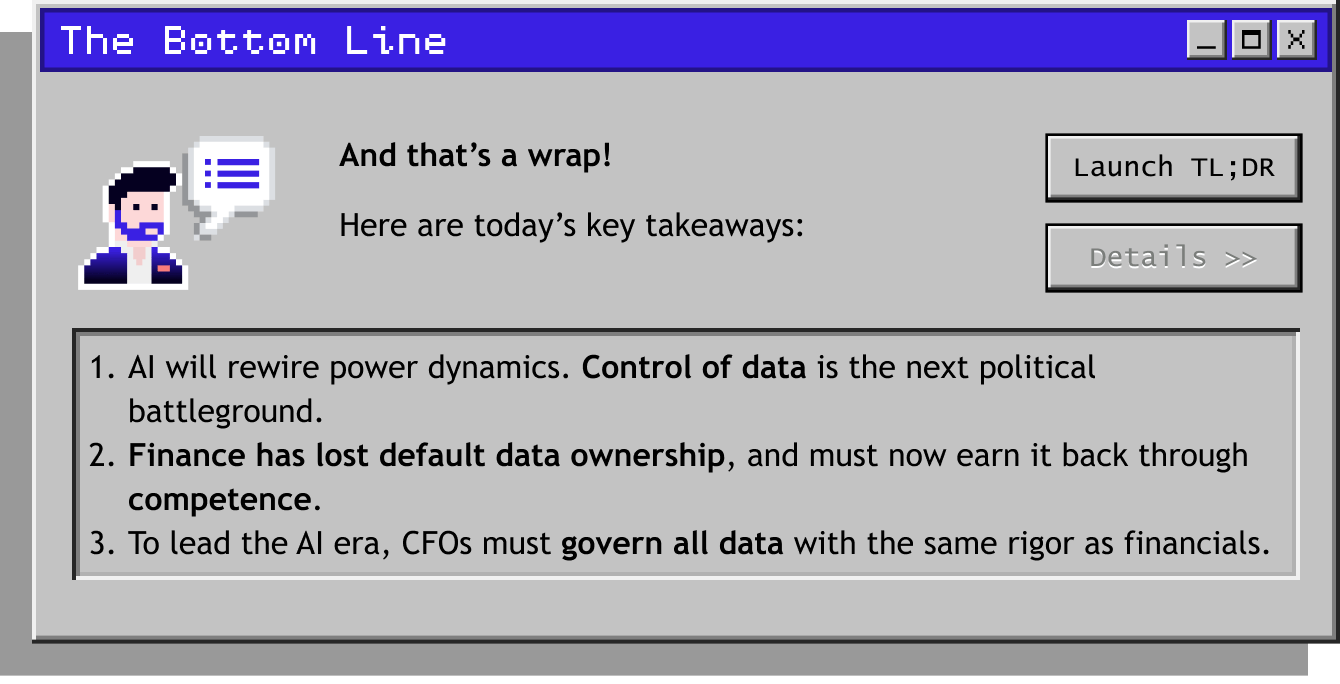

Net Net

A few years from now, someone in your business will be the undisputed owner of the centralized data stack. And that data stack will power automation and artificial intelligence throughout your business.

AI is going to redraw the corporate org chart in the years that come. And there will be a lot of jockeying for position (and politics) as that happens.

And it is on that happy note that we end this series on corporate politics and the invisible org chart.

In August, we are heading into a more technical area, as we breakdown funding and capital structures.

🚨 ANNOUNCEMENT 🚨

I’m looking for experienced CFOs and readers of this newsletter to join the Secret CFO Content Board. I’m working on some exciting new content formats. It’ll bring more voices into the conversation, and yours could be one of them.

To apply, complete this short form👇

If you’re looking to sponsor CFO Secrets Newsletter fill out this form and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

:::::::::::::::::::::::::::::::::::::::::::::::::::

:: Thank you to our sponsor ::

:: CAMPFIRE ::

:::::::::::::::::::::::::::::::::::::::::::::::::::

What did you think of this week’s edition?

If you enjoyed today’s content, don’t forget to subscribe.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.