We're all talking about AI, but are you doing something about it?

Meet Finance Forward – the first AI Summit built for finance and accounting teams, hosted by Campfire. Get the knowledge, strategies, and community you need to thrive in the AI era.

Join peers in San Francisco this Fall for tactical sessions and actionable insights to drive greater efficiency in your org.

Sign up here to learn more.

Who Really Runs the Business?

Welcome to part 2 of this 4-part series on corporate politics.

Last week, we set the tone and explored the 8 political ‘faces’ you’ll find inside every business.

We also made the case that the CFO seat (and the rest of the C-Suite) isn’t above politics. If anything, it’s where the game gets nastier. Why?

The stakes are bigger. See: equity, bonuses, reputation.

The power is real. This isn’t Susan being passive-aggressive over you using her stapler. Boardroom proximity means decisions that actually move the needle.

The players are sharper. Chairs, CEOs, COOs, etc., don’t land those roles by accident. They know how to play. So you need to know how to play, too.

This week, we’re heading into the shadow corridors. Not the people on the org chart, the ones pulling the strings behind them.

But first, a story…

A few years ago, I sat in a monthly performance review. Dan, the divisional president, was under the spotlight. He was presenting yet another leadership restructure. It was his third in twelve months.

And it wasn’t just the restructures. Every month, Dan came with a new idea to shake things up. Normally, I’d support that. But this division was performing well. There was more to lose than gain. We had bigger problems elsewhere. Dan’s job was to stay steady, not keep reinventing.

I liked him. I’d known him for a long time. But something had changed. Over a beer, I asked what was going on.

Eventually, he told me. He’d started working with an executive coach. Monthly sessions. Every time, a new idea to implement. On paper, that sounds great. In reality, it was destabilizing.

Dan had become too enamored with his coach and wanted to impress him. To show he was an ‘action guy’. The coach was pushing him to make bold moves, and he was following. A few thousand people were being steered by Dan… but the strings were being pulled by someone who had never set foot in the business.

The Invisible Org Chart

The org chart shows you the formal lines of power. Who signs off on the decisions. Whose neck is on the line. But it doesn’t tell you how those decisions actually get made.

If your boss is giving you grief about something, and it feels unreasonable, they’re probably not doing it for fun. More likely, there’s something, or someone, you can’t see who’s driving them. Understanding those influences and what they might be saying is crucial.

Invisible power is everywhere in film and TV.

Keyser Soze in The Usual Suspects appeared to be a physically weak minor player in a criminal gang. In reality, he ran the whole operation. Gus Fring in Breaking Bad played the part of a friendly chicken shop owner. In truth, he controlled the region’s crystal meth empire. Or The Wizard of Oz… all smoke and noise. Behind the curtain [SPOILER ALERT], just a guy with good tech and even better PR.

Even Logan Roy (Succession) and Bobby Axelrod (Billions). Despite all their wealth and status, much of their decision-making is shaped by the investors behind them.

And this plays out in real life, too. Just look at how the CEOs of the world’s biggest companies have been public in their support for the new administration over the last six months:

It’s easy to spot invisible influence elsewhere, but we rarely apply the same lens to our own world. We project more power onto those around us than they really have.

But the truth is, if Sandra is busting your balls, chances are someone’s doing the same to her.

So if you want to understand how decisions really get made, start by understanding who’s influencing the people who appear to be in charge.

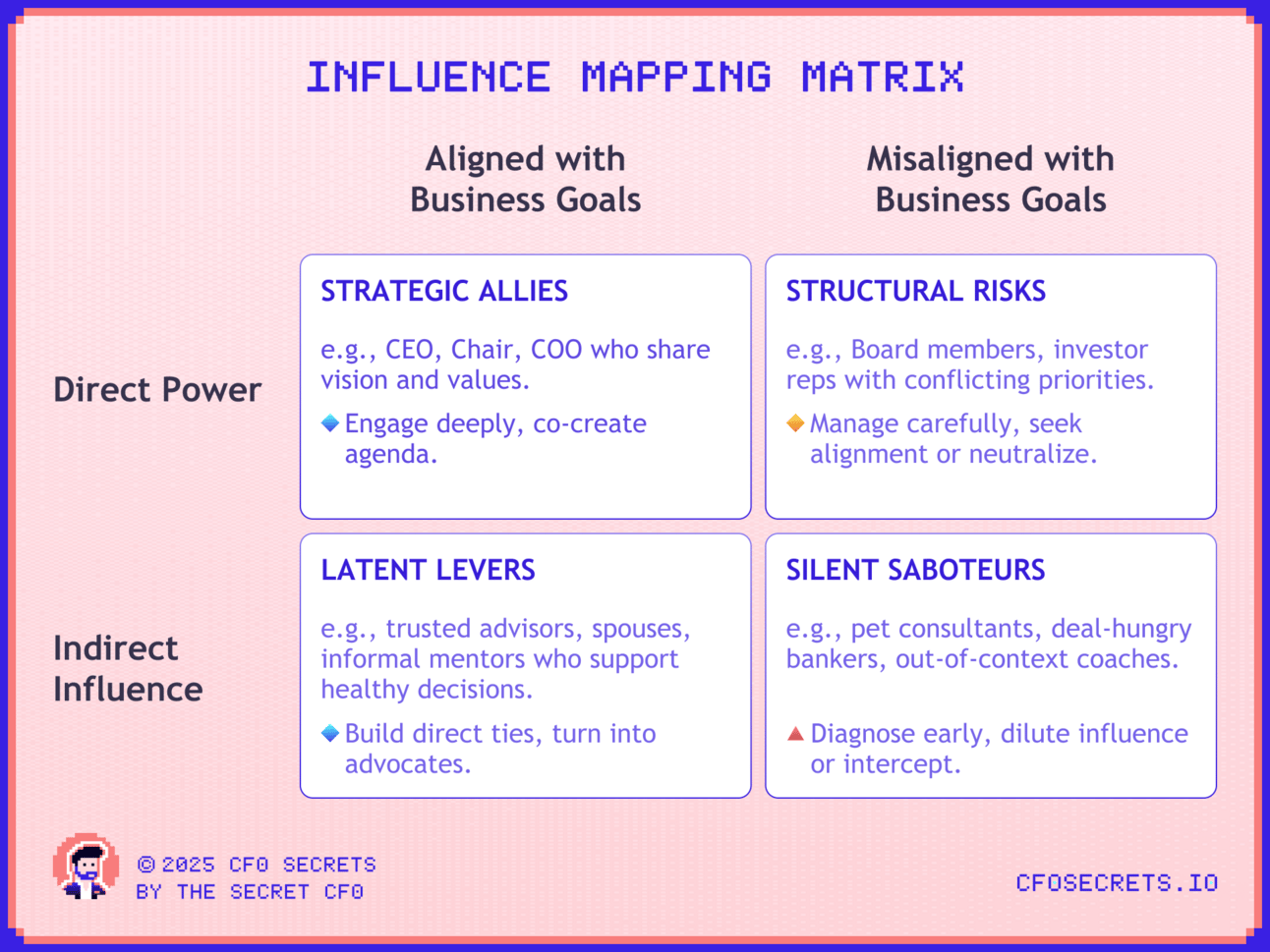

Boardroom Influence Map

Below summarizes how you should think about and interact with the different types of influences in the board room.

Let’s break these forces down in more depth.

Start with Direct Power

The first step in identifying indirect power is mapping the people with direct power.

For a CFO, these are the ones who can reshape the business overnight. Usually:

The CEO

The Board, especially the Chair, the Audit Committee Chair, or the Investor Reps

The real exec power nodes. This varies by company, but examples could include the COO, Chief People Officer, or General Counsel

If someone can launch a reorg or get you (or other execs) fired, they hold power. Title doesn’t matter.

If you're in a PE-backed business and the CEO loves you, but the Investor Director / PE operating partner hates you, trust me, you’re f*cked. That’s power.

You can still see the direct lines here. You know the players. You just need to figure out which ones matter most. This is the “easy” part.

Then Dig Deeper For Indirect Power

Indirect power comes from people who don’t have formal authority but influence the ones who do.

Sometimes they’re obvious: investors, advisors, exec coaches, mentors, industry friends, former bosses.

Other times, they’re hidden in plain sight: long-time lieutenants, spouses, and even kids.

If I had a penny for every time Mrs. Secret CFO said to me, “I thought you had people working for you who were supposed to deal with this shit?”

Once you understand who’s shaping your stakeholders, you start to see motive. And once you see the motive, behavior becomes far more predictable.

If you listen closely, the clues are there. If your Audit Committee Chair quotes their EY partner friend in every board meeting, that’s not small talk. It’s a benchmark. They’re mentally measuring you against that view of what finance “should” look like.

Whether it’s helpful or harmful doesn’t matter. It will shape how they treat you. And it will carry more weight than it probably should.

Just remember, not all indirect influence is bad. In fact, often acts as a healthy challenge to executive groupthink. The key is to distinguish signal from noise. Hear it, acknowledge it, and then channel it toward better results for the business.

Sources of Indirect Influence

Let’s dive into what each type of indirect influence looks like and what they might be saying about the business, finance, or even you.

Investors: These people have a direct financial interest in the business. They want strong governance and even stronger returns.

Examples: PE partners, institutional shareholders, banks

Imagine your CEO grabbing a round of golf with the fund manager at one of your biggest investors: “The numbers in your quarterly earnings deck aren’t clear enough, I don’t know how you run the business with this. And where is the urgency on cash generation?” A few words of outside perspective from a trusted source like this could change your CEO’s perception of your function and its priorities quickly.

Insiders: Your fellow execs and board members would have made plenty of friends inside the business and the industry on their way up the ladder. After all, they were a rookie once, with a peer group. And those ties run deep. Even someone who barely made it past junior management can influence the CEO if they’ve known them long enough. These are the people trying to preserve their relevance.

Examples: trusted colleagues, pet advisors, long-time lieutenants

That middle manager in the sales team who’s known the board chair for 30 years could be whispering all kinds of ‘insights from the ground’ into their ear: “These guys aren’t like we were. They just don’t want to work hard. Finance has made it impossible for me to do my job.”

Talent Gatekeepers: These people trade on relationships and fees. They benefit when management changes.

Examples: exec search firms, board advisors

Rest assured, your board’s most trusted exec search firm will be on hand to remind them that their “management needs to grow with the business.” And that “I know you aren’t looking for anyone, but I did meet a COO who would be perfect for you if you changed your mind.”

Advisory: They want influence and follow-on work. They’ll go where they think the next engagement is most likely.

Examples: consultants, Big 4 partners

I once had a partner from Big 4 advisory desperate to land a finance transformation engagement in our business. It was never going to happen. But after I’d politely let him down a couple of times, he tried to go around me. He lobbied the CEO and the audit chair. When I found out, I told him to back off and reminded him that finance transformation was my job, not the CEO’s, not the audit chair's, and definitely not his.

Deal Junkies: These people earn when deals happen. Their job is to make leadership believe it’s the perfect time to transact, whether that’s raising money, selling a business, or buying a business. They’ll always try and convince you it’s the right time to do something.

Examples: investment bankers, M&A advisors

CEOs and boards love the attention of these folks, so expect frequent calls telling them ‘the market is hot right now’ and that you’d be the ‘perfect owner’ for some asset they can’t shift. This is kinda like the advisor problem above, but on steroids. CEOs, boards, etc., often like the idea of a deal more than they should, and it's usually because they are being prodded by the deal junkies.

Commercial: These partners are the lifeblood of the business. It’s easy for them to get the ears of the people that matter. They hold even more power if they double-dip as insiders (this happens a lot more than you think).

Examples: customers, suppliers

The key watch out here is on finance operations and working capital. Imagine the CEO to CEO conversation of your biggest customer relationship: “We could do so much more business with you, if only you could move our credit terms. We’ve tried talking to your finance team, but they don’t get it. We are ready to grow together.”

Developmental: Without context, even well-meaning advice can become misaligned.

Examples: exec coach, mentor, former colleagues, other board members

You heard earlier how influential coaches and mentors can be. I’ve seen this same phenomenon to explain uncharacteristic behavior in leaders more than once. So often, the answer from a mentor or exec coach is some variant of “sounds like you are trying to solve problems your team should be solving.” At the leadership level, the advice is almost always how to get more done through other people. Not a bad thing, but if that advice lacks context of the business, it might be unwelcome disruption.

Personal: Their influence is emotional and well-intentioned (usually). But it’s personal. They often don’t care the org itself (and nor should they)

Examples: spouse, kids, family, friends

I remember once, the CEO and I would take along trip out to visit an overseas business unit every month. Then one day he stopped and left me to it. A one-man roadshow. It changed the dynamic of the visits significantly. A few months later, he told me it was because his wife was sick of him traveling so much. These kinds of influences are everywhere and more impactful than people realize.

How to influence the invisible

Not all of these voices are wrong. Many of the quotes above are fair challenges. Others are out of context, misinformed, or just plain self-serving. But that’s not the point.

The point is: they’re influential. And they’re invisible. You don’t hear them spoken, but you feel their weight in the decisions.

Which means your job isn’t just to dismiss or absorb them. It’s to identify them and then figure out how you are able to influence those invisible voices.

And by doing that through the lens of a ‘grown-up’ (i.e., actively engaged in politics but only for the sake of putting the business first), you can get to better outcomes for the business.

So let’s dive into how you do that:

Map the direct power: Who has the authority to change your scope, your team, pursue an acquisition, engage a consultant, etc.? This is important because the direct power will be the mouthpiece for the invisible influence.

Understand their political face: Think back to last week. Which of the 8 political faces are you dealing with in your boardroom? A ‘grown-up’ is going to be more rational than a ‘shit-bag’.

Identify indirect power sources: Listen for cues on where influences might be coming from. Sometimes they are easy to spot. Like if you hear a CEO mention their ‘friend at Goldman Sachs’ a couple of times in quick succession, that’s an influence. Others will be harder to pick out. This takes skill, patience, and perception. But listen for long enough, and ask good, open questions:

“What’s driving your view on that?”

“Do you know where the board is leaning?”

“Feels like something has shifted — is there more to it?”

These questions can reveal the source of unseen pressure without triggering defensiveness.

Interact with the invisible influence through the person. At this point, you likely don’t have a direct line of communication with the invisible hand. So, reach them through the person you have a relationship with. Don’t (at this stage) undermine the influence, or get defensive. However ridiculous, unreasonable, or tenuous it might be. Listen to it, show empathy, even agree with it, and then say you’ll take it away and think about it. They are enthusiastic about their influence. You need to be, too.

Seek opportunities for direct contact. If you take one thing from this piece, make it this. If you can get your own direct relationship with their ‘invisible’ influence, that’s the most powerful way to build your own influence and negate theirs. That Big 4 partner will start lobbying you for work instead of whispering in your audit committee chair’s ears. The investors will start hearing your perspective on capital allocation. The investment banker will see that you have a plan to get the reporting IPO ready. You have to give yourself an opportunity to control the narrative.

Don’t force this process. Let it happen naturally. It takes time. You aren’t going to develop this influence overnight. But being deliberate and positive, you can grow both your direct and indirect influence. You need to know when to and when not to engage. Political influence work is exhausting. Especially at a board level. Make sure you give yourself space.

Used properly, these are powerful principles. So, I’ll remind you that with great power comes great responsibility. It’s important to use this and act in the best interest of the business.

Although this piece is about invisible influence and how to react, the CFO isn't just reacting to power. Far from it. You can become a power broker, too. When your voice is strong enough to drive board thinking, or when execs pre-clear decisions with you before taking them upward, you’ve become part of the influence machinery.

This is particularly effective with the rest of the execs, who may have less experience with the board than you and look to you for feedback or advice. This is a great way to build your own invisible influence and might help you run through the steps above a bit more effectively.

What to do when you are losing a political knife fight

Even if you do all the right things (put the business first, cultivate your influences, and engage properly), you still might find yourself on the wrong end of boardroom politics.

As I told in the opening anecdote last week, I’d been too slow to recognize a coalition that was building to remove myself and the CEO before we’d even gotten started. Fortunately, the CEO was not so slow and killed the coup. Boardroom politics like this are unpleasant, unsettling, and unhelpful.

So avoid at all costs… but if you end up looking down the barrel of a gun, maybe even (unfairly) fighting to keep your job, how do you handle yourself?

Stay calm. You can’t let your emotions get the better of you. Don’t lash out. But keep your guard up. It’s easy to do something you can’t take back. So every move needs to be deliberate and unemotional.

Double down on business value. Now is a great time to focus on outcomes, not process. So if you’ve got a big reporting project close to launch that will unlock value, get it over the line. Got some cashflow opportunities up your sleeve? Now’s the time to land it. Remind them why they hired you.

Rebuild privately. Identify some key voices who you can hold as advocates. Focus on the direct sources of power (the board and the exec), and the most important ones. Focus, in particular, on the person who has the most direct influence over whether you’ll be the CFO tomorrow (likely the CEO, but not necessarily). Communicate more often, deliver more value, and strengthen advocacy with the players that matter most.

Don’t confront the influence… yet. This is a tricky one. There are times when it makes sense to tackle the nonsense head-on. Other times it’s better to let it play out. If it’s an invisible hand that’s moved against you, it’s likely too late to confront head-on. They aren’t going to change their mind. So focus on the board and the exec(s). Build support before you confront the issue. But don’t be too slow. If there is a real coup at play, the knife might be in your back while you're still playing with chess pieces.

Decide if it’s reversible. Some political shifts can be reversed, and it is only experience and judgment that will tell you whether it can or not. In the meantime, it can do no harm to hedge your bets and warm up your recruitment contacts. When things go sour, it happens fast, so it’s better if you aren’t at a standing start.

We will focus on more ways you can protect yourself from visible and invisible threats next week.

Net Net

The invisible org chart is hard to read, and even harder to predict. But the closer you listen, the more you’ll learn. And the more you can make those ‘indirect influences’ your own contacts and influences… the more you can influence them.

One of the trickiest political events for a CFO to deal with is a change in CEO. More on that next week.

If you’re looking to sponsor CFO Secrets Newsletter fill out this form and we’ll be in touch.

Find amazing accounting talent in places like the Philippines and Latin America in partnership with OnlyExperts (20% off for CFO Secrets readers)

:::::::::::::::::::::::::::::::::::::::::::::::::::

:: Thank you to our sponsor ::

:: CAMPFIRE ::

:::::::::::::::::::::::::::::::::::::::::::::::::::

What did you think of this week’s edition?

If you enjoyed today’s content, don’t forget to subscribe.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.