Is your “AI strategy” just a chatbot? Or is it actually closing your books?

With Ledge, digital accountants (AI agents) prepare your close tasks automatically:

Pulling data from NetSuite and other systems

Rebuilding spreadsheets with live formulas

Preparing reconciliations

Drafting flux narratives

Proposing and posting journal entries

This isn’t a chatbot guessing. You describe the process once, and AI turns it into repeatable code that runs the same way every close.

Let me take you back to the story that started this series.

I’d just landed as CFO of a business that was burning cash - over $100m annually. It needed a root-and-branch reset. Sure, I had some tricks up my sleeve to extend the runway: bridge financing, asset sales, and inventory releases. But those were sugar hits. One-time, short-term benefits.

All they did was buy us time.

Within that window, we had to reprogram the business to think about and use cash in a fundamentally different way. You can’t turn an oil tanker on a dime. It takes surgical intervention, applied consistently. It has to be relentless.

We needed a new operating system. One where cashflow was no longer peripheral, but central to how we measured our operators, right alongside employee engagement and customer satisfaction.

The goal? To help the business implement and then internalize the principles I’ve shared in this series so far.

Welcome to the final part of this five-part Playbook series: Cashflow Mastery.

Part 1: Why cashflow is so much more volatile than profit

Part 2: Defining Maintainable Free Cashflow (MFCF) to create a dividing line for our two core cashflow systems

Part 3: Engaging the business to deliver operational cash, even in complex, decentralized organizations

Part 4: Mastering capital allocation by focusing on economic substance over accounting form

We have all the ingredients. But you, the chef, need the recipe to bake the cake. One that can be enjoyed by your Board, investors, and employees alike.

Today, we focus on the system of governance that brings it all together into a high-performance cashflow operating system.

Let’s go…

Cashflow Governance Cadence

I'll admit it. Cashflow. Governance. Cadence. Three words that could cure insomnia when said separately. But together?

They should make even the stoniest CFO's heart flutter.

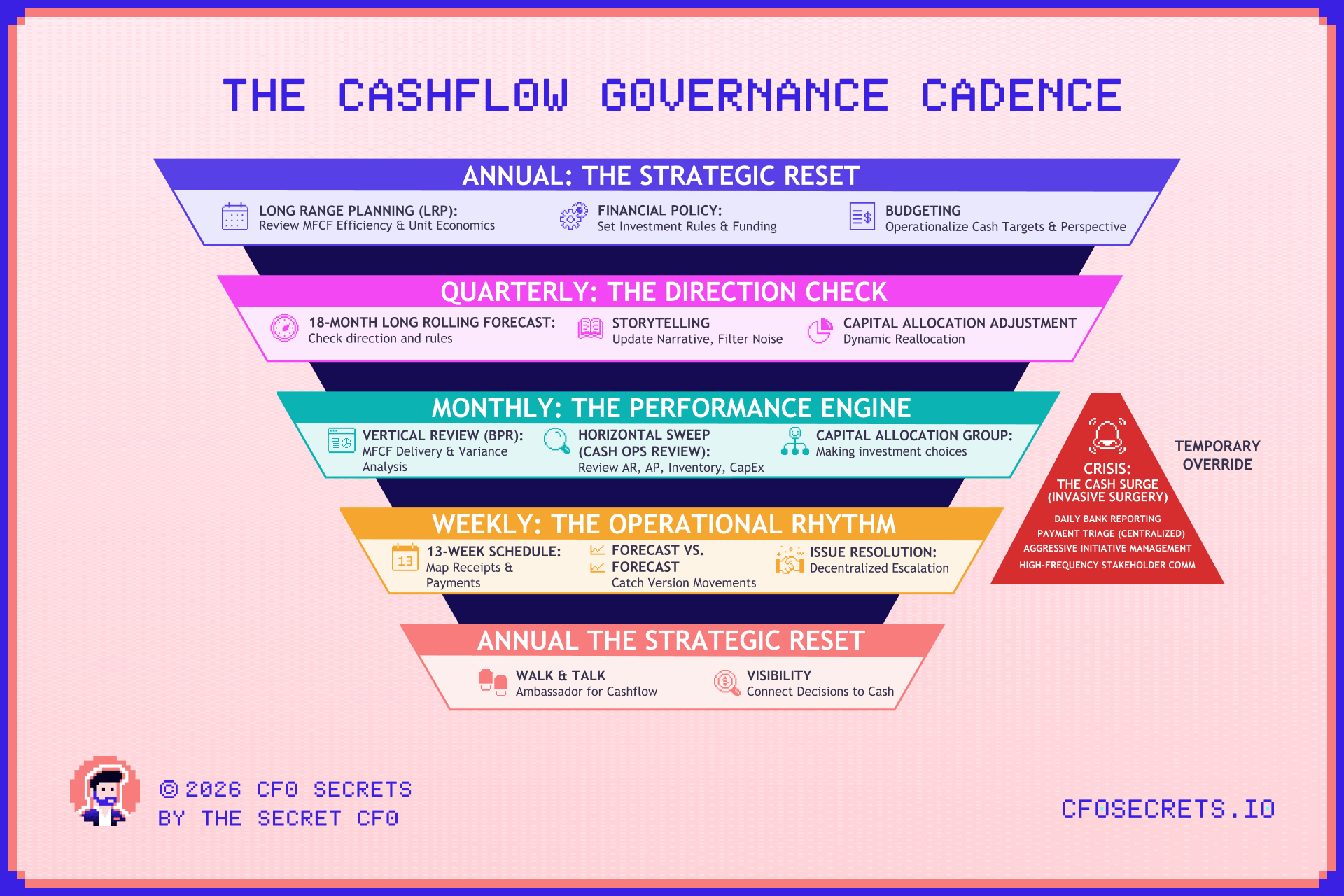

A high-performing governance system for cashflow is the rhythm of the machine. It’s about knowing exactly what to do annually, quarterly, monthly, weekly, and daily - moving from broad strategic calls down to the gritty daily rigor.

Today, we’ll map out the operating rhythm that keeps the "oil tanker" on course.

And because real life rarely follows a plan, we’ll also spend some time on what to do when those routines fail and how to change course in the middle of a cash panic.

Let’s start with the big picture, and then break down each component:

Annual: The Strategic Reset

The bedrock of the annual cycle is the Long Range Planning (LRP) process. This is the moment to verify the cashflow mechanics of the business, specifically, your MFCF Efficiency.

You need to know exactly how your business generates (or consumes) cash by each business unit or cashflow personality. Before you start dreaming about how to spend it. Here are some useful ratios:

MFCF / Revenue: The pure conversion rate

MFCF / Employee Count: Are you scaling efficiently or just adding "people drag"?

MFCF / SKU (or Complexity Unit): More complexity means more surface area for capital requirements

MFCF / EBITDA: The "Quality of Earnings" reality check

It is vital to understand, for every dollar of revenue generated, how that cash is converted into MFCF.

Map this against your Cashflow Personalities (from Part 3) to see how 3–5 year growth shifts will alter your total cashflow profile.

This analysis will dictate how much capital you actually have available to place the four types of bets we discussed last week.

However, the rules for those bets are more important than the pot size itself. In a volatile world, your capital allocation methodology must be dynamic. The pot size will fluctuate, but the hurdle rates and strategic logic should be resilient to that.

This all gets weighed against your funding capacity and investor expectations. These aren't questions you want to be answering every Tuesday. They are the bedrocks. This is why I "over-invest" in the annual process.

Once decided, codify it into a formal Financial Policy. This is your constitution: it dictates when you pay dividends, when you raise debt, and exactly how you greenlight investment. I’ve written more on that here.

Finally, we operationalize. Good FP&A hygiene will see the LRP principles cascade down into the budget.

Just make sure that happens for cashflow targets too, and gets locked all the way into individual performance metrics/OKRs.

Quarterly: The Direction Check

Managing MFCF is about wrestling a complex operation into conforming to a plan. But here’s the problem: reading real performance in cashflow is significantly harder than in the P&L.

Cashflow is a slave to timing. If a massive customer receipt lands one day after month-end, a standard variance analysis will tell you the sky is falling. It’s not. It’s just noise.

This is why I prefer to build the true narrative for cashflow performance quarterly. I’m not talking about the hand-to-hand combat of weekly management… don’t worry, we’ll get to that. But the macro narrative.

Reviewing quarterly allows you to step back, reduce the "timing chaos," and see the underlying health of the machine.

Your job in finance is to act as the translation force for the business. You absorb the volatility, scrub out the noise, and deliver a simple, stable message to the business, Board, and investors. The story should evolve, but it should rarely "whipsaw”

As that MFCF story stabilizes, your capital allocation can become dynamic.

Great capital allocation isn't about hitting a static budget; it’s about responding to reality. For example, if your fast payback investments are outperforming - say you planned for an LTV:CAC of 2.5, but you’re hitting 3.0 - it would be negligent not to overinvest. I call this a "pleasurable overspend."

A bit like when you find a superfood you actually enjoy (for me, it’s blueberries).

To manage this, you need an 18-month rolling forecast. Depending on your business, you might roll this monthly or quarterly, but it must be light-touch and driver-led. Your FP&A team should be plugged in enough to refresh this without a heavy "reforecasting exercise" that distracts the business.

This forecast ensures your decision-making isn’t handcuffed to a stale budget.

The quarterly rhythm is the perfect time to:

Refine the Story: What happened, what was the timing, and what was a real shift in performance?

Check the Rules: You shouldn’t change your capital allocation rules every quarter, but if the dynamics of the business have changed, now is the time to figure that out

Update the Stakeholders: It’s also the time to align the Board and investors, if the story hasn’t changed. Don’t be afraid to be boring if it has. Show them how, why, and what it means.

Monthly: The Performance Engine

This is where the magic happens, the point where the planning and good intentions of the annual and quarterly cycles meet the hard reality of the day-to-day.

To keep the engine running, you need to attack the month from two angles:

1. The Vertical Drill-Down (The BPR)

Your first job is to establish whether the business delivered its MFCF, and where. This means your Monthly Business Performance Reviews (BPRs) must drill into cash delivery alongside the rest of the balanced scorecard.

The Focus: Relentless accountability for Month-Prior and YTD cash delivery vs. plan

The Lens: Review through the "Cashflow Personalities" defined in Part 3 to confirm each unit is behaving as expected

2. The Horizontal Sweep (The Cash Operating Review)

Next, you must step back and look across the business. While BPRs are vertical, a Cash Operating Review is a horizontal sweep. You are reviewing cashflow performance by line item (below EBITDA): AR, AP, Inventory, Restructuring, CapEx, etc.

The "Mop Up": This is how you catch the "rogue" items that vertical reviews miss - like a stray AR balance sitting in a holding account or restructuring costs accounted for at the Group level

The Discipline: Bridge the Story

Use your management accounts to bridge the variance between actuals and your plan. If you are telling the story quarterly, you must be building that narrative monthly. This granularity is how you earn the right to tell the macro story later.

Anchor yourself to the discipline of writing a simple, monthly note to explain the cashflow picture for the period. Take MFCF delivery for the month (and year-to-date) and total cashflow. Explain what happened versus plan; isolate what is timing, from what is real. What is one-time, from what is recurring. Send it to the Board. I have done this for multi-billion dollar companies and startups alike; and always sit and write it myself. It is the ultimate forcing mechanism to ensure you never miss what’s important in cashflow.

The Capital Allocation Group (not a "CapEx Committee")

Finally, convene your Capital Committee monthly. Most businesses have a "CapEx Committee," but miss other forms of capital commitment. That makes the mistake of organizing management discipline around accounting definitions rather than economic behavior.

When the alternative to a new piece of equipment (CapEx) might be a massive paid ads campaign (OpEx), an R&D sprint, or a dividend, you need those alternatives in the same room. Elevating these conversations into a single forum with comparable disciplines is how you truly put economic substance ahead of accounting form. This is where projects are greenlit, pivoted, or shelved.

Weekly: The Performance Engine

The weekly ritual for cashflow is where the "hand-to-hand combat" happens. The level of detail you dive into as CFO will depend on the size and complexity of the business, but the tool remains the same: the trusty 13-Week Cashflow Forecast.

The purpose of the 13-week forecast is widely misunderstood. It is not a planning tool; it is a scheduling tool. Most of the decisions affecting the next 13 weeks have already been made. The sales are booked, the payment terms are signed, and the purchases are committed. You aren't "predicting" the future as much as you are "mapping" it.

The real power of the 13-week forecast lies in:

Feeling the "Texture": Understanding the lumpy nature of your receipts and disbursements. Particularly, how timing shifts affect your liquidity

Early Warning: Spotting a cliff-edge before you're feet from reaching it

Scheduling: Moving the "blocks" of payments to match the "blocks" of receipts as needed

The Discipline of the Version Review

The forecast should be prepared every week without fail, immediately after the week closes. But here is the secret: don't just review Actual vs. Forecast. You must review Forecast vs. Forecast. Comparing this week’s view of "Week 8" against last week’s view of "Week 8" tells you exactly what has shifted.

It’s also the only way to catch the "handover" errors that plague cash scheduling.

When one week’s forecast is consumed into the actuals, small timing swings are dangerous. If a major receipt was expected Friday (last week’s forecast) but doesn't hit until Monday (this week’s forecast), there is a high risk of it being missed in the actuals cutoff or double-counted in the new forecast.

Reviewing the versions side-by-side on a disciplined weekly routine ensures that every dollar that moves "right" on the timeline is still accounted for. It’s the only way to ensure your closing balance doesn't hide a hole or create an imaginary windfall.

I’ve been in enough situations where those kind of errors could have been fatal to know its a good thing to be obsessive about.

Decentralized Escalation

Finally, the weekly rhythm is about Issue Resolution. Train the business to escalate major cash-impacting operational issues (like a major debt risk, or unexpected payment) to you weekly, or even more frequently.

If you are finding out about major, unresolved cash issues for the first time during your Monthly Operating Review, your teams don’t truly own the cash yet. By driving accountability into the weekly cadence, you move the responsibility for cashflow out of the Finance department and into the hands of the operators. That is when the system starts running itself.

Daily: The Performance Engine

The decisions that actually drive cashflow happen every single day, with every sale made, every inventory minimum set, and every purchase order approved. Your role as CFO in the daily cycle is to build the cashflow culture in the business.

And ensure the business makes everyday operational decisions with cashflow top of mind.

You need to be the walking, talking ambassador for cash and MFCF delivery. Your job is to take cashflow from an abstract concept that only the Finance team worries about and turn it into a language the rest of the business comprehends.

It’s about making the mechanics of cash approachable. When an operator understands that a slightly higher inventory buffer isn't just "safety," but a direct withdrawal from the company’s ability to invest, you are winning.

In Crisis: The Curveball

As I said at the start of this series, cashflow management is a muscle. If you aren't training it constantly, it won't be there when you need it.

That doesn’t mean treating every day like a crisis. In a real cash panic, you are forced to make brutal, short-term decisions that can damage the long-term health of the business. You don't want to live there. The art of the CFO is to be "on it" enough during the good times that you (a) prevent the crisis from happening and (b) have a solid baseline of process if it does.

Even so, despite your best efforts, you may find yourself in the cockpit during a freefall. It happens to great operators in impossibly competitive industries every day. When it does, the rules of the game change instantly:

Radical Visibility: You need sight of the bank balance and credit facilities daily

Forecasting Frequency: In extreme cases, your 13-week ritual becomes a 4-week daily forecast. If your payment and receipt profiles are messy, you need to manage the cash at a molecular level.

Payment Triage: Centralize all payment decisions. Nothing leaves the bank without a "triage" call. You are no longer paying based on due dates; you are paying based on affordability.

Aggressive Initiative Delivery: You need a "Heat Map" of the things that will pull the nose of the plane up. Whether it’s a big customer deposit, a supplier renegotiation, or an emergency equity round, you monitor the progress of these initiatives daily.

Tactical Communication: Stakeholder management is a minefield. You must keep the Board and investors in the loop, but you have to be surgical with anyone who provides credit. If they have the power to pull your facilities, you tread carefully. Above all, watch the "internal" narrative, spooking your staff can turn a temporary liquidity crunch into a self-fulfilling death spiral.

Ultimately, you need to pull out of the death spiral quickly. The longer you stay in freefall, the harder it is to recover, and the more permanent the damage becomes.

I wrote a full breakdown on managing a "Cash Panic" during the Silicon Valley Bank crisis. The principles remain the same for any liquidity event.

Net Net

The art of being a great cashflow leader comes down to two things:

Building systemic operational ownership for cash delivery

Creating the right governance forums for making world-class capital decisions

It sounds simple, but it isn’t. Doing this well requires tuning your entire Finance function around it. It starts with how you code a single invoice and ends with how you write your investor reports, and encompasses every critical decision in between.

At the same time, no business wants a "Chicken Little" CFO. If you scream that the sky is falling every time a payment lands a day late, you will fatigue the organization. Eventually, they’ll become "snow-blind" to the cashflow message entirely, and they won't listen when a real crisis arrives.

Ultimately, you have to lead by example. The business will mirror the leadership you demonstrate and the function you build to support it.

If you treat cashflow as a strategic lever rather than an accounting byproduct, they will too.

Remember, you’ve only got another 24 hours to cash in on the exclusive reader launch offer for SimCFO. An innovative new L&DE experience for CFOs.

If you’re looking to sponsor CFO Secrets Newsletter fill out this form and we’ll be in touch.

:::::::::::::::::::::::::::::::::::::::::::::::::::

:: Thank you to our sponsor ::

:: Ledge ::

:::::::::::::::::::::::::::::::::::::::::::::::::::

What did you think of this week’s edition?

If you enjoyed today’s content, don’t forget to subscribe.

Disclaimer: I am not your accountant, tax advisor, lawyer, CFO, director, or friend. Well, maybe I’m your friend, but I am not any of those other things. Everything I publish represents my opinions only, not advice. Running the finances for a company is serious business, and you should take the proper advice you need.