The CFO role has changed. Legacy ERPs haven’t kept up.

Subscriptions change mid-term, cloud costs spike overnight, your close takes 15 days because you end up using spreadsheets.

Everest is built from the ground up to handle usage billing, contract modifications, consolidations, and be endlessly flexible to test changes in unlimited sandboxes that you can spin up with a click.

Answering your questions is one of the most fulfilling things I do. Hit me with your most challenging CFO issue, and you could be featured in next week’s Mailbag.

👉 Send me your questions by filling out this form.

Now, on to today’s Mailbag.

We’ve got some great topics. Here’s what’s on tap:

AI finance agents

Investing vs. Operating

Narrowing focus on the CFO job search

Now, let’s get into it.

Raquel from Barcelona, Spain asked:

Do you think AI agents will help CFOs and finance teams in the near future to do repetitive tasks?

Thanks for the question, Raquel.

The short answer: yes, they already are. And it’s only the beginning.

RPA (robotic process automation) tools have been automating repetitive finance tasks for more than a decade. I implemented them in a shared service center nearly ten years ago. What AI changes is that we can now create agents that can reason, not just follow scripts. They can take instructions, interpret context, and make decisions within boundaries.

You can already build your own using tools like Make or n8n, and the major LLMs are rolling out native agent features. A number of finance software vendors are doing the same.

The real question isn’t can they do it, it’s how well. How reliable are they? What is the hallucination rate? How much oversight do they need before the benefit erodes? How much maintenance do they require? Those are the open questions.

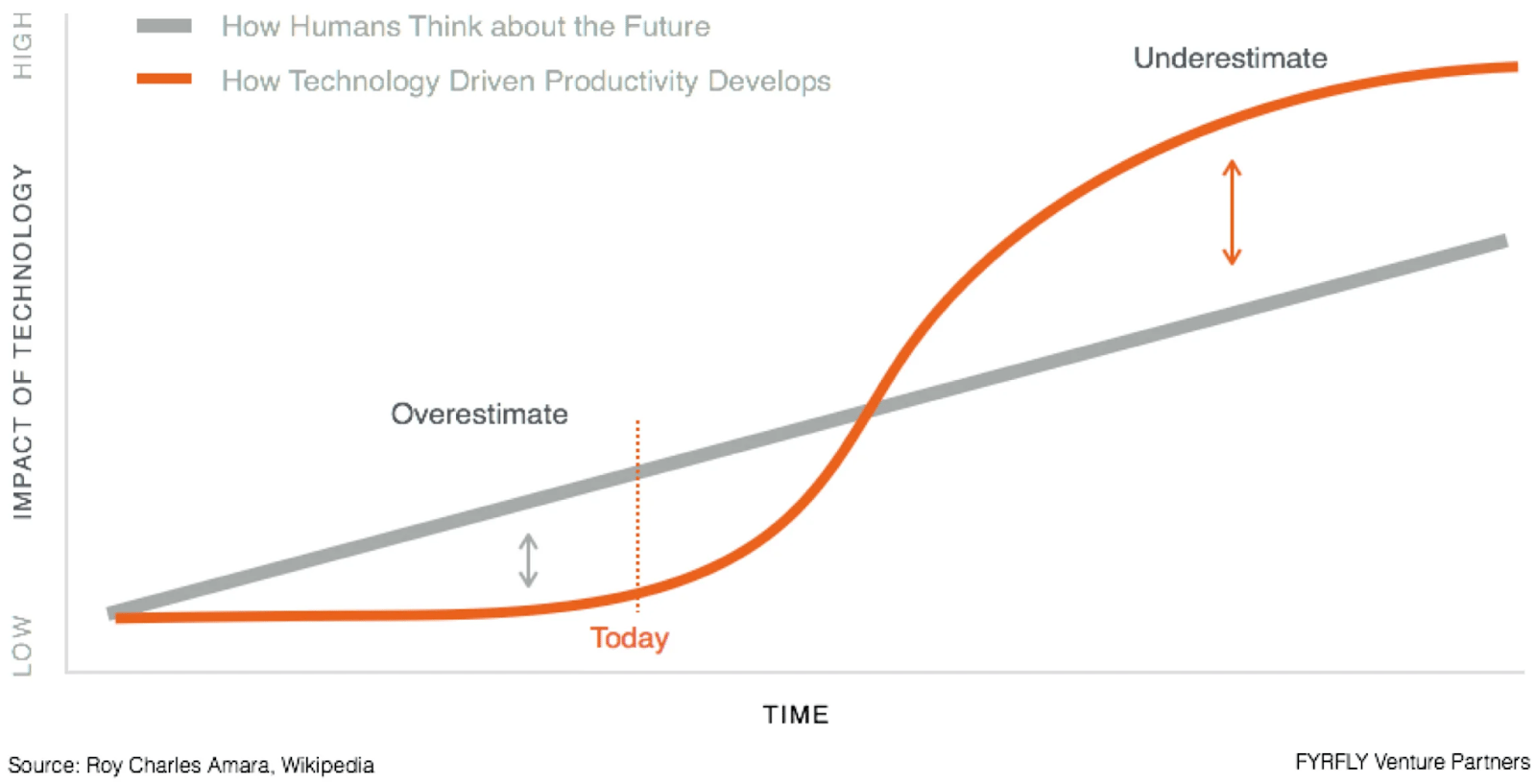

We’re still very early in this journey. AI is an exponential technology curve. Progress feels slow, then sudden. It’s hard to predict where we’ll be in 1, 5, or 10 years.

I remember when Napster came out, and everyone predicted CDs would be dead within 12 months. They weren’t. But they did die out steadily over the 15 years that followed.

There’s a lot of noise right now. You’ll hear people say “AI has already changed finance,” and that anyone not fully on board is already obsolete. That’s nonsense. The smart people are leaning in, but with curiosity and caution.

The way I think about it follows Amara’s Law: we overestimate the impact of new technologies in the short term, and underestimate them in the long term.

I loved how Andrej Karpathy (co-founder of OpenAI) put it recently. People are calling 2025 “the year of the agents,” but he called it “the decade of the agents.” That’s the right framing.

There are still big challenges: data security, integration, reliability, and governance. They’ll get solved, but slowly.

There’s no doubt we’re heading toward a different future. The timeline is just unclear. The key is to stay curious, experiment, and learn, without losing focus on the core fundamentals of running your business.

And a final thought: the world feels deeply unstable right now. Interest rates, geopolitics, supply chains. There are plenty of things to keep CFOs awake at night beyond AI. The key is to lean in and experiment, but don’t become obsessed. Keep it all in context.

TLDR: AI agents will absolutely reshape finance. Just not overnight.

Jack Aubrey from New York, USA asked:

I’m currently in a private credit investment role lending to PE-backed companies, but considering making the leap to acquiring and operating a business, I think I’m ready for the entrepreneurial path. My question is this: What should I be ready for from the finance / CFO side that I wouldn’t consider on the credit investing side?

Great question, Jack.

I have a deep respect for private credit pros. I’ve had to drink from that (expensive) well more than once. Some of the smartest people I’ve worked with have come from that world.

And in a way, that’s your challenge if you decide to cross over.

In private credit, you’re surrounded by very smart people solving complex problems that ultimately boil down to math and deal structure. You assume rational actors. Everyone around the table has read the same finance textbooks and speaks the same language of risk and return.

Operating a business is very different. On paper, the problems look simpler. The hard part is making them happen.

Let’s say you buy a $10m revenue metal-bashing business. You stack it with debt, build a clean model, and map out a value-creation plan with $500k of annual margin improvement.

It all works beautifully until you realize every penny of that $500k depends on Alan, your factory manager, making it happen on the ground. And your ability to meet your first debt repayment depends on it happening fast. And that debt probably has your personal guarantee on it.

Alan has been doing the job for 25 years. There aren’t many Alans around. He might not like your new plan, or maybe he’s already tried it and knows something you don’t. Or maybe he’s coasting toward retirement and doesn’t want the aggravation of new ideas. His team has seen this movie before. “Savings” usually mean less overtime and a few redundancies.

That’s the shift. In credit, the logic sits safely in a spreadsheet. In operations, it has to survive contact with reality, full of human friction, half-broken systems, and finite cash.

In small-company acquisitions, that’s amplified. The talent is more variable, the budgets are smaller, and the leadership leverage is personal, not institutional.

I’m not saying don’t do it. Just go in with your eyes open. It will be far harder than you think, and far more fun if you get it right.

TLDR: Institutional investing is rational. Operating is messy. One is cerebral, the other is hand-to-hand combat.

97Gopher from Northbrook, IL asked:

I've had a very non-linear career path, started as an investor (12 years), then moved into a finance role at a startup, then Corporate Business Development / M&A, and have been a part of many asset & company acquisitions & integrations at two publicly traded companies - one turned into a role with P&L and strategic responsibility for a large business unit. Later took on the CFO role of a publicly traded company and loved the job & excelled at it - for company-specific issues, after two years I was promoted to CEO, where I stayed for an additional 3 years.

Now, after some time off, I've concluded that what I liked the most and where I think I can add the most value is as CFO. Finding it difficult to convince recruiters and sitting CEO's to take me as a serious candidate - any advice?

Thanks for the question, Gopher.

First off, congratulations on a seriously impressive and varied career. You’ve held the two hardest jobs in business, CFO and CEO, and done both at a public company. That’s rarefied air.

It actually surprises me that you are struggling to get traction. Five years in board seats across CFO and CEO roles should make you a serious contender. But I do think there are a few dynamics at play.

For all the talk of boards wanting more strategic CFOs, the pendulum has quietly swung back. The current macro environment has created a flight to safety. A Korn Ferry survey last year showed a sharp rise in CFO appointments coming from CPA or controllership backgrounds. Boards and CEOs are once again valuing control, compliance, and predictability. Read more: The Path to CFO

That means your profile - strategic, commercial, and proven in the top job - is exactly what businesses need, but not always what they think they need.

The mistake many senior executives make in your position is casting the net too wide. At your level, the open market is inefficient. You will get lost in the noise of recruiters sifting through hundreds of similar applications.

Instead, narrow your focus. What is your lane? Where do you have credibility, pattern recognition, and a network? If you have an industry specialism, start there. You will also have built relationships with CEOs, Chairs, and Audit Committee members over the years. Those are your advocates. Use them. A warm introduction from someone trusted in your target space will get you infinitely further than any cold process.

And be deliberate. Define your “category of one” CFO role - the intersection of what you are exceptional at and what the market actually needs right now. Write that narrative clearly, both in your materials and in how you talk about yourself.

Casting your net everywhere is tempting, but the best fishers know which pond they’re built for.

I covered this idea again here just this last weekend: How to Get Hired and Fired — The Private Equity CFO IV

TLDR: Sounds like you need to niche down and do a better job of activating your network.

A few of the biggest stories that every CFO is paying close attention to. This is the section you might not want to see your name in.

There are maybe only a handful of companies that would be more fun/challenging to sit on the board of in 2025. Walmart CFO John David Rainey, and his impressive CV (PayPal, United Airlines), will join the board of Microsoft.

Settlement incoming for Deloitte: $6.3M in a class action suit, with the specific caveat that “Deloitte denies all liability and wrongdoing.” Those affected by identity theft can claim up to $5k. All told, the bill is a drop in the bucket…

McKinsey is pushing for a unified metrics approach for CMOs and CFOs… meaning, of course, AI tools to tie marketing closer to financial performance.

Measurement and attribution has been a challenge as old as time for both finance and marketing teams alike. McKinsey aren’t wrong with this statement, but as ever it seems quiet on how to actually execute this in a business. If it were easy, we’d be doing it already.

ICYMI, here are some of my favorite finance/business social media posts from this week. In the words of Kendall Roy, “all bangers, all the time.”:

Wow, well… cheers, I guess?

Defamation? Or just a bit petty from BDO? You decide … I’ll keep my opinion to myself. I’d hate to get a letter from their lawyers …

If you’re looking to sponsor CFO Secrets Newsletter, fill out this form, and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

If you enjoyed today’s content, don’t forget to subscribe.

You can help make sure this newsletter always stays free simply by spreading the word. And when you share CFO Secrets with your finance friends, you’ll earn rewards, including a 50-page PDF guide on what it takes to be a great CFO. Start sharing your unique referral code today: {{rp_refer_url}}

Let me know what you thought of today’s Mailbag. Just hit reply… I read every message.

A new Boardroom Brief just dropped. We explored the good, the bad, and the ugly of ESG for CFOs. Read it here.

On Saturday, I wrapped my Playbook series on private equity CFOs with a look at how to get hired (and fired) as a PE CFO. Check out the newsletter here.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.